- South Korea

- /

- Food

- /

- KOSDAQ:A025880

Optimistic Investors Push KC Feed Co., Ltd. (KOSDAQ:025880) Shares Up 35% But Growth Is Lacking

The KC Feed Co., Ltd. (KOSDAQ:025880) share price has done very well over the last month, posting an excellent gain of 35%. Looking back a bit further, it's encouraging to see the stock is up 41% in the last year.

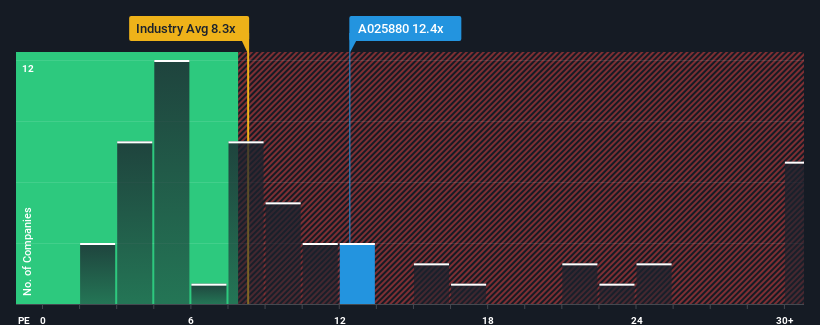

In spite of the firm bounce in price, it's still not a stretch to say that KC Feed's price-to-earnings (or "P/E") ratio of 12.4x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, KC Feed has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for KC Feed

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, KC Feed would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 50% gain to the company's bottom line. The latest three year period has also seen an excellent 35% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to deliver 33% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it interesting that KC Feed is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From KC Feed's P/E?

Its shares have lifted substantially and now KC Feed's P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of KC Feed revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with KC Feed (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If you're unsure about the strength of KC Feed's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if KC Feed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A025880

KC Feed

Engages in the manufacture and sale of formulated feed in South Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives