Stock Analysis

- South Korea

- /

- Personal Products

- /

- KOSE:A278470

KRX Growth Leaders With High Insider Stakes June 2024

Reviewed by Simply Wall St

The South Korean market has shown promising growth, with a 1.1% increase over the last week and a 3.7% rise over the past year, alongside forecasts predicting annual earnings growth of 29%. In this environment, stocks with high insider ownership can be particularly appealing, as they often indicate strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| Devsisters (KOSDAQ:A194480) | 27.2% | 71.9% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.9% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Underneath we present a selection of stocks filtered out by our screen.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd. specializes in the manufacture of telecom equipment, repeaters, mechanical products, and LED and other equipment, with a market capitalization of approximately ₩1.60 billion.

Operations: The company generates revenue from the manufacture of telecom equipment, repeaters, mechanical products, and LED equipment.

Insider Ownership: 26.4%

Revenue Growth Forecast: 28.5% p.a.

Seojin System Co., Ltd, a South Korean growth company with high insider ownership, demonstrates promising financial prospects despite some challenges. Analysts expect the stock price to increase by 26.4%, with revenue and earnings forecasted to grow at 28.5% and 48.06% per year respectively, outpacing the KR market averages significantly. However, concerns include a highly volatile share price and poor coverage of interest payments by earnings, alongside recent shareholder dilution and declining profit margins from last year.

- Delve into the full analysis future growth report here for a deeper understanding of Seojin SystemLtd.

- Upon reviewing our latest valuation report, Seojin SystemLtd's share price might be too pessimistic.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CLASSYS Inc. specializes in providing medical aesthetics devices globally, with a market capitalization of approximately ₩3.37 billion.

Operations: The company specializes globally in medical aesthetics devices, achieving a market capitalization of approximately ₩3.37 billion.

Insider Ownership: 10.1%

Revenue Growth Forecast: 21.3% p.a.

CLASSYS Inc., a South Korean entity with significant insider ownership, is poised for substantial growth, albeit at a pace slightly below market expectations. The company's earnings are projected to grow by 22.18% annually, while its revenue growth forecast at 21.3% annually surpasses the KR market prediction of 10.4%. Despite this promising outlook, CLASSYS faces challenges such as high share price volatility and earnings growth that does not lead the broader market's pace.

- Click here and access our complete growth analysis report to understand the dynamics of CLASSYS.

- Upon reviewing our latest valuation report, CLASSYS' share price might be too optimistic.

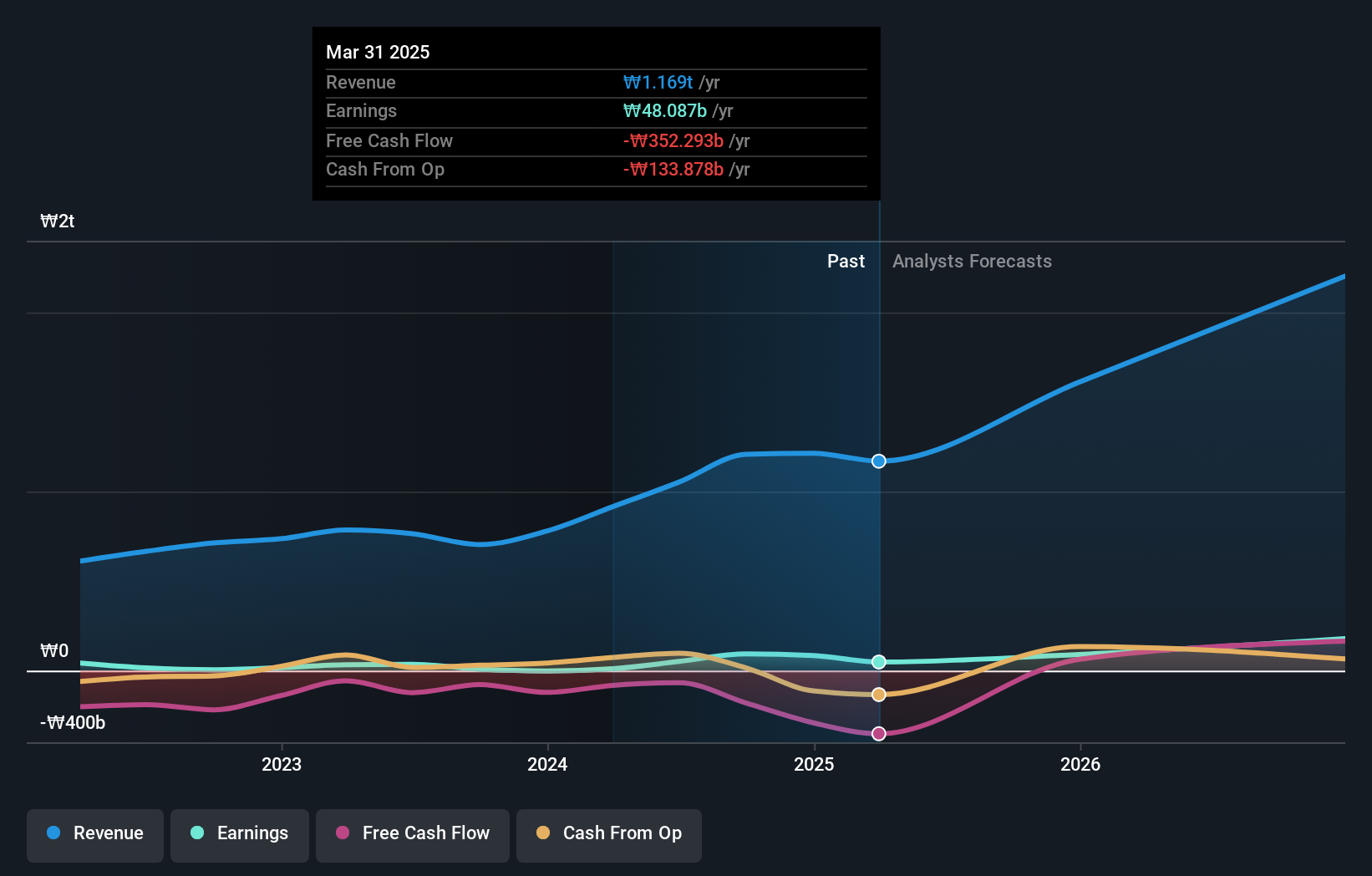

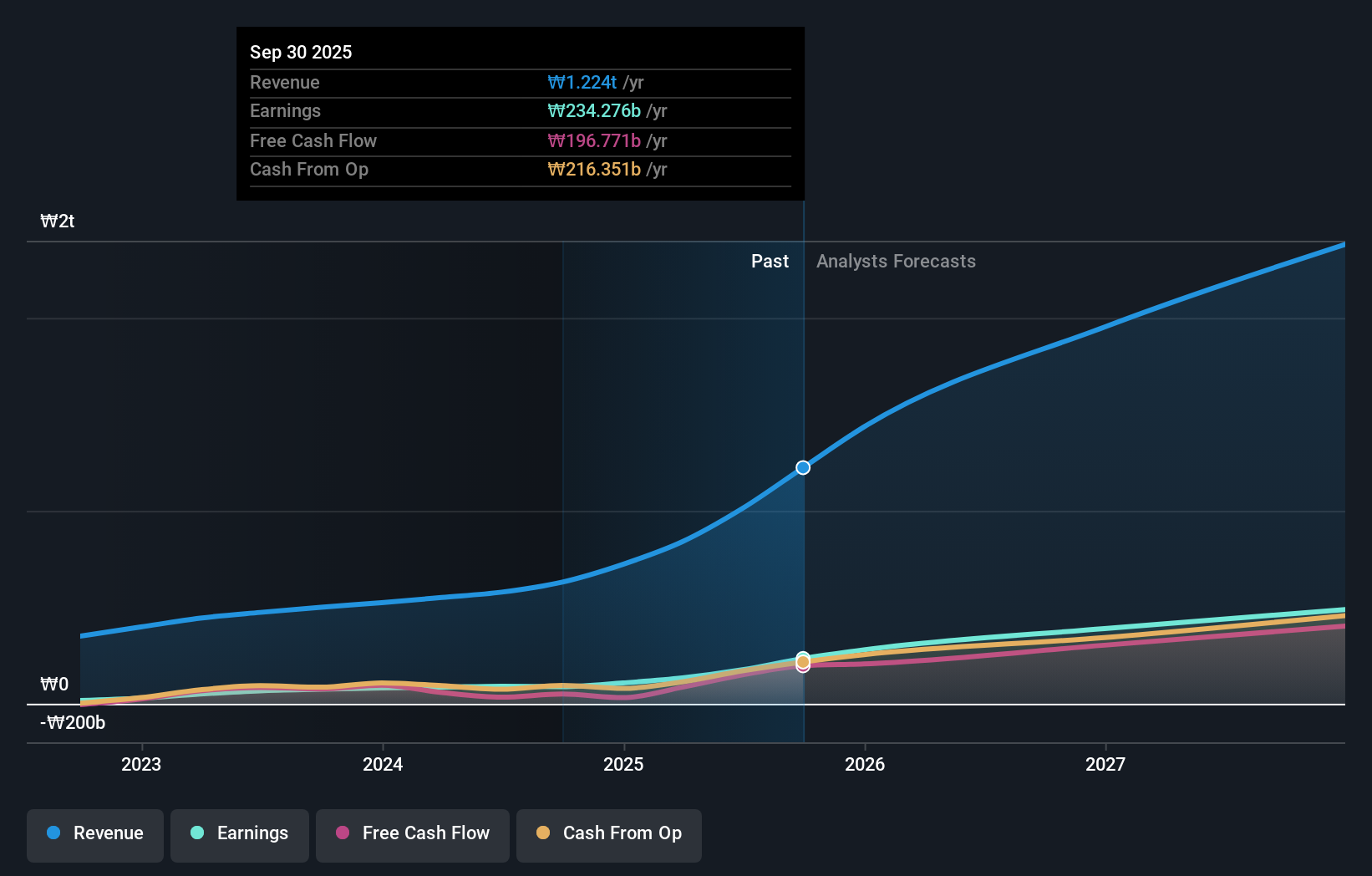

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd specializes in the manufacturing and sale of cosmetics for both men and women, with a market capitalization of approximately ₩2.97 billion.

Operations: The company generates its revenue from the sale of cosmetics designed for both male and female consumers.

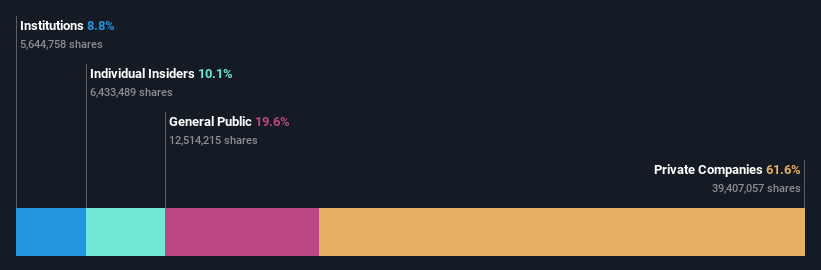

Insider Ownership: 34.2%

Revenue Growth Forecast: 23.1% p.a.

APR Co., Ltd. demonstrates robust potential with its revenue expected to increase by 23.1% annually, outpacing the South Korean market forecast of 10.4%. Although its earnings growth projection of 26.2% per year slightly trails the broader market expectation of 29%, APR maintains a strong forecast Return on Equity at 34.8%. The stock is currently valued at 15.3% below its estimated fair value, indicating a potentially attractive investment despite recent share price volatility and no recent insider trading data.

- Click here to discover the nuances of APR with our detailed analytical future growth report.

- Our valuation report unveils the possibility APR's shares may be trading at a premium.

Key Takeaways

- Click here to access our complete index of 82 Fast Growing KRX Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether APR is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Flawless balance sheet with high growth potential.