- South Korea

- /

- Entertainment

- /

- KOSDAQ:A078340

3 Stocks Estimated To Be 33.6% To 43.9% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets show signs of resilience with U.S. indexes nearing record highs and broad-based gains across sectors, investors are increasingly attentive to opportunities that may be undervalued in the current economic landscape. In this environment, identifying stocks trading below their intrinsic value can offer potential for growth, making them attractive considerations for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victory Capital Holdings (NasdaqGS:VCTR) | US$72.24 | US$144.03 | 49.8% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.12 | US$99.93 | 49.8% |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR2.39 | 49.7% |

| Synovus Financial (NYSE:SNV) | US$57.97 | US$115.67 | 49.9% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| EuroGroup Laminations (BIT:EGLA) | €2.728 | €5.42 | 49.7% |

| Nidaros Sparebank (OB:NISB) | NOK100.00 | NOK198.62 | 49.7% |

| Nutanix (NasdaqGS:NTNX) | US$72.35 | US$143.99 | 49.8% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2914.00 | ¥5793.07 | 49.7% |

| VerticalScope Holdings (TSX:FORA) | CA$9.01 | CA$18.01 | 50% |

Let's review some notable picks from our screened stocks.

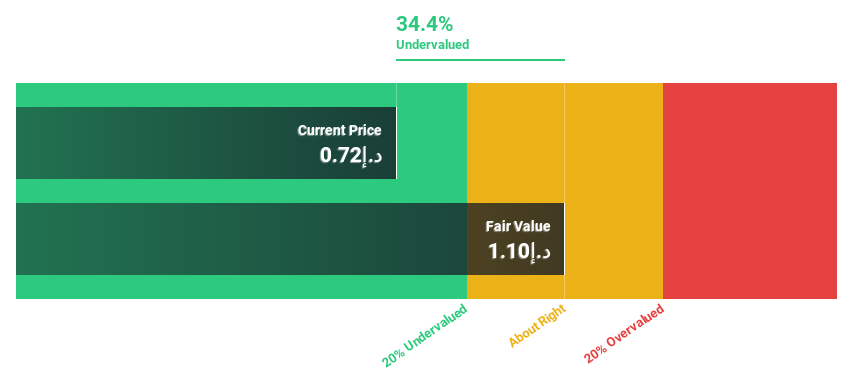

Dana Gas PJSC (ADX:DANA)

Overview: Dana Gas PJSC operates in the exploration, production, transportation, processing, and sale of natural gas and petroleum products across the United Arab Emirates, Iraq, and Egypt with a market cap of AED4.83 billion.

Operations: The company's revenue is primarily derived from its oil and gas integrated operations, amounting to $300 million.

Estimated Discount To Fair Value: 33.6%

Dana Gas PJSC is trading at a significant discount, around 33.6% below its estimated fair value of AED1.09, with shares currently priced at AED0.73. Despite an 8% production decline and reduced earnings compared to last year, the company's earnings are projected to grow significantly by over 20% annually, outpacing the local market's growth rate. However, its high dividend yield of 12.38% isn't well-covered by free cash flows, indicating potential sustainability concerns.

- Our growth report here indicates Dana Gas PJSC may be poised for an improving outlook.

- Dive into the specifics of Dana Gas PJSC here with our thorough financial health report.

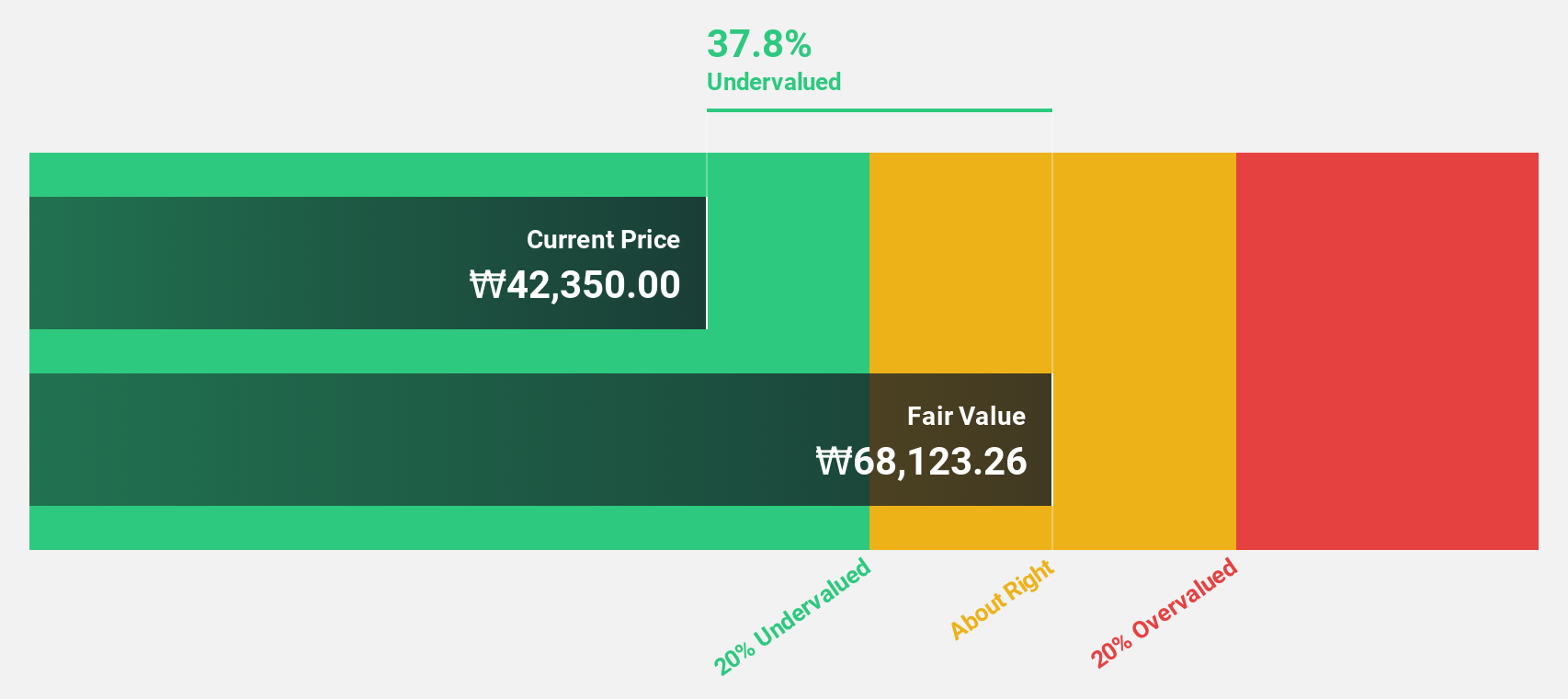

Com2uS (KOSDAQ:A078340)

Overview: Com2uS Corporation develops and publishes mobile games across various international markets, including South Korea, the United States, and Europe, with a market cap of ₩535.68 billion.

Operations: Revenue Segments (in millions of ₩): Online Games ₩370,000; Mobile Games ₩210,000; Advertising ₩50,000.

Estimated Discount To Fair Value: 41.4%

Com2uS is trading at ₩47,150, significantly below its estimated fair value of ₩80,441.18, representing a substantial discount. Despite recent earnings showing a decline in net income to ₩3.21 billion from ₩18.31 billion year-on-year, the company is expected to become profitable in three years with above-average market growth and earnings projected to grow 95.28% annually. However, its dividend yield of 2.76% isn't well-supported by current earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Com2uS is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Com2uS' balance sheet health report.

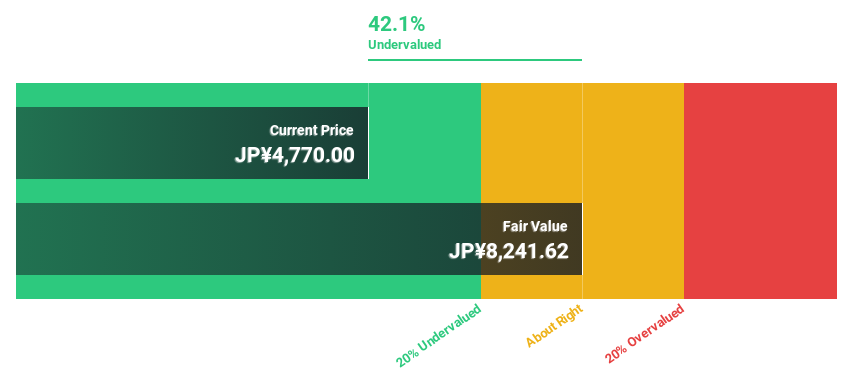

SEIKOH GIKEN (TSE:6834)

Overview: SEIKOH GIKEN Co., Ltd. designs, manufactures, and sells optical components, lenses, and radio over fiber products both in Japan and internationally, with a market cap of ¥40.69 billion.

Operations: The company's revenue is primarily derived from two segments: Optical Products Related, contributing ¥8.23 billion, and Precision Machine Related, contributing ¥8.78 billion.

Estimated Discount To Fair Value: 43.9%

Seikoh Giken, trading at ¥4620, is considerably undervalued with an estimated fair value of ¥8239.96, presenting a significant discount. The company’s earnings grew by 67.8% last year and are forecast to increase by 25.1% annually over the next three years, outpacing the Japanese market average. Despite high volatility in its share price recently, Seikoh Giken's revenue growth of 10.8% per year remains strong compared to market averages.

- Our earnings growth report unveils the potential for significant increases in SEIKOH GIKEN's future results.

- Click here to discover the nuances of SEIKOH GIKEN with our detailed financial health report.

Summing It All Up

- Click here to access our complete index of 914 Undervalued Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078340

Com2uS

Develops and publishes mobile games in South Korea, the United States, China, Japan, Taiwan, Southeast Asia, Europe, and internationally.

Undervalued with reasonable growth potential.