- South Korea

- /

- Food and Staples Retail

- /

- KOSDAQ:A250000

Investors Holding Back On BORATR CO., Ltd. (KOSDAQ:250000)

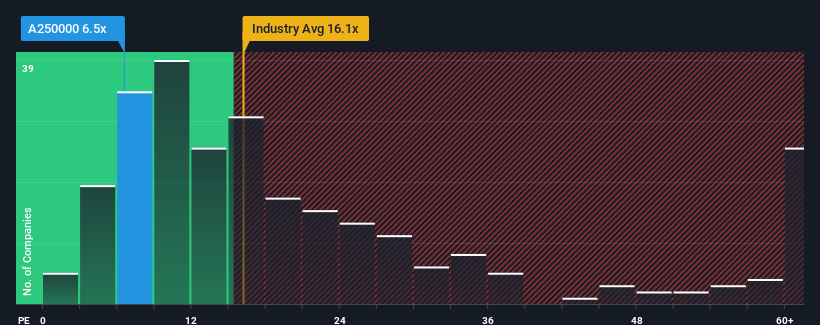

BORATR CO., Ltd.'s (KOSDAQ:250000) price-to-earnings (or "P/E") ratio of 6.5x might make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 11x and even P/E's above 22x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, BORATR has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for BORATR

How Is BORATR's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like BORATR's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 44% gain to the company's bottom line. The latest three year period has also seen an excellent 136% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

It's interesting to note that the rest of the market is similarly expected to grow by 31% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that BORATR's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On BORATR's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of BORATR revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for BORATR you should be aware of.

You might be able to find a better investment than BORATR. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if BORATR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A250000

BORATR

Engages in the food materials distribution, school, restaurant, and online businesses in South Korea and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success