- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

High Growth Tech Stocks In South Korea To Watch

Reviewed by Simply Wall St

The South Korea stock market recently saw a setback, ending a two-day winning streak with the KOSPI index closing at 2,664.63 after shedding 16.37 points or 0.61 percent on Tuesday amid mixed performances from various sectors. In this fluctuating environment, identifying high-growth tech stocks becomes crucial as they often demonstrate resilience and potential for significant returns even during broader market downturns.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.83% | 65.02% | ★★★★★★ |

| Park Systems | 23.49% | 35.59% | ★★★★★★ |

| Devsisters | 25.46% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

WemadeLtd (KOSDAQ:A112040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wemade Co., Ltd. develops and publishes games in South Korea and internationally, with a market cap of ₩1.17 trillion.

Operations: Wemade Co., Ltd. focuses on the development and publication of games both domestically in South Korea and internationally. The company generates revenue primarily from game sales and related services, contributing significantly to its market cap of ₩1.17 trillion.

WemadeLtd. is making significant strides in the blockchain gaming sector with its WEMIX ecosystem, driven by the innovative WEMIX3.0 public blockchain. The company reported Q2 2024 sales of ₩332.7 billion, despite a net loss of ₩51.6 billion for the quarter, indicating ongoing investments in growth areas like GameFi and NFTs. With an annual revenue forecast to grow at 11.1%, Wemade's earnings are expected to surge by 107.94% per year over the next three years, reflecting robust future prospects in South Korea's high-growth tech landscape. In terms of R&D expenses, Wemade has consistently prioritized innovation; for instance, their recent financials show substantial investment aimed at enhancing their gaming ecosystem and user experience on platforms like WEMIX PLAY. This commitment to R&D underpins their strategic focus on long-term growth and industry leadership within blockchain technology and digital entertainment sectors.

- Get an in-depth perspective on WemadeLtd's performance by reading our health report here.

Understand WemadeLtd's track record by examining our Past report.

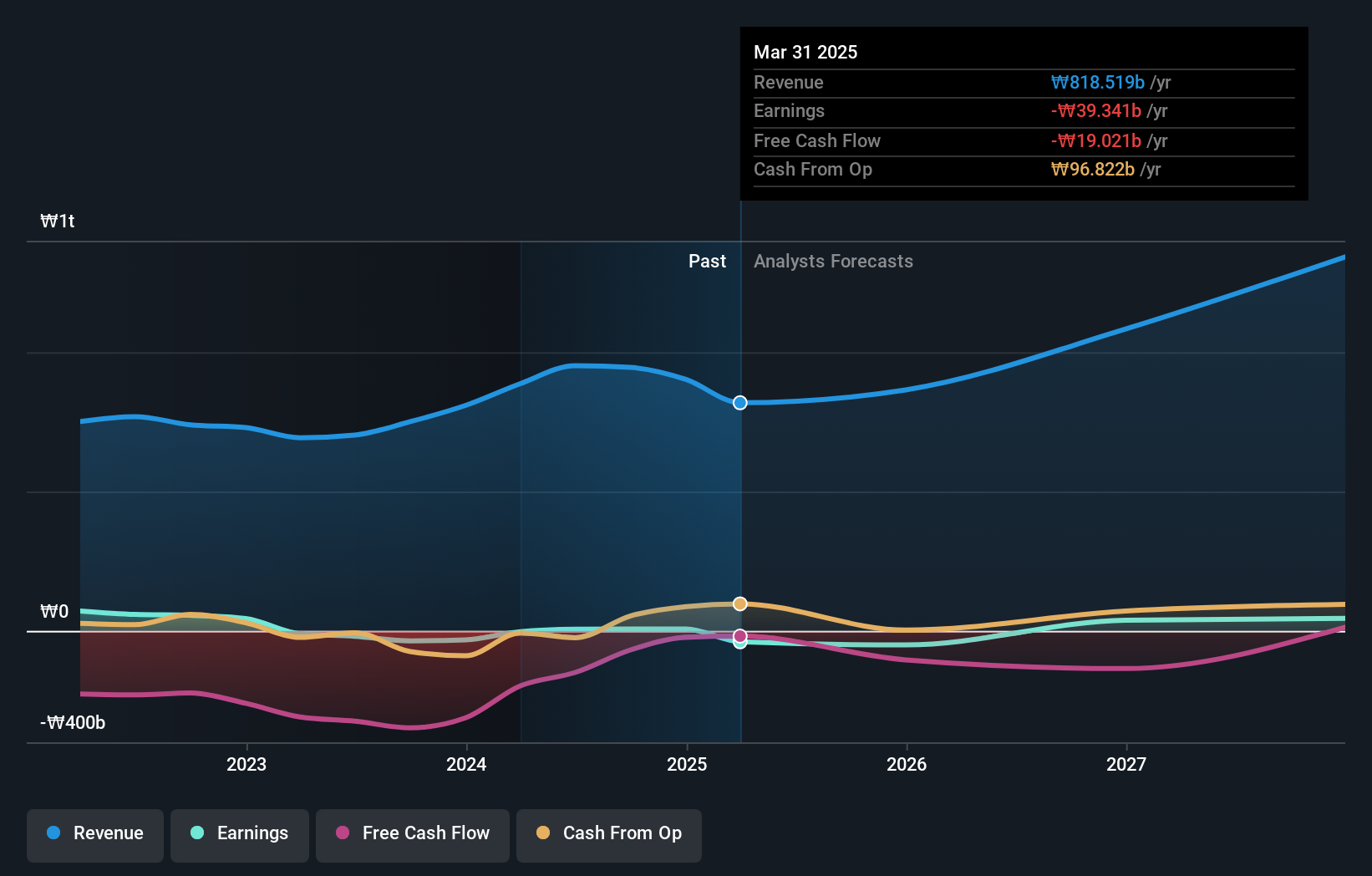

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a biotechnology company, specializes in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩17.29 billion.

Operations: ALTEOGEN Inc. generates revenue primarily from its biotechnology segment, amounting to ₩90.79 million. The company's focus areas include long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

ALTEOGEN's recent MFDS approval for Tergase®, a recombinant hyaluronidase with 99.5% purity, showcases its innovative Hybrozyme™ Technology. This product is set to revolutionize various medical applications, including dermal filler removal and orthopedics pain management. With an anticipated revenue growth of 64.2% per year, ALTEOGEN is poised for significant expansion in South Korea's biotech sector. Despite current unprofitability, the company's robust R&D investments underline its commitment to long-term growth and industry leadership.

- Click here and access our complete health analysis report to understand the dynamics of ALTEOGEN.

Evaluate ALTEOGEN's historical performance by accessing our past performance report.

Lotte Energy Materials (KOSE:A020150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Energy Materials Corporation produces and sells elecfoils in Korea and internationally, with a market cap of ₩1.91 trillion.

Operations: The company generates revenue primarily from its manufacturing sector, which contributes ₩768.85 billion, and the service sector, adding ₩218.48 billion.

Lotte Energy Materials, a notable player in South Korea's tech sector, is experiencing robust growth with its revenue projected to rise by 16.3% annually, outpacing the broader market's 10.8%. The company's earnings are expected to grow at an impressive 53.7% per year, reflecting its strong market positioning. Despite a significant one-off loss of ₩36.7B impacting recent financial results, Lotte Energy Materials remains focused on innovation and long-term growth through substantial R&D investments.

- Click to explore a detailed breakdown of our findings in Lotte Energy Materials' health report.

Explore historical data to track Lotte Energy Materials' performance over time in our Past section.

Seize The Opportunity

- Discover the full array of 49 KRX High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with excellent balance sheet.