- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A039840

DIO Corporation (KOSDAQ:039840) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

DIO Corporation (KOSDAQ:039840) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.5% in the last twelve months.

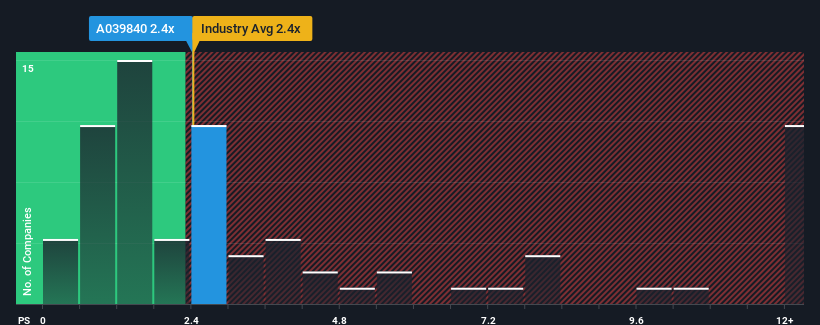

Even after such a large jump in price, you could still be forgiven for feeling indifferent about DIO's P/S ratio of 2.4x, since the median price-to-sales (or "P/S") ratio for the Medical Equipment industry in Korea is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for DIO

How DIO Has Been Performing

DIO could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think DIO's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like DIO's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 20% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 34% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 33%, which is not materially different.

In light of this, it's understandable that DIO's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does DIO's P/S Mean For Investors?

Its shares have lifted substantially and now DIO's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at DIO's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for DIO with six simple checks.

If these risks are making you reconsider your opinion on DIO, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A039840

DIO

Manufactures and sells dental implants in South Korea and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives