Stock Analysis

- South Korea

- /

- Food

- /

- KOSE:A145990

Exploring Dividend Stocks On The KRX June 2024

Reviewed by Simply Wall St

The South Korean market has seen a modest uptick of 3.3% over the past week, though it has remained relatively stable over the past year, with earnings expected to grow by 29% annually. In this context, dividend stocks can be particularly appealing for investors looking for potential income combined with growth opportunities in such an evolving market landscape.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.61% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 6.71% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.55% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.33% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.43% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.33% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.90% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.97% | ★★★★★☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.02% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.38% | ★★★★☆☆ |

Click here to see the full list of 70 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

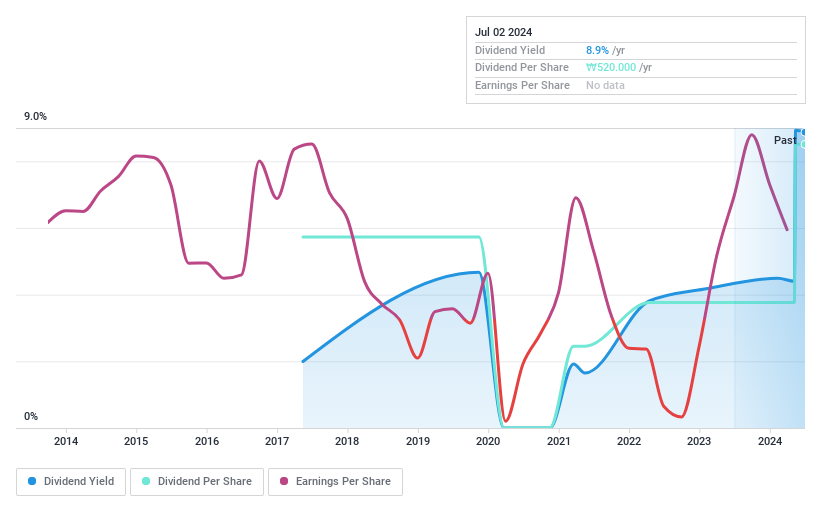

Dong Suh Companies (KOSE:A026960)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dong Suh Companies Inc., operating in sectors such as food, packaging, tea, logistics, and import/export, has a market capitalization of approximately ₩1.84 trillion.

Operations: Dong Suh Companies Inc. generates its revenue from diverse sectors including food, packaging, tea, logistics, and import/export activities.

Dividend Yield: 3.9%

Dong Suh Companies, with a dividend yield of 3.92%, ranks in the top 25% of South Korean dividend payers. Although it has only been distributing dividends for six years, payments have shown growth and stability. The dividends are well-supported by both earnings and cash flows, with payout ratios at 48.8% and cash payout ratios at 59.4%, respectively. However, its short history in dividend payments may concern investors seeking long-term proven reliability in their income-generating stocks.

- Delve into the full analysis dividend report here for a deeper understanding of Dong Suh Companies.

- Upon reviewing our latest valuation report, Dong Suh Companies' share price might be too pessimistic.

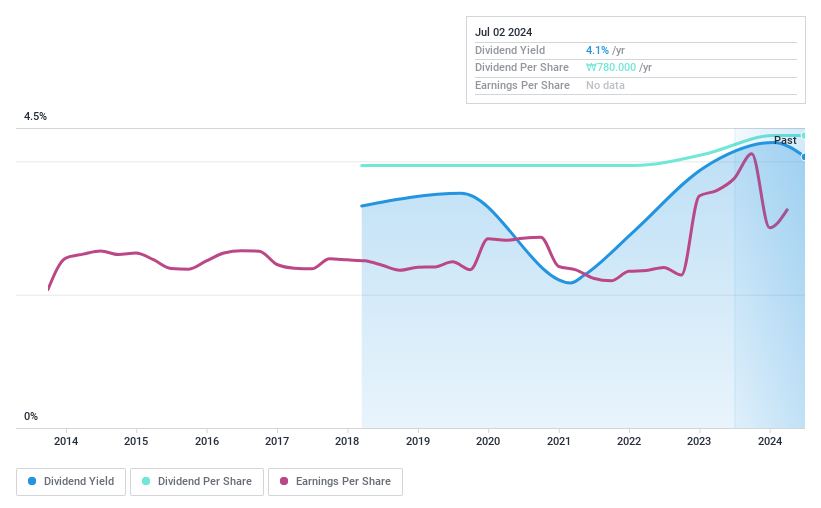

Muhak (KOSE:A033920)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Muhak Co., Ltd. is a South Korean company engaged in the manufacturing and selling of liquors, with a market capitalization of approximately ₩148.86 billion.

Operations: Muhak Co., Ltd. generates its revenue primarily through the production and sale of liquors in South Korea.

Dividend Yield: 4.1%

Muhak Co., Ltd. has shown a mixed performance in its dividend reliability over the past seven years with volatile payments, despite a current yield of 4.08% placing it in the top quartile of Korean dividend stocks. Its dividends are well-covered by earnings and cash flows, with payout ratios at 14.1% and 50.1% respectively, indicating sustainability from a financial perspective. However, recent earnings have been inconsistent, showing significant fluctuations which could impact future dividend stability.

- Navigate through the intricacies of Muhak with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Muhak shares in the market.

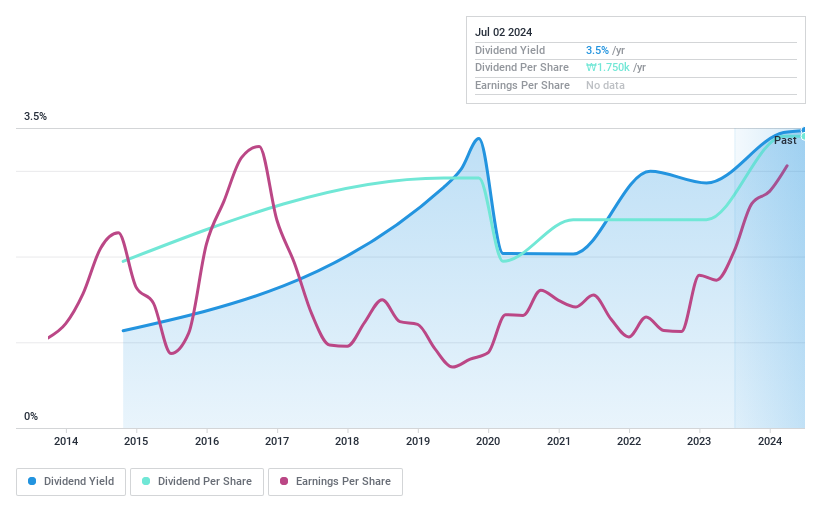

Samyang (KOSE:A145990)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyang Corporation, operating both domestically and internationally, is engaged in the production and sale of chemicals and foodstuffs, with a market capitalization of approximately ₩0.50 billion.

Operations: Samyang Corporation generates its revenue through the production and sale of chemicals and foodstuffs across both domestic and international markets.

Dividend Yield: 3.4%

Samyang's dividend yield of 3.38% trails slightly behind the top quartile of Korean dividend stocks at 3.52%. Despite a robust earnings growth of 77.4% over the past year, its dividend track record has been marked by inconsistency and volatility over the last decade. Nonetheless, with a low price-to-earnings ratio of 4.6x compared to the market average and both earnings and cash flow payout ratios around 15%, its dividends are financially sustainable, though past fluctuations suggest caution is warranted in expecting stable future payouts.

- Unlock comprehensive insights into our analysis of Samyang stock in this dividend report.

- In light of our recent valuation report, it seems possible that Samyang is trading beyond its estimated value.

Turning Ideas Into Actions

- Unlock more gems! Our Top KRX Dividend Stocks screener has unearthed 67 more companies for you to explore.Click here to unveil our expertly curated list of 70 Top KRX Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Samyang is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A145990

Samyang

Produces and sells chemicals and foodstuff in Korea and internationally.

Flawless balance sheet with solid track record and pays a dividend.