Stock Analysis

- South Korea

- /

- Luxury

- /

- KOSE:A194370

Exploring KRX Dividend Stocks For May 2024

Reviewed by Simply Wall St

In the past year, South Korea's stock market has shown a modest increase of 5.0%, maintaining stability with flat performance over the last week. Given these conditions and anticipated annual earnings growth of 28%, investors might find dividend stocks particularly appealing as they can offer potential for steady income alongside capital appreciation opportunities.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.65% | ★★★★★★ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.11% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.42% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.52% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.96% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.16% | ★★★★★☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.13% | ★★★★☆☆ |

| Tong Yang Life Insurance (KOSE:A082640) | 7.75% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.38% | ★★★★☆☆ |

| Hansae Yes24 Holdings (KOSE:A016450) | 5.25% | ★★★★☆☆ |

Click here to see the full list of 62 stocks from our Top KRX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

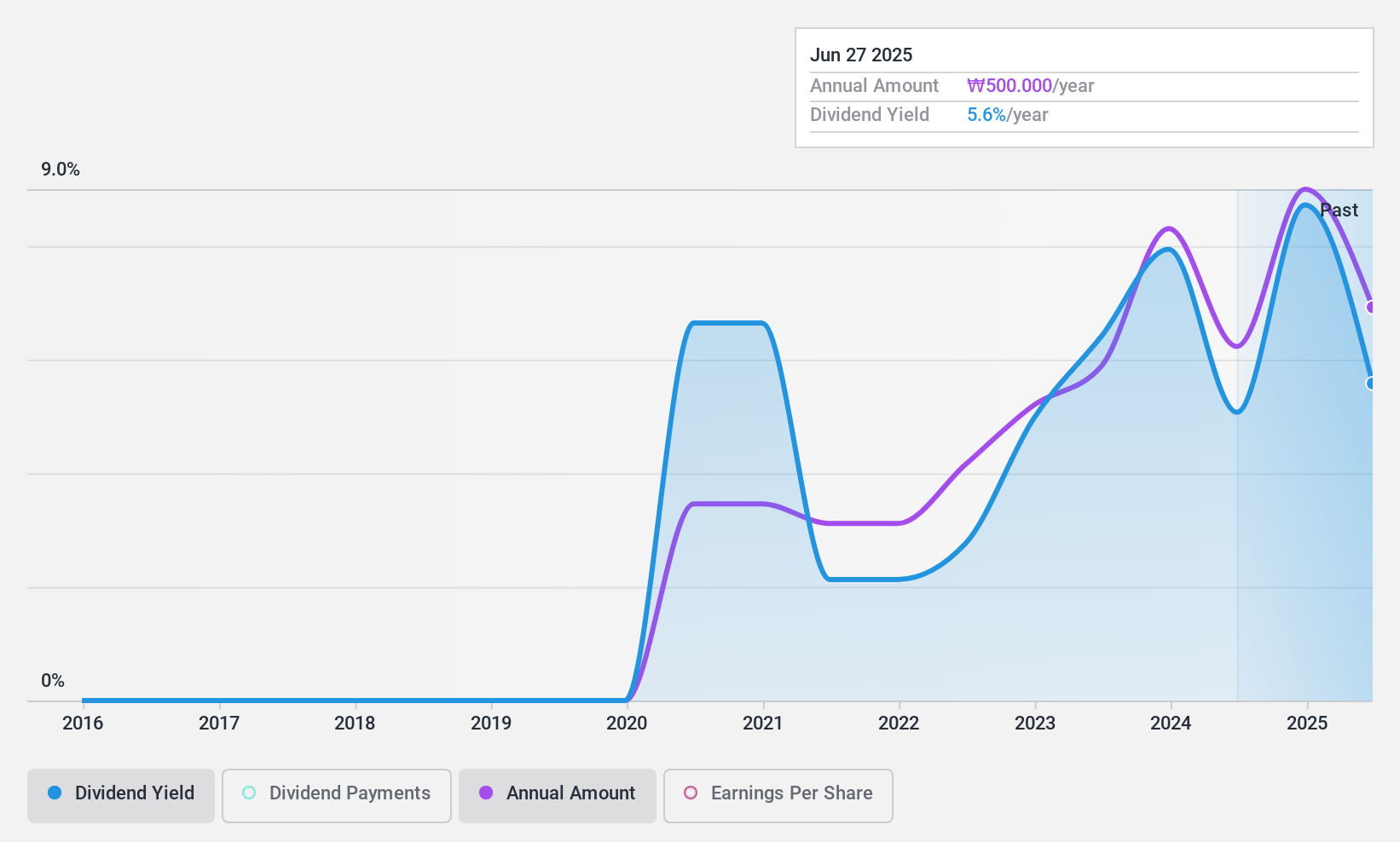

Snt DynamicsLtd (KOSE:A003570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Snt Dynamics Co., Ltd. specializes in manufacturing and selling precision machinery, with a market capitalization of approximately ₩391 billion.

Operations: Snt Dynamics Co., Ltd. generates its revenue primarily through the production and sales of precision machinery.

Dividend Yield: 4%

Snt DynamicsLtd has shown a notable increase in sales and net income, with first-quarter sales rising to ₩0.00046 million from ₩0.00029 million year-over-year, and net income up to ₩12.88 billion from ₩10.87 billion. Despite this growth, the company's dividend history is marked by instability and volatility over its short 4-year dividend-paying period. Although dividends are well-covered by earnings with a payout ratio of 30.4% and cash flows at a low payout ratio of 12.5%, future earnings are expected to decline annually by 8.5%. This financial backdrop presents challenges for predicting long-term dividend reliability despite current affordability.

- Dive into the specifics of Snt DynamicsLtd here with our thorough dividend report.

- According our valuation report, there's an indication that Snt DynamicsLtd's share price might be on the cheaper side.

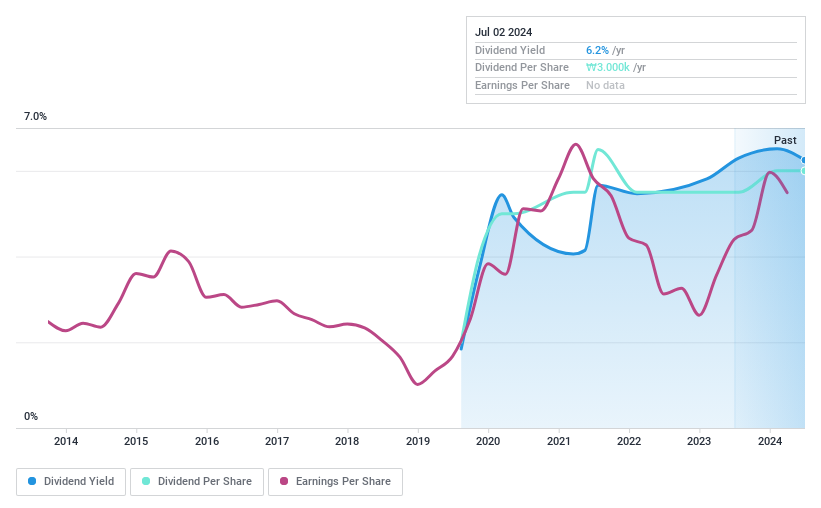

KPX ChemicalLtd (KOSE:A025000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KPX Chemical Co., Ltd. is a South Korean company engaged in the manufacturing and selling of organic chemicals and chemical products, with a market capitalization of approximately ₩225.16 billion.

Operations: KPX Chemical Co., Ltd. generates ₩0.91 billion in revenue from its specialty chemicals segment.

Dividend Yield: 6.3%

KPX Chemical Ltd maintains a solid dividend coverage with a payout ratio of 22% and cash payout ratio of 24.1%, ensuring dividends are well-supported by both earnings and cash flows. Despite its attractive yield of 6.34%, which ranks in the top quartile in the South Korean market, the company's dividend history is relatively short and marked by volatility, having been established only within the past five years with significant fluctuations. This instability could concern investors looking for consistent long-term returns from dividends.

- Get an in-depth perspective on KPX ChemicalLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility KPX ChemicalLtd's shares may be trading at a discount.

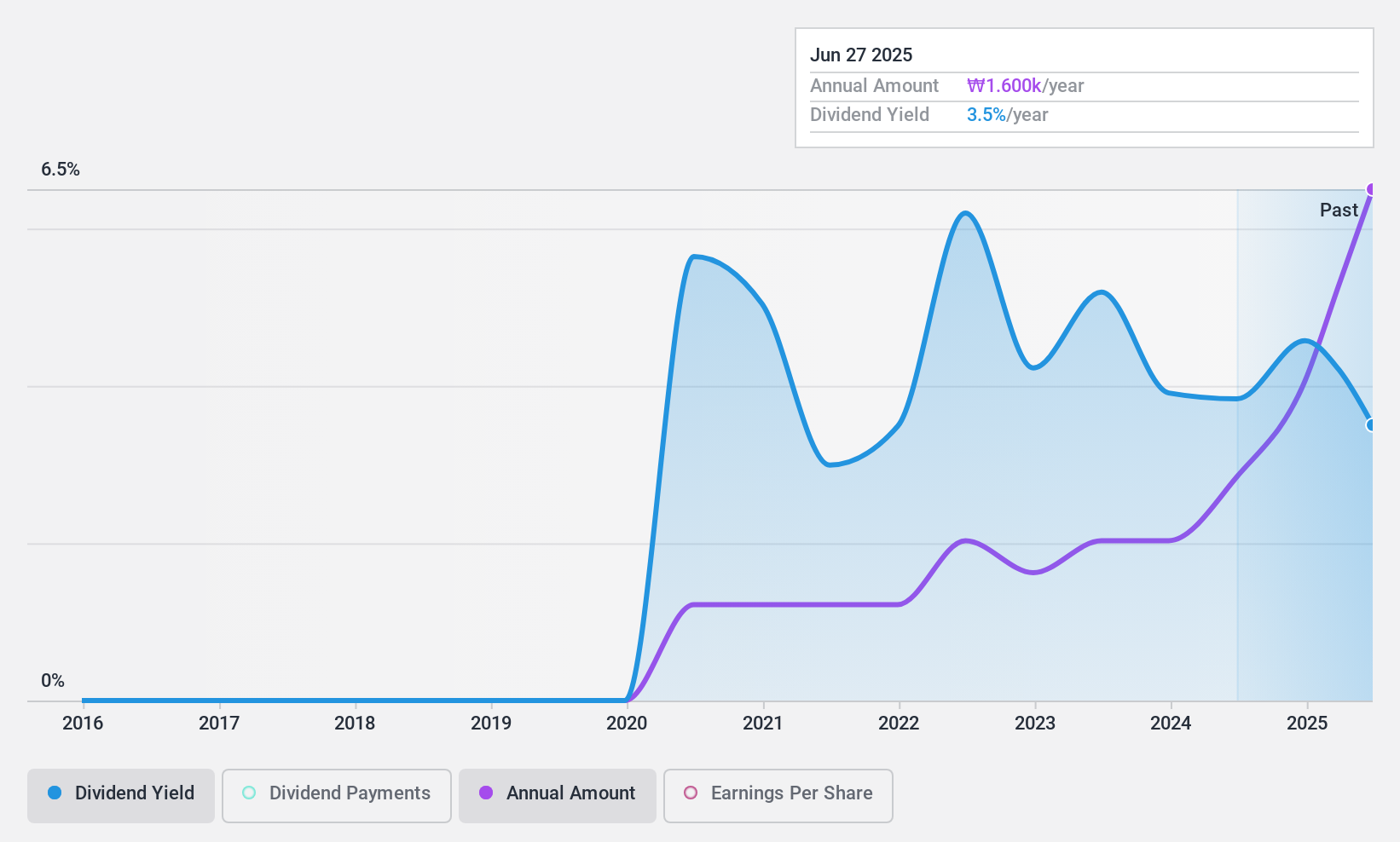

JS (KOSE:A194370)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JS Corporation specializes in the manufacturing and selling of handbags globally, with a market capitalization of approximately ₩234.52 billion.

Operations: JS Corporation generates ₩580.16 billion from its Apparel Manufacturing Sector and ₩282.61 billion from its Handbag Manufacturing Division.

Dividend Yield: 4.9%

JS Corporation offers a dividend yield of 4.92%, placing it in the top 25% of South Korean dividend payers. The dividends are sustainable, backed by a payout ratio of 25.7% and a cash payout ratio of 15.4%. However, the company's dividend history is less reliable, with volatile payments over its short four-year dividend-paying span despite trading at 51% below estimated fair value and expected earnings growth of 28.27% annually. Recent developments include an anticipated Q1 earnings report on May 10, 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of JS.

- The analysis detailed in our JS valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Dive into all 62 of the Top KRX Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether JS is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A194370

Undervalued with adequate balance sheet and pays a dividend.