- South Korea

- /

- Electrical

- /

- KOSE:A103590

Discovering Three Hidden Gems In South Korea's Stock Market

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 7.9%, although it has remained flat overall in the past year. With earnings expected to grow by 28% per annum over the next few years, identifying stocks with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 0.40% | 27.17% | ★★★★★★ |

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| ASIA Holdings | 34.13% | 8.28% | 15.67% | ★★★★★★ |

| Kyung Dong Navien | 26.97% | 11.54% | 19.49% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 59.19% | 3.54% | 5.92% | ★★★★★★ |

| BIO-FD&CLtd | 2.01% | 8.27% | 22.82% | ★★★★★★ |

| Hansae Yes24 Holdings | 97.82% | 2.74% | 18.89% | ★★★★★☆ |

| KG Chemical | 43.62% | 33.46% | 8.39% | ★★★★★☆ |

| Daewon Cable | 24.70% | 8.50% | 62.14% | ★★★★★☆ |

| EASY BIOInc | 188.46% | 15.71% | 55.75% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. produces and exports laminating machines and films worldwide, with a market cap of ₩1.25 billion.

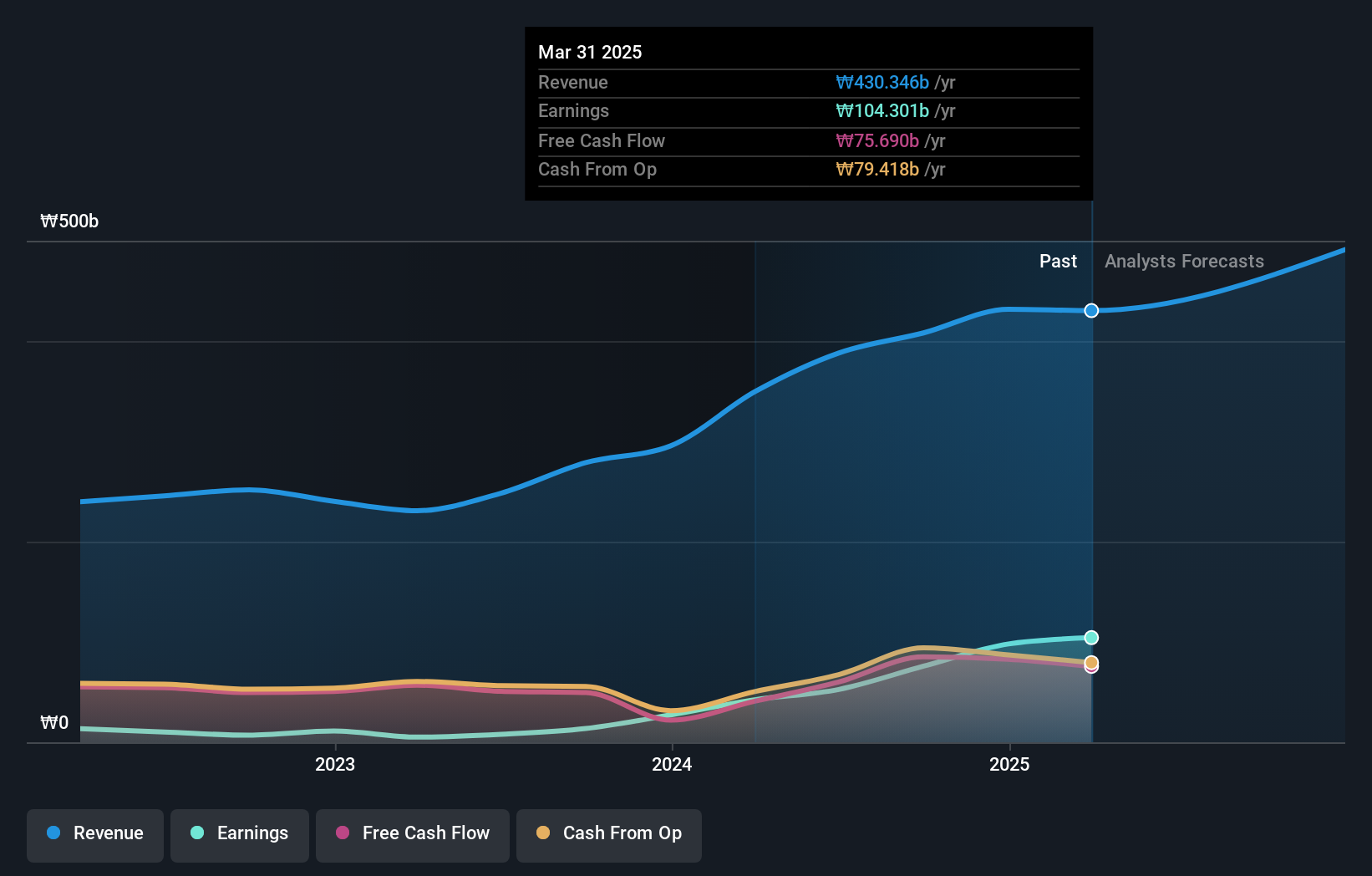

Operations: VT Co., Ltd. generates revenue primarily from its Cosmetic segment (₩213.71 billion), Laminating segment (₩33.15 billion), and Entertainment segment (₩98.08 billion). The Cosmetic segment is the largest contributor to its revenue stream.

VT has shown significant promise with its debt to equity ratio decreasing from 43.3% to 24.6% over the past five years, reflecting prudent financial management. The company’s earnings growth of 727.4% in the last year far outpaced the industry average of 36.9%, highlighting its robust performance potential. Despite a highly volatile share price over the past three months, VT's profitability ensures that cash runway isn't a concern, presenting an intriguing investment opportunity in South Korea's market.

- Take a closer look at VT's potential here in our health report.

Gain insights into VT's historical performance by reviewing our past performance report.

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★★

Overview: Taihan Cable & Solution Co., Ltd. manufactures, processes, and sells electric wires, cables, and related products worldwide with a market cap of ₩2.49 trillion.

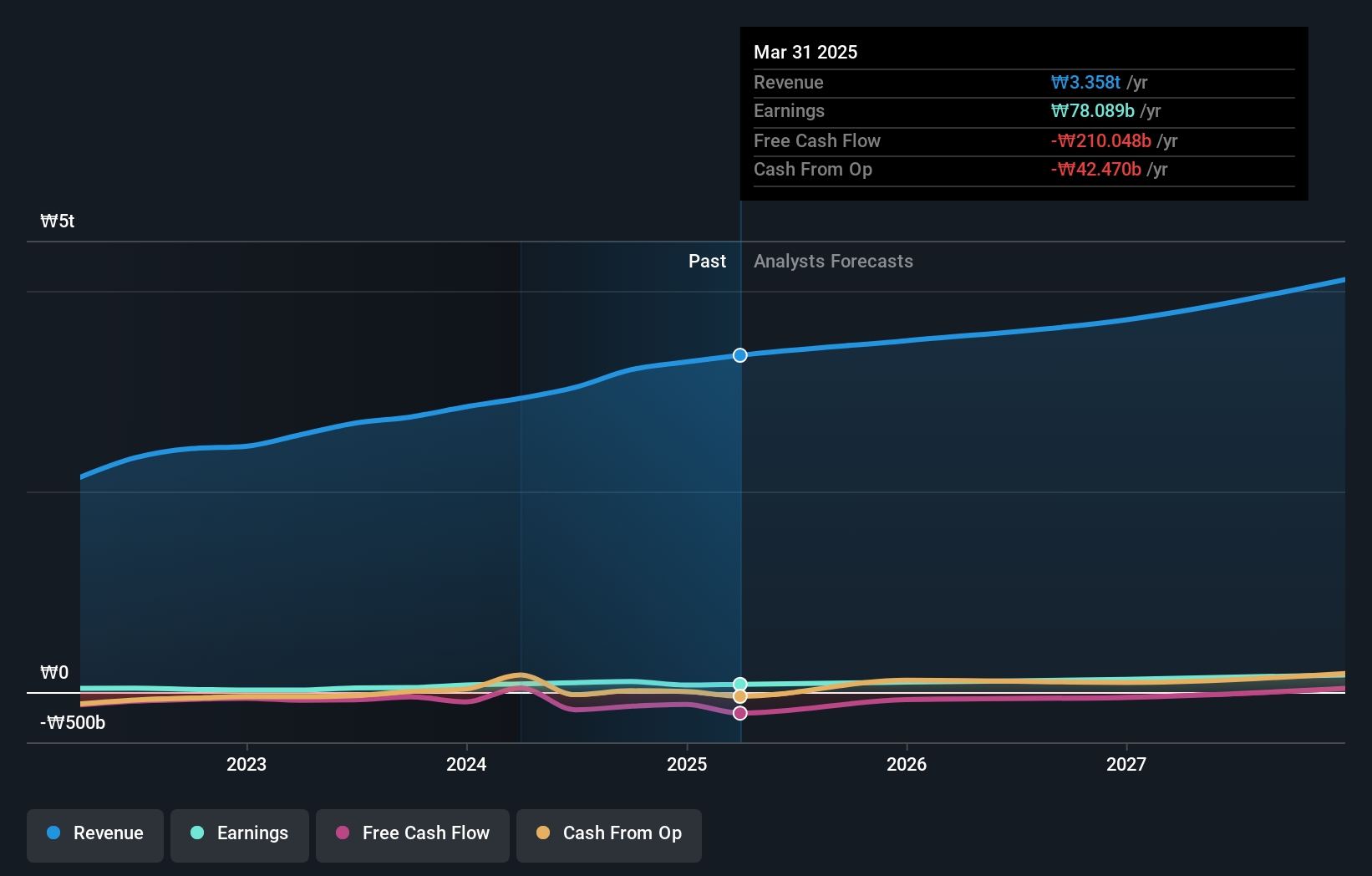

Operations: Taihan Cable & Solution generates revenue primarily from its wire segment, amounting to ₩3.28 billion. Sales between divisions are recorded as -₩349.13 million, impacting the overall revenue figures.

Taihan Cable & Solution, a notable player in South Korea's electrical industry, reported impressive earnings growth of 305.7% over the past year, significantly outpacing the industry's 16%. The company's interest payments are well covered by EBIT at 4.4x coverage, indicating strong financial health. Despite a highly volatile share price in recent months, Taihan Cable's debt to equity ratio has improved from 191.9% to 30.6% over five years.

Iljin ElectricLtd (KOSE:A103590)

Simply Wall St Value Rating: ★★★★★★

Overview: Iljin Electric Co., Ltd operates as a heavy electric machinery company in South Korea and internationally, with a market cap of ₩1.13 trillion.

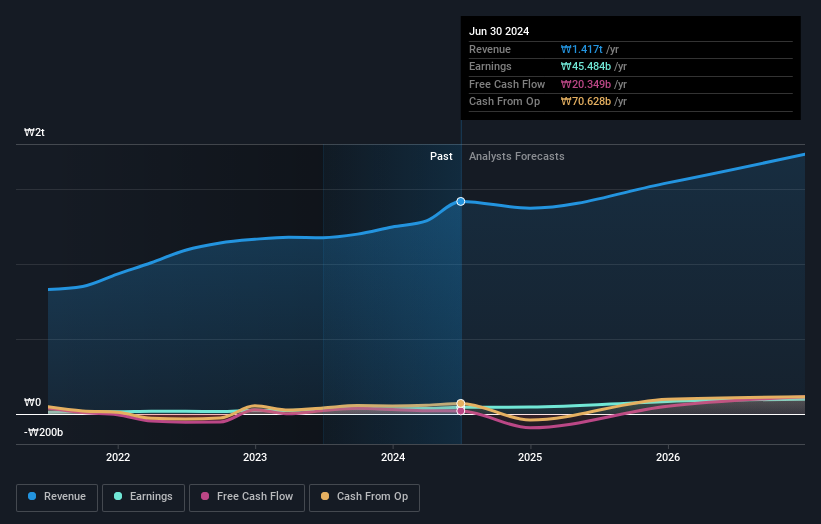

Operations: Iljin Electric Co., Ltd generates revenue primarily from its Wire segment (₩1.03 billion) and Power System segment (₩321.97 million).

Iljin Electric has shown impressive growth, with earnings rising 50.8% over the past year, surpassing the Electrical industry’s 16%. The company’s debt to equity ratio improved from 96.6% to 35.3% over five years, indicating better financial health. Interest payments are well covered by EBIT at 6.3x coverage, reflecting strong operational performance. Despite a highly volatile share price in recent months, Iljin's forecasted annual earnings growth of 37.12% suggests promising potential ahead.

Where To Now?

- Get an in-depth perspective on all 202 KRX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A103590

Iljin ElectricLtd

Operates as a heavy electric machinery company in South Korea and internationally.

Flawless balance sheet with solid track record.