- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A041920

Does MedianaLtd's (KOSDAQ:041920) Share Price Gain of 82% Match Its Business Performance?

If you want to compound wealth in the stock market, you can do so by buying an index fund. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Mediana Co.,Ltd (KOSDAQ:041920) share price is 82% higher than it was a year ago, much better than the market return of around 41% (not including dividends) in the same period. So that should have shareholders smiling. Looking back further, the stock price is 41% higher than it was three years ago.

See our latest analysis for MedianaLtd

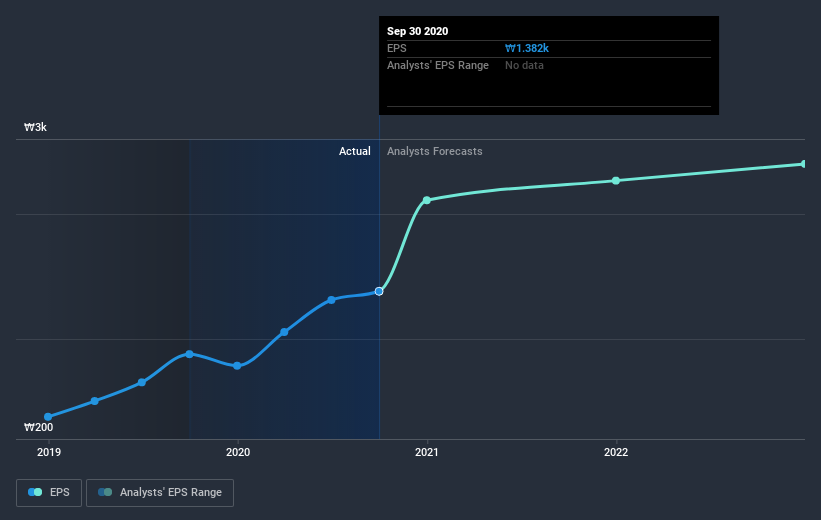

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

MedianaLtd was able to grow EPS by 57% in the last twelve months. The share price gain of 82% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that MedianaLtd has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

It's nice to see that MedianaLtd shareholders have received a total shareholder return of 82% over the last year. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Before forming an opinion on MedianaLtd you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading MedianaLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A041920

MEDIANALtd

Develops, manufactures, and sells medical devices in South Korea.

Flawless balance sheet with low risk.

Market Insights

Community Narratives