- South Korea

- /

- Personal Products

- /

- KOSDAQ:A092730

Would Shareholders Who Purchased NeoPharm's (KOSDAQ:092730) Stock Year Be Happy With The Share price Today?

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in NeoPharm CO., LTD. (KOSDAQ:092730) have tasted that bitter downside in the last year, as the share price dropped 39%. That's disappointing when you consider the market returned 28%. However, the longer term returns haven't been so bad, with the stock down 26% in the last three years.

View our latest analysis for NeoPharm

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the NeoPharm share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

NeoPharm's revenue is actually up 10% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

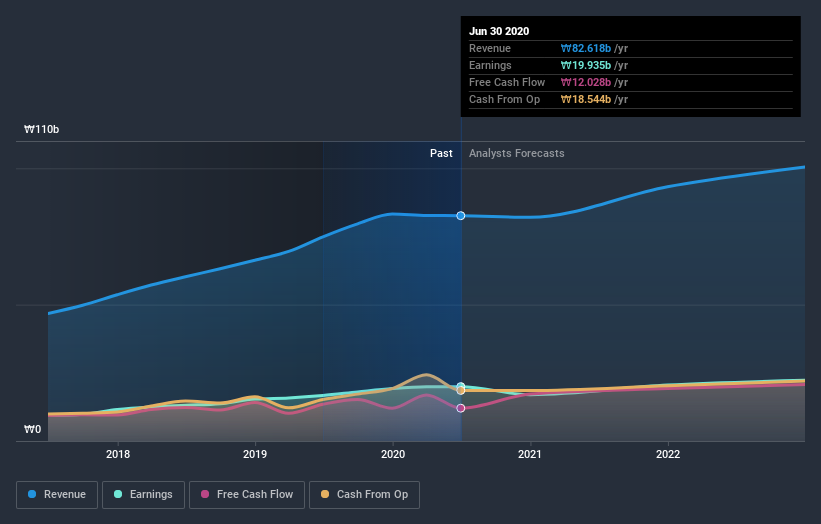

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

NeoPharm shareholders are down 38% for the year (even including dividends), but the market itself is up 28%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for NeoPharm you should know about.

Of course NeoPharm may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade NeoPharm, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NeoPharm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A092730

NeoPharm

Engages in the manufacturing and sale of skin care products in South Korea.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives