- South Korea

- /

- Food

- /

- KOSE:A145990

Unveiling These 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets exhibit broad-based gains, with smaller-cap indexes outperforming their larger counterparts, investors are increasingly looking toward the potential of under-the-radar opportunities. Amidst this backdrop of economic optimism and stabilizing conditions, identifying stocks that demonstrate resilience and growth potential can be key to navigating the current market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soft-World International | NA | -0.68% | 6.00% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Dareway SoftwareLtd | NA | 2.71% | -0.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interarch Building Products | 2.55% | 10.02% | 28.21% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Pharmanutra (BIT:PHN)

Simply Wall St Value Rating: ★★★★★☆

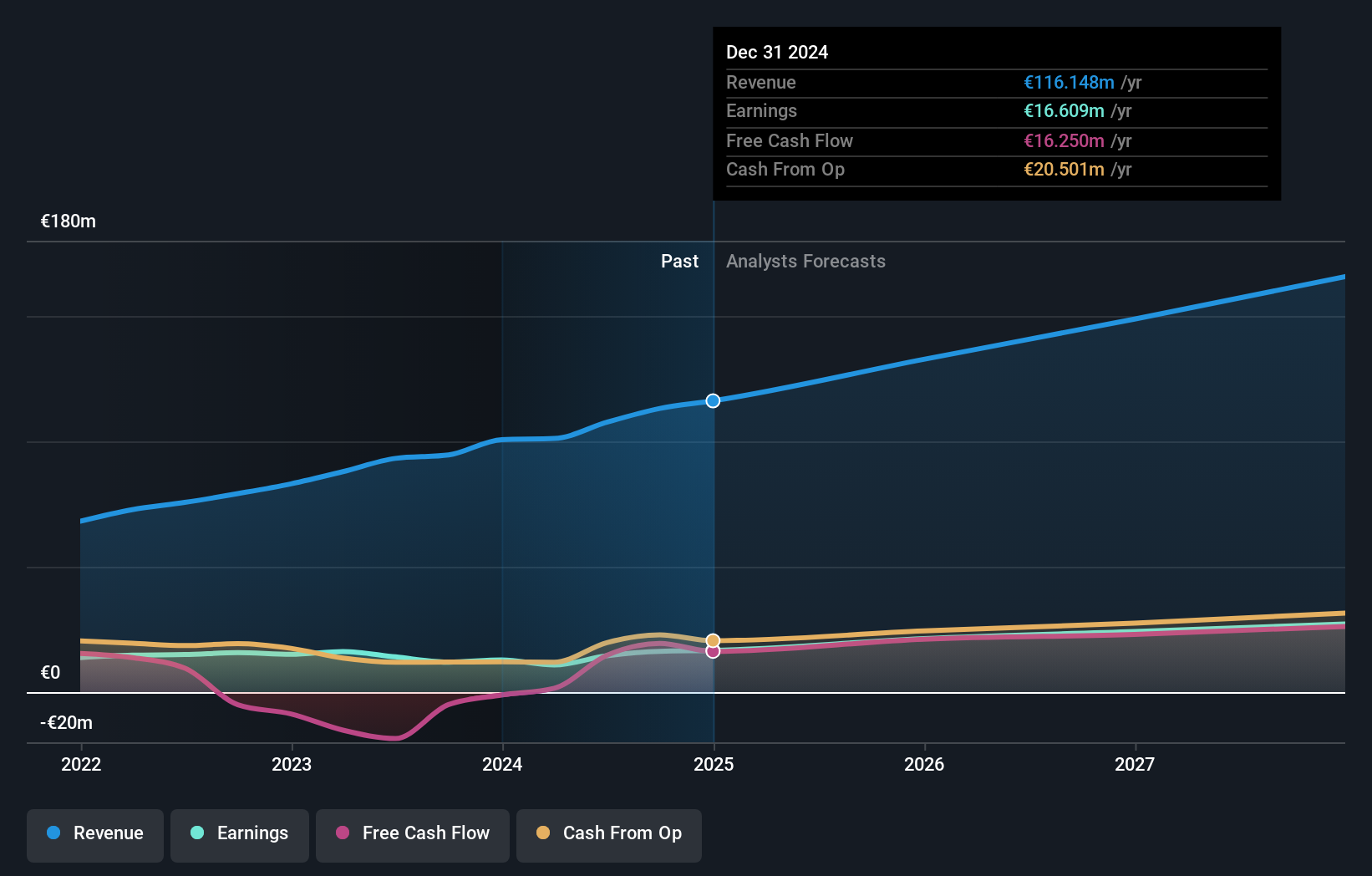

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on researching, designing, developing, and marketing nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and internationally with a market cap of €530.36 million.

Operations: Pharmanutra generates revenue primarily from its operations in Italy (€68.35 million) and international markets (€38.40 million), with a smaller contribution from Akern (€5.49 million).

Pharmanutra, a promising player in the personal products sector, has shown impressive earnings growth of 36% over the past year, outpacing the industry average of 11%. With revenue reaching €84.5 million for the first nine months of 2024, up from €72.19 million in the previous year, and net income climbing to €13.17 million from €9.73 million, its financial health appears robust. The company enjoys high-quality earnings and maintains a strong cash position relative to its debt obligations. Despite an increased debt-to-equity ratio from 19% to nearly 40% over five years, interest payments are comfortably covered by EBIT at a multiple of 41x.

- Click to explore a detailed breakdown of our findings in Pharmanutra's health report.

Review our historical performance report to gain insights into Pharmanutra's's past performance.

Galata Wind Enerji (IBSE:GWIND)

Simply Wall St Value Rating: ★★★★☆☆

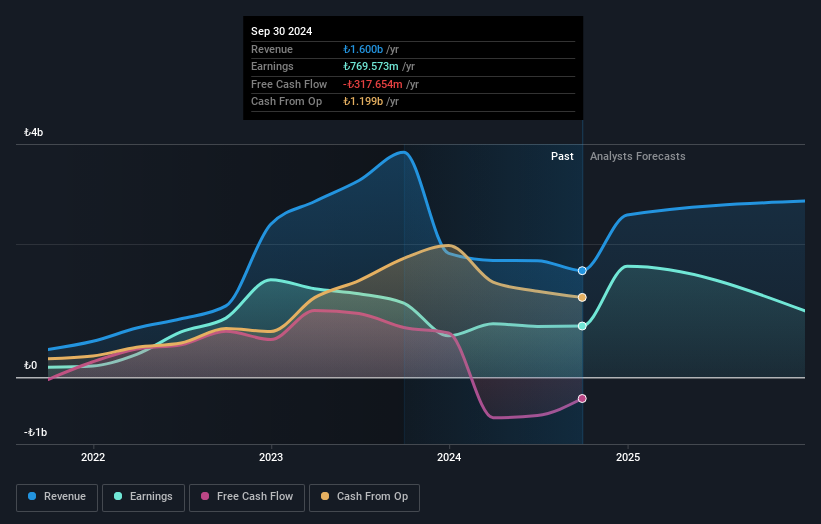

Overview: Galata Wind Enerji A.S. operates and rents electric power plants in Turkey with a market capitalization of TRY13.50 billion.

Operations: Galata Wind Enerji generates revenue primarily from electricity generation, amounting to TRY1.60 billion. The company focuses on optimizing its cost structure to enhance profitability, reflected in its net profit margin trends over recent periods.

Galata Wind Enerji showcases a mix of strengths and challenges. Despite negative earnings growth of 30.9% over the past year, its revenue is expected to climb by 29.49% annually, hinting at potential future expansion. The company boasts a satisfactory net debt to equity ratio of 6.5%, down from 52.4% five years ago, indicating improved financial health and reduced leverage risks. Recent earnings reports reveal sales for Q3 at TRY 617 million with net income rising to TRY 151 million compared to last year’s TRY 146 million, reflecting resilience in profitability despite fluctuating revenues across periods analyzed.

Samyang (KOSE:A145990)

Simply Wall St Value Rating: ★★★★★★

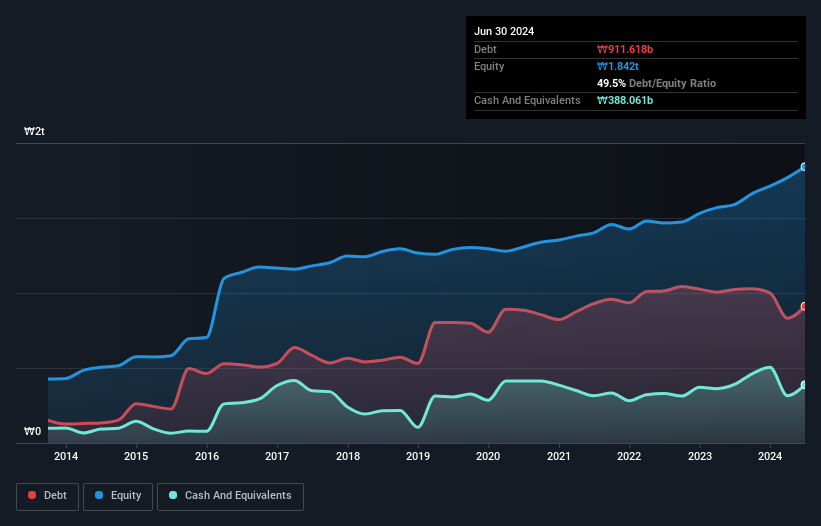

Overview: Samyang Corporation operates in the chemicals and food industries across Korea, China, Japan, the rest of Asia, Europe, and internationally with a market capitalization of approximately ₩504.49 billion.

Operations: Samyang Corporation generates revenue primarily from its chemicals and food segments. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

Samyang's recent ventures into the Australian and New Zealand markets mark a strategic milestone, particularly with its exclusive Novel Food approval for allulose. This expansion is supported by robust financials, including a 19% earnings growth over the past year, outpacing the industry average of 5.8%. The company's debt to equity ratio has improved from 61% to 47% in five years, indicating prudent financial management. Trading at 78% below estimated fair value presents potential upside for investors. With high-quality earnings and satisfactory net debt levels at 23%, Samyang seems poised for further growth as it leverages its new production capabilities in Korea.

- Get an in-depth perspective on Samyang's performance by reading our health report here.

Assess Samyang's past performance with our detailed historical performance reports.

Next Steps

- Investigate our full lineup of 4637 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A145990

Samyang

Engages in the chemicals and food business in Korea, China, Japan, rest of Asia, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.