- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A043100

Solco Biomedical Co., Ltd.'s (KOSDAQ:043100) 27% Dip In Price Shows Sentiment Is Matching Revenues

Unfortunately for some shareholders, the Solco Biomedical Co., Ltd. (KOSDAQ:043100) share price has dived 27% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

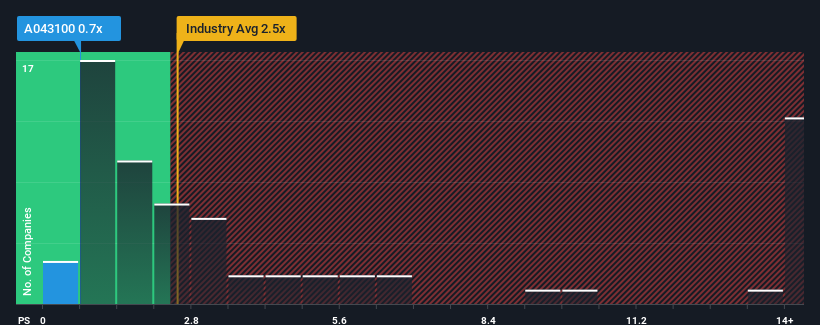

Since its price has dipped substantially, Solco Biomedical's price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Medical Equipment industry in Korea, where around half of the companies have P/S ratios above 2.5x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Solco Biomedical

What Does Solco Biomedical's P/S Mean For Shareholders?

Solco Biomedical has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Solco Biomedical's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Solco Biomedical?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Solco Biomedical's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The latest three year period has also seen a 19% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 29% shows it's noticeably less attractive.

With this information, we can see why Solco Biomedical is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

Solco Biomedical's recently weak share price has pulled its P/S back below other Medical Equipment companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

In line with expectations, Solco Biomedical maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Solco Biomedical, and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A043100

AlphanoxLtd

Manufactures and sells medical devices and healthcare products in South Korea.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives