- South Korea

- /

- Consumer Durables

- /

- KOSE:A192400

Discovering South Korea's Hidden Gems: 3 Promising Stocks with Strong Fundamentals

Reviewed by Simply Wall St

The South Korea stock market recently ended a two-day winning streak, with the KOSPI index experiencing a modest decline due to losses in industrials and mixed performances in financial shares and chemicals. Broader market sentiment remains cautious amid global economic concerns, impacting small-cap stocks. In this environment, identifying stocks with strong fundamentals becomes crucial. Here are three promising South Korean companies that stand out for their robust financial health and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.98% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| BIO-FD&CLtd | 1.99% | 10.59% | 21.51% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.38% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Soulbrain Holdings (KOSDAQ:A036830)

Simply Wall St Value Rating: ★★★★★☆

Overview: Soulbrain Holdings Co., Ltd. develops, manufactures, and supplies core materials for the semiconductor, display, and secondary battery cell industries in South Korea and internationally with a market cap of ₩1.12 trillion.

Operations: Soulbrain Holdings generates revenue primarily from the sale of core materials for the semiconductor, display, and secondary battery cell industries. The company has a market cap of ₩1.12 trillion.

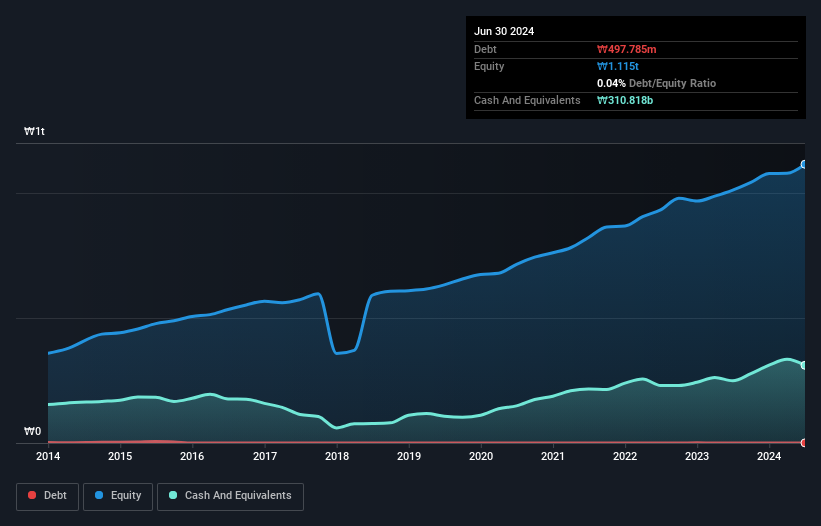

Soulbrain Holdings, a small-cap player in South Korea's chemicals sector, has shown resilience with earnings growth of 2.4% over the past year. The company’s debt to equity ratio has increased from 19.4% to 24.5% over five years but remains satisfactory at 3.3%. Trading at a significant discount of 70.7% below its estimated fair value, it offers an intriguing investment opportunity despite recent share price volatility and negative free cash flow trends.

Dongwon Systems (KOSE:A014820)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dongwon Systems Corporation, a packaging company, manufactures and markets packaging materials in South Korea with a market cap of ₩1.27 billion.

Operations: Dongwon Systems generates revenue primarily from its packaging business, amounting to ₩1.27 billion. The company's cost structure and profitability metrics are not provided in the available data.

Dongwon Systems, a notable player in South Korea's packaging industry, has shown solid financial performance. Recent earnings reports indicate net income for Q2 2024 at KRW 22.26 million, up from KRW 17.90 million the previous year, with basic earnings per share rising to KRW 761 from KRW 612. The company's net debt to equity ratio stands at a high 48.4%, yet interest payments are well covered by EBIT (5.2x). Earnings growth over the past year was robust at 4.8%.

- Click to explore a detailed breakdown of our findings in Dongwon Systems' health report.

Assess Dongwon Systems' past performance with our detailed historical performance reports.

Cuckoo Holdings (KOSE:A192400)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cuckoo Holdings Co., Ltd. manufactures and sells electric heaters and daily necessities in South Korea and internationally, with a market cap of ₩767.64 billion.

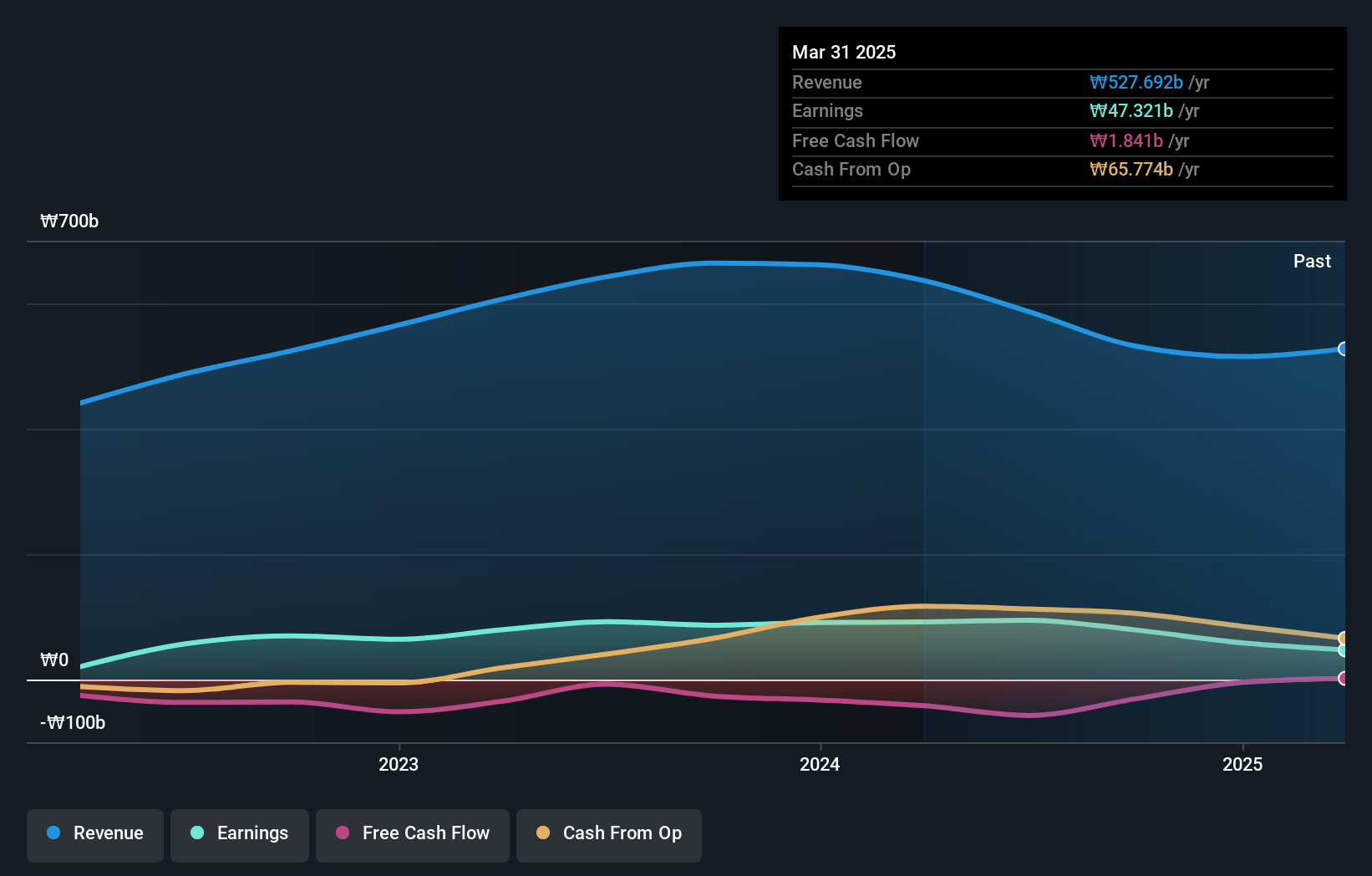

Operations: Cuckoo Holdings generates revenue primarily through the sale of electric heaters and daily necessities both domestically and internationally. The company’s financial performance includes a notable net profit margin of 10.5%.

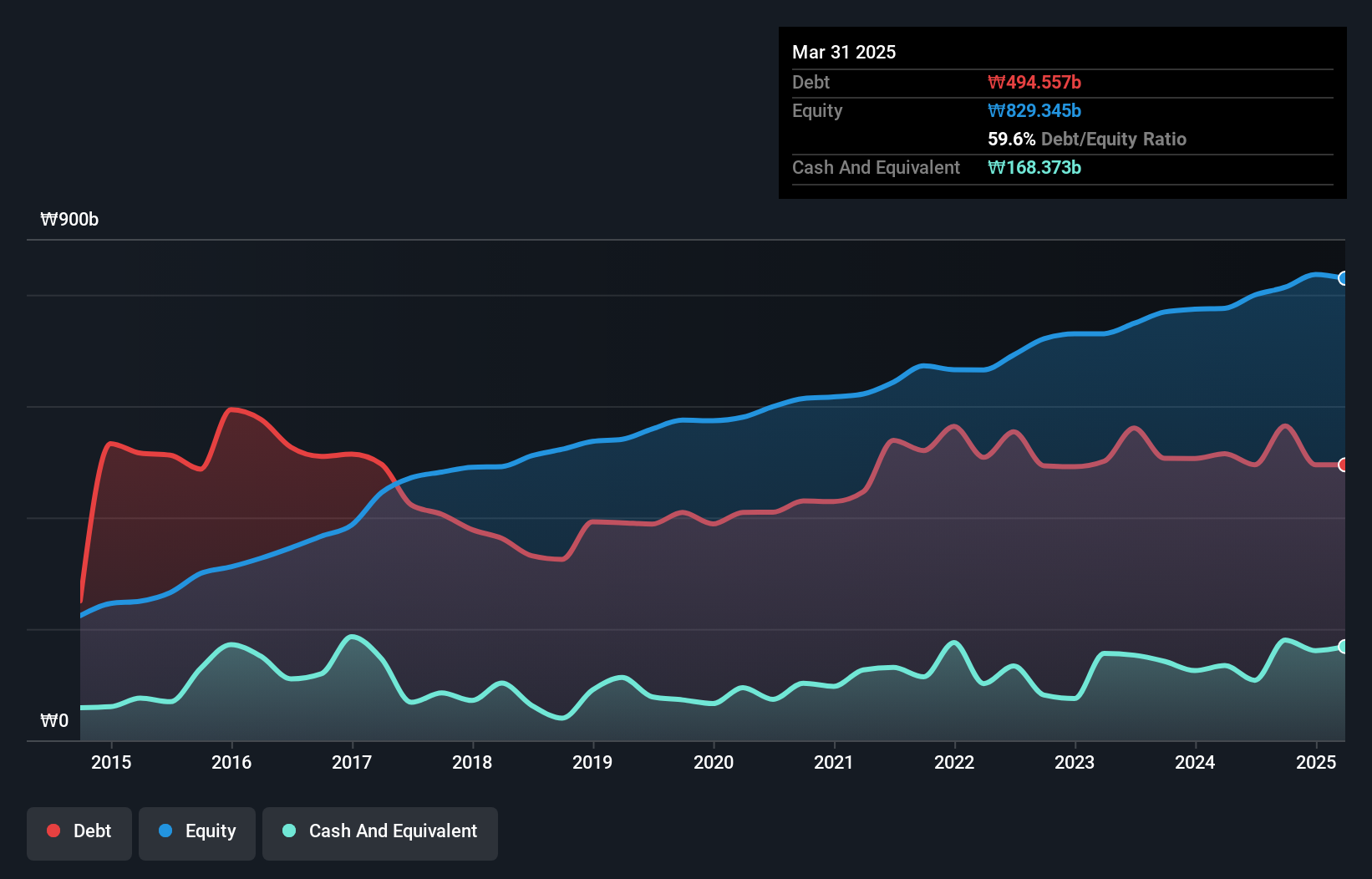

Cuckoo Holdings, a prominent player in South Korea's consumer durables sector, has shown steady earnings growth of 8.8% annually over the past five years. Despite this, its recent 6.5% earnings growth lagged behind the industry average of 26.5%. The company is trading at a significant discount, about 79% below estimated fair value. Additionally, Cuckoo's debt-to-equity ratio has slightly increased to 0.04%, yet it holds more cash than total debt and remains free cash flow positive.

- Click here and access our complete health analysis report to understand the dynamics of Cuckoo Holdings.

Review our historical performance report to gain insights into Cuckoo Holdings''s past performance.

Taking Advantage

- Embark on your investment journey to our 192 KRX Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A192400

Cuckoo Holdings

Manufactures and sells electric heaters and daily necessities in South Korea and internationally.

Excellent balance sheet, good value and pays a dividend.