Stock Analysis

- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214150

High Insider Ownership Growth Stocks On KRX June 2024

Reviewed by Simply Wall St

The South Korean market has shown steady growth, with a 1.3% increase over the last week and a 3.7% rise over the past year, alongside an optimistic forecast of 29% annual earnings growth. In this buoyant environment, stocks with high insider ownership can be particularly compelling, as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| SamyoungLtd (KOSE:A003720) | 25% | 30.4% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.9% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's review some notable picks from our screened stocks.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CLASSYS Inc. specializes in the global provision of medical aesthetics devices, with a market capitalization of approximately ₩3.24 billion.

Operations: The firm operates internationally in the medical aesthetics device sector, generating revenues globally.

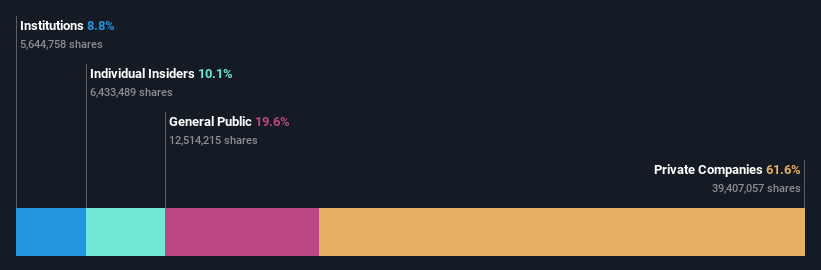

Insider Ownership: 10.1%

Earnings Growth Forecast: 22.2% p.a.

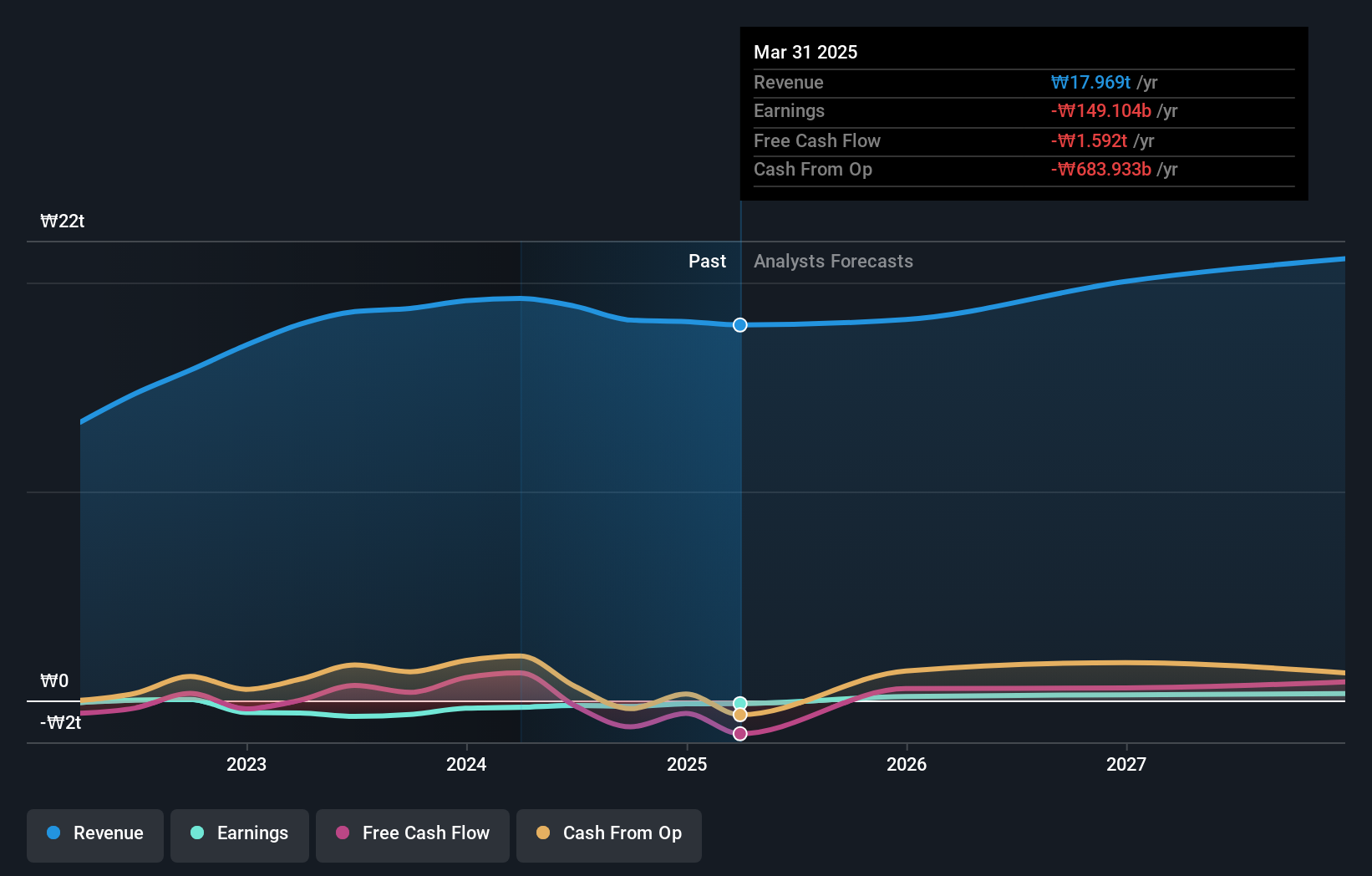

CLASSYS, a South Korean growth company with high insider ownership, has shown robust activity in the corporate event circuit, recently presenting at multiple international conferences. Despite its earnings forecast to grow significantly at 22.2% annually over the next three years—slightly below the broader Korean market rate of 28.9%—its projected revenue growth of 21.3% per year surpasses the market's expectation of 10.5%. Additionally, CLASSYS is expected to maintain a high return on equity at 28%, indicating efficient management and profitability potential.

- Click here and access our complete growth analysis report to understand the dynamics of CLASSYS.

- The analysis detailed in our CLASSYS valuation report hints at an inflated share price compared to its estimated value.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across South Korea, the United States, Asia, the Middle East, and Europe with a market capitalization of approximately ₩3.41 billion.

Operations: The company's revenue is derived from three primary activities: heavy industry, machinery manufacturing, and apartment construction spanning various global regions including South Korea, the United States, Asia, the Middle East, and Europe.

Insider Ownership: 34.3%

Earnings Growth Forecast: 72.9% p.a.

Doosan Corporation, despite a forecasted revenue growth of 3.6% per year—below South Korea's market average of 10.5%—is expected to transition from a net loss to profitability within three years, aligning with above-average market growth expectations. Recent financials show improvement, with first quarter sales rising to ₩180.97 billion and net income reaching ₩4.98 billion after a significant loss the previous year. The company's projected return on equity is high at 22.2%, suggesting potential for efficient capital management in the future.

- Take a closer look at Doosan's potential here in our earnings growth report.

- According our valuation report, there's an indication that Doosan's share price might be on the cheaper side.

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd. is a company that manufactures and sells cosmetic products for both men and women, with a market capitalization of approximately ₩2.97 billion.

Operations: The company's revenue is derived from the manufacture and sale of cosmetic products targeted at both male and female consumers.

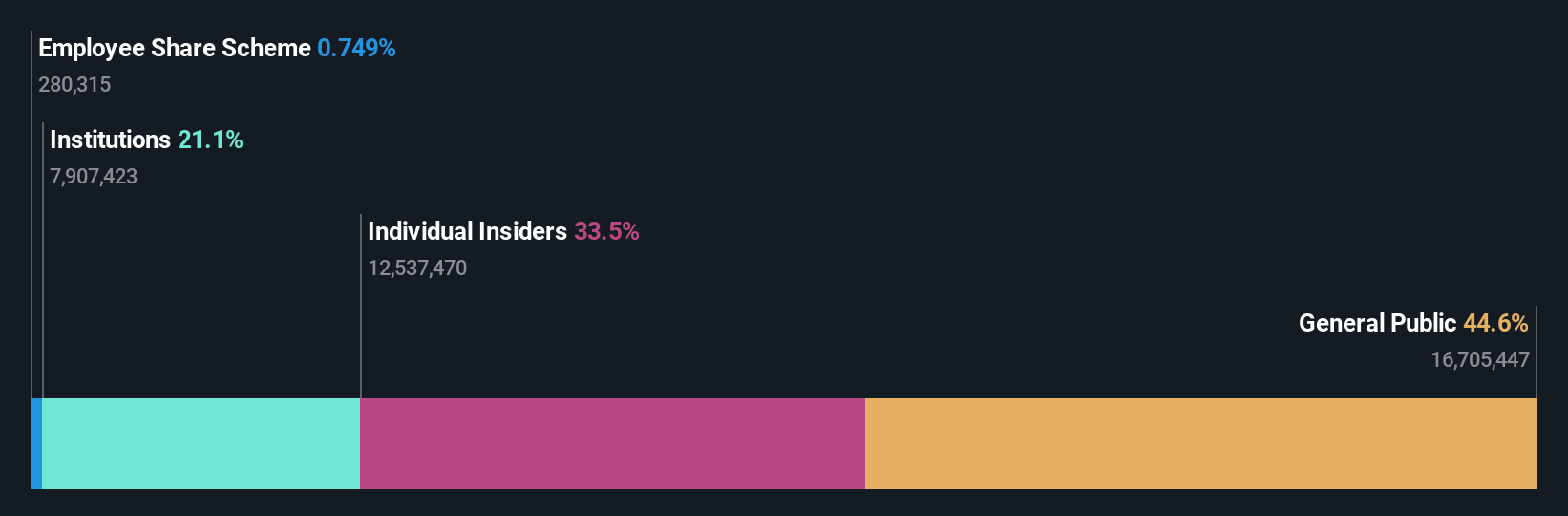

Insider Ownership: 34.2%

Earnings Growth Forecast: 26.2% p.a.

APR Co., Ltd. stands out with its robust earnings growth, projected at 26.2% annually over the next three years, although slightly trailing the South Korean market forecast of 28.9%. Its revenue growth is notably strong at 23.1% per year, surpassing the market average of 10.5%. Last year's earnings surged by 70.2%, supported by a high level of non-cash earnings, indicating quality in its financial gains despite not leading in insider ownership metrics for growth companies in South Korea.

- Click to explore a detailed breakdown of our findings in APR's earnings growth report.

- Our comprehensive valuation report raises the possibility that APR is priced higher than what may be justified by its financials.

Taking Advantage

- Unlock more gems! Our Fast Growing KRX Companies With High Insider Ownership screener has unearthed 78 more companies for you to explore.Click here to unveil our expertly curated list of 81 Fast Growing KRX Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether CLASSYS is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214150

Flawless balance sheet with high growth potential.