- South Korea

- /

- Food and Staples Retail

- /

- KOSE:A282330

BGF retail CO., LTD. (KRX:282330) Stock Goes Ex-Dividend In Just Three Days

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see BGF retail CO., LTD. (KRX:282330) is about to trade ex-dividend in the next three days. This means that investors who purchase shares on or after the 29th of December will not receive the dividend, which will be paid on the 14th of April.

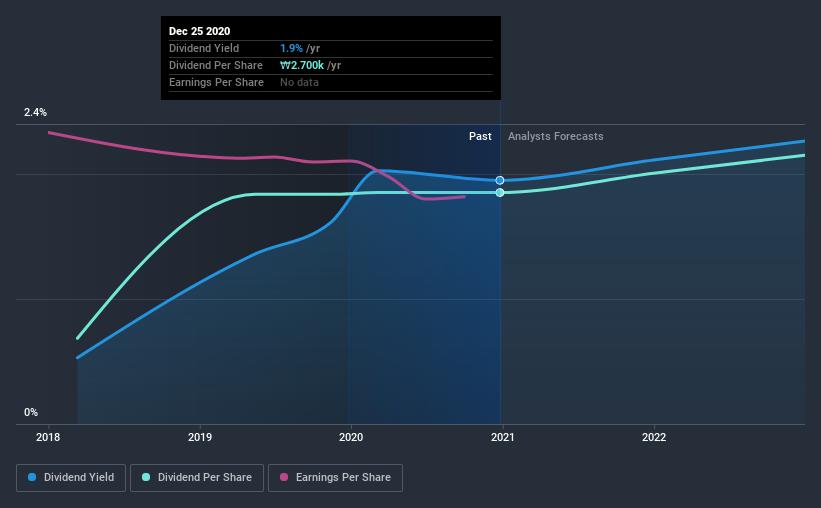

BGF retail's next dividend payment will be ₩2,700 per share, and in the last 12 months, the company paid a total of ₩2,700 per share. Looking at the last 12 months of distributions, BGF retail has a trailing yield of approximately 1.9% on its current stock price of ₩138500. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for BGF retail

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. That's why it's good to see BGF retail paying out a modest 36% of its earnings. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. What's good is that dividends were well covered by free cash flow, with the company paying out 14% of its cash flow last year.

It's positive to see that BGF retail's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's not ideal to see BGF retail's earnings per share have been shrinking at 4.9% a year over the previous three years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, three years ago, BGF retail has lifted its dividend by approximately 39% a year on average.

The Bottom Line

From a dividend perspective, should investors buy or avoid BGF retail? BGF retail has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

On that note, you'll want to research what risks BGF retail is facing. For example, we've found 1 warning sign for BGF retail that we recommend you consider before investing in the business.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade BGF retail, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BGF Retail might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A282330

BGF Retail

Operates convenience stores under the CU brand in South Korea.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026