Stock Analysis

- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A287410

KRX Growth Leaders With Up To 29% Insider Ownership

Reviewed by Simply Wall St

The South Korean market has recently experienced a slight downturn, dropping 1.3% over the last week, though it remains up by 5.6% over the past year with earnings expected to grow by 28% annually. In this context, stocks of growth companies with high insider ownership can be particularly appealing as they often reflect a commitment from those who know the company best, aligning their interests closely with other shareholders especially in promising market conditions.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| Modetour Network (KOSDAQ:A080160) | 12.3% | 45.6% |

| S&S Tech (KOSDAQ:A101490) | 21.6% | 44.1% |

| ALTEOGEN (KOSDAQ:A196170) | 26.7% | 75.1% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| UTI (KOSDAQ:A179900) | 34.2% | 111.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 74.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.9% | 48.1% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 67.2% |

| Enchem (KOSDAQ:A348370) | 21.3% | 105.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 102.5% |

Let's review some notable picks from our screened stocks.

GAMSUNG Corporation (KOSDAQ:A036620)

Simply Wall St Growth Rating: ★★★★★★

Overview: GAMSUNG Corporation Co., Ltd. operates in the apparel and mobile peripheral sectors, with a market capitalization of approximately ₩408.81 billion.

Operations: The company generates revenue from its operations in the apparel sector and mobile peripherals.

Insider Ownership: 24.7%

GAMSUNG Corporation, a South Korean company with high insider ownership, is poised for robust growth. Its revenue and earnings are expected to outpace the market significantly over the next three years, with annual revenue growth forecasted at 34.4% and earnings growth at 43.82%. The company's recent share buyback program underscores its commitment to shareholder value. However, it faces challenges with a highly volatile share price and lacks recent insider trading activity to gauge internal confidence further.

- Unlock comprehensive insights into our analysis of GAMSUNG Corporation stock in this growth report.

- Our valuation report here indicates GAMSUNG Corporation may be overvalued.

ST PharmLtd (KOSDAQ:A237690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ST Pharm Co., Ltd. specializes in custom manufacturing services for active pharmaceutical ingredients and intermediates, operating both in South Korea and internationally, with a market capitalization of approximately ₩1.87 billion.

Operations: The company generates revenue through custom manufacturing services for active pharmaceutical ingredients and intermediates, serving clients both domestically and globally.

Insider Ownership: 13.4%

ST Pharm Co., Ltd. has demonstrated strong growth, with earnings increasing by 63.6% annually over the past five years and expected to rise by 37.3% per year moving forward, outpacing the South Korean market's forecast of 28%. The company trades at a significant discount to its estimated fair value and is set to experience revenue growth faster than the market average. Despite these positives, it faces challenges such as high share price volatility and low forecasted return on equity in three years at only 15.5%.

- Click here to discover the nuances of ST PharmLtd with our detailed analytical future growth report.

- The valuation report we've compiled suggests that ST PharmLtd's current price could be inflated.

Jeisys Medical (KOSDAQ:A287410)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jeisys Medical Inc. specializes in designing, developing, and manufacturing medical devices for plastic surgeons, dermatologists, physicians, and healthcare professionals both in South Korea and globally, with a market capitalization of approximately ₩907.43 billion.

Operations: The company generates revenue by designing, developing, and manufacturing medical devices for use by various healthcare professionals across domestic and international markets.

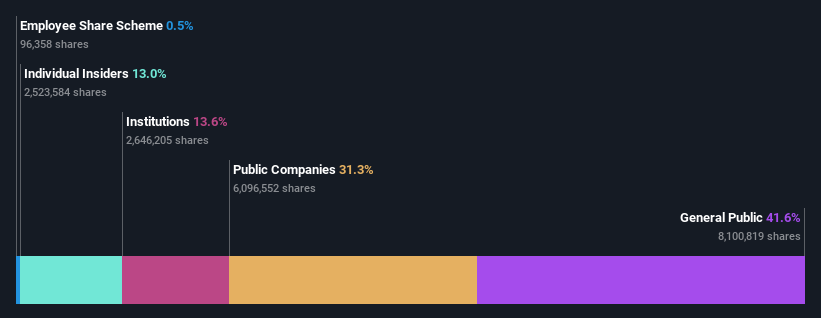

Insider Ownership: 29.3%

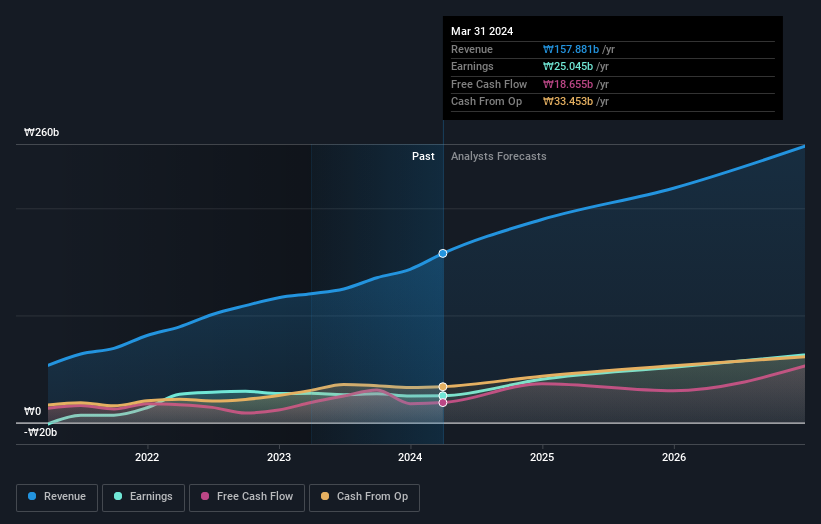

Jeisys Medical Inc., a key distributor for the newly launched MIRIA by AVAVA, is poised for substantial growth with expected significant earnings expansion over the next three years. Although its revenue growth is forecasted at 16.8% per year, slower than some peers, it outpaces the broader South Korean market's 10%. High insider ownership aligns leadership with shareholder interests, enhancing trust despite a highly volatile share price recently. The company's Return on Equity is projected to be robust at 30.8% in three years, signaling efficient capital utilization.

- Delve into the full analysis future growth report here for a deeper understanding of Jeisys Medical.

- Upon reviewing our latest valuation report, Jeisys Medical's share price might be too optimistic.

Make It Happen

- Reveal the 85 hidden gems among our Fast Growing KRX Companies With High Insider Ownership screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Jeisys Medical is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A287410

Jeisys Medical

Designs, develops, and manufactures medical device for plastic surgeons, dermatologist, physicians, and healthcare professionals in South Korea and internationally.

High growth potential with excellent balance sheet.