- South Korea

- /

- Personal Products

- /

- KOSDAQ:A260930

CTK (KOSDAQ:260930 shareholders incur further losses as stock declines 11% this week, taking three-year losses to 53%

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of CTK Co., Ltd (KOSDAQ:260930) have had an unfortunate run in the last three years. Sadly for them, the share price is down 54% in that time. Furthermore, it's down 19% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 9.8% decline in the broader market, throughout the period.

If the past week is anything to go by, investor sentiment for CTK isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for CTK

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

CTK became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

With a rather small yield of just 2.0% we doubt that the stock's share price is based on its dividend. We think that the revenue decline over three years, at a rate of 14% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

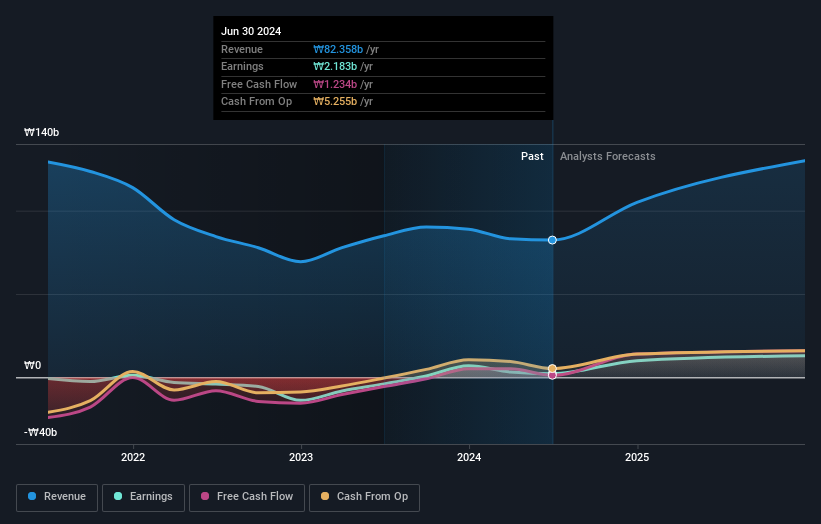

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that CTK has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 3.4% in the twelve months, CTK shareholders did even worse, losing 4.9% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with CTK .

But note: CTK may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A260930

CTK

Manufactures and sells cosmetics and cosmetic containers in South Korea and internationally.

High growth potential with excellent balance sheet.