- South Korea

- /

- Auto

- /

- KOSE:A000270

Exploring Dividend Stocks On The KRX June 2024

Reviewed by Simply Wall St

As the South Korean stock market experiences fluctuations, with the KOSPI recently breaking a two-day winning streak, investors are closely monitoring various sectors for resilient investment opportunities. In this context, dividend stocks remain a compelling option for those looking to potentially stabilize their portfolios amidst market volatility and economic events.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.59% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 6.72% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.55% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.34% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.43% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.23% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.90% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.94% | ★★★★★☆ |

| Tong Yang Life Insurance (KOSE:A082640) | 7.98% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.41% | ★★★★☆☆ |

Click here to see the full list of 70 stocks from our Top KRX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kia (KOSE:A000270)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kia Corporation, a South Korean automaker, engages in the manufacturing and selling of vehicles across markets including South Korea, North America, and Europe, with a market capitalization of approximately ₩47.83 trillion.

Operations: Kia Corporation generates its revenue primarily from vehicle sales across key markets such as South Korea, North America, and Europe.

Dividend Yield: 4.6%

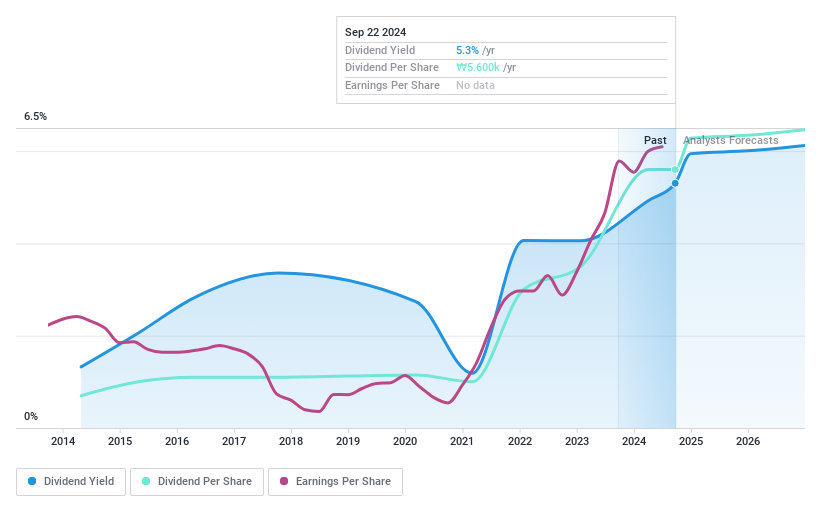

Kia Corporation, trading 46.9% below its estimated fair value, offers a compelling dividend yield of 4.59%, ranking in the top 25% of Korean dividend payers. The dividends are well-supported with a low payout ratio of 23.4% from earnings and 25.4% from cash flows, indicating sustainability. Dividends have shown stability over the past decade and have also increased during this period, reflecting reliability in shareholder returns despite recent legal issues regarding vehicle theft vulnerabilities which led to a settlement potentially costing up to US$145 million.

- Get an in-depth perspective on Kia's performance by reading our dividend report here.

- Our expertly prepared valuation report Kia implies its share price may be lower than expected.

Samhwa Paints Industrial (KOSE:A000390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samhwa Paints Industrial Co., Ltd. is a company based in South Korea that specializes in manufacturing and selling a diverse range of paints, both domestically and internationally, with a market capitalization of approximately ₩195.80 billion.

Operations: Samhwa Paints Industrial Co., Ltd. generates revenue through the manufacture and sale of various paints across domestic and international markets.

Dividend Yield: 4.7%

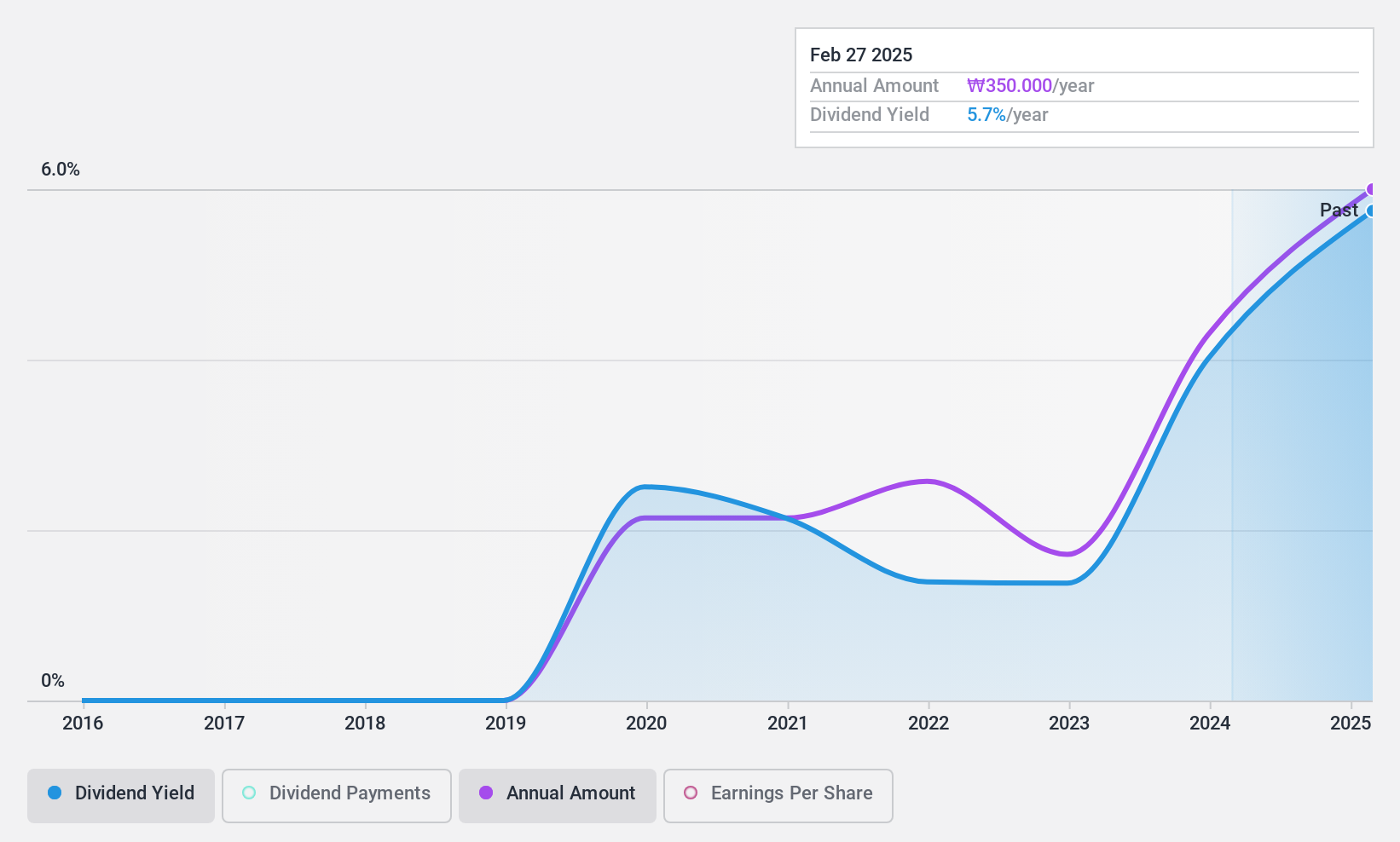

Samhwa Paints Industrial Co., Ltd. has shown significant earnings growth, with net income increasing to KRW 16.16 billion in 2023 from KRW 5.60 billion the previous year, and continuing strong into the first quarter of 2024. Despite this performance, the company's dividend history is marked by instability and volatility over its relatively short dividend-paying tenure of less than a decade. The dividends are supported by earnings and cash flows with a payout ratio of 49.4% and a cash payout ratio of 25.8%, respectively; however, the share price has been highly volatile recently, which might concern dividend-focused investors seeking stability.

- Click to explore a detailed breakdown of our findings in Samhwa Paints Industrial's dividend report.

- Our valuation report here indicates Samhwa Paints Industrial may be undervalued.

Hansae Yes24 Holdings (KOSE:A016450)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hansae Yes24 Holdings Co., Ltd. is engaged in the production and sale of fabrics both domestically in South Korea and internationally, with a market capitalization of approximately ₩188.54 billion.

Operations: Hansae Yes24 Holdings Co., Ltd. generates its revenue primarily from the production and international sale of fabrics.

Dividend Yield: 5.2%

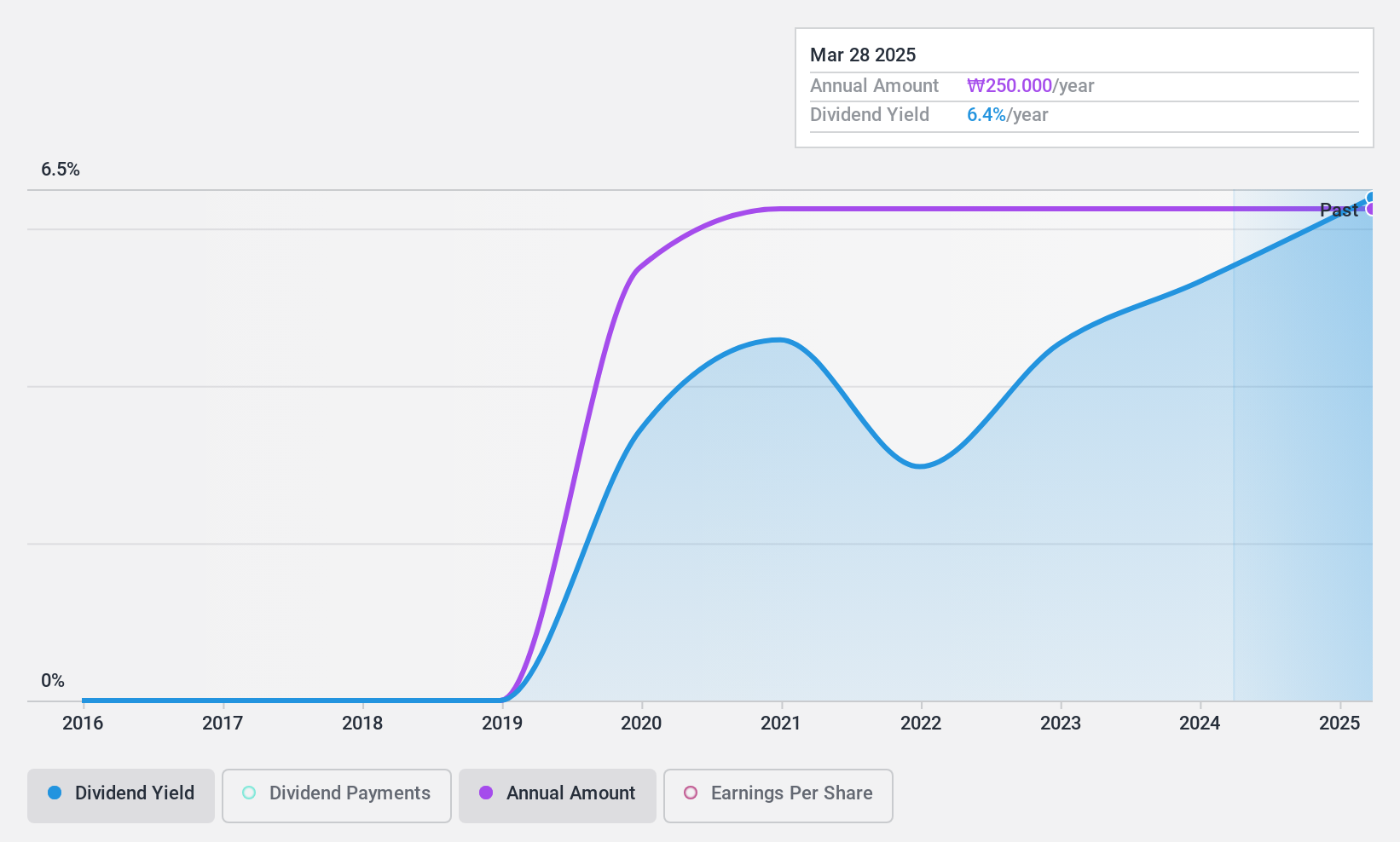

Hansae Yes24 Holdings reported a decrease in Q1 2024 sales to KRW 672.90 million from KRW 698.27 million year-over-year, with net income also falling to KRW 11.79 million from KRW 13.34 million. Despite a short dividend history of five years, dividends have shown growth and stability, supported by a low payout ratio of 17.9% and an even lower cash payout ratio of 6%, indicating strong coverage by earnings and cash flows respectively. The company's debt level is high, yet it maintains a competitive Price-To-Earnings ratio at 3.4x against the market average of 12.9x.

- Click here to discover the nuances of Hansae Yes24 Holdings with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Hansae Yes24 Holdings shares in the market.

Next Steps

- Click through to start exploring the rest of the 67 Top KRX Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000270

Kia

Manufactures and sells vehicles in South Korea, North America, and Europe.

Very undervalued with flawless balance sheet and pays a dividend.