- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A039840

We Think DIO (KOSDAQ:039840) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that DIO Corporation (KOSDAQ:039840) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for DIO

What Is DIO's Net Debt?

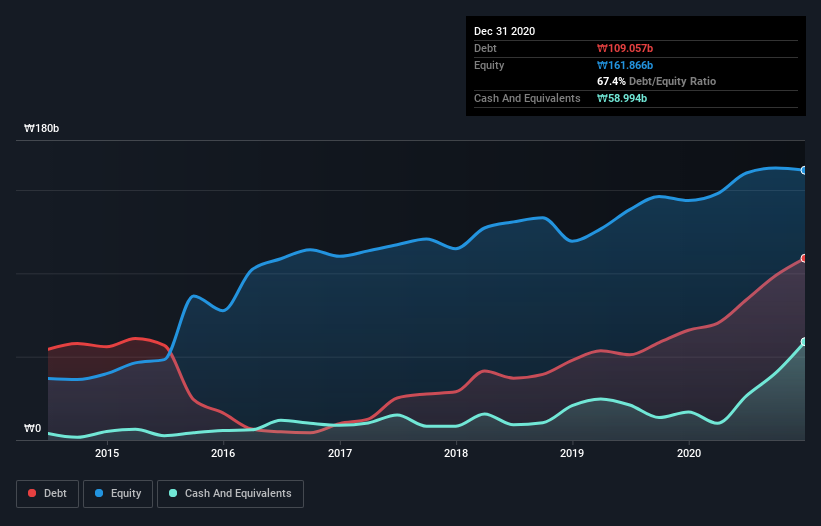

You can click the graphic below for the historical numbers, but it shows that as of December 2020 DIO had ₩109.1b of debt, an increase on ₩65.9b, over one year. However, it does have ₩59.0b in cash offsetting this, leading to net debt of about ₩50.1b.

How Strong Is DIO's Balance Sheet?

According to the last reported balance sheet, DIO had liabilities of ₩134.0b due within 12 months, and liabilities of ₩25.6b due beyond 12 months. Offsetting this, it had ₩59.0b in cash and ₩96.2b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩4.32b.

This state of affairs indicates that DIO's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the ₩605.2b company is struggling for cash, we still think it's worth monitoring its balance sheet.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With net debt sitting at just 1.3 times EBITDA, DIO is arguably pretty conservatively geared. And it boasts interest cover of 9.5 times, which is more than adequate. But the other side of the story is that DIO saw its EBIT decline by 6.4% over the last year. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if DIO can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Considering the last three years, DIO actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Based on what we've seen DIO is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its interest cover. We would also note that Medical Equipment industry companies like DIO commonly do use debt without problems. When we consider all the factors mentioned above, we do feel a bit cautious about DIO's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with DIO (including 1 which doesn't sit too well with us) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A039840

DIO

Manufactures and sells dental implants in South Korea and internationally.

High growth potential and good value.

Market Insights

Community Narratives