- South Korea

- /

- Consumer Durables

- /

- KOSE:A009240

Are Hanssem Co., Ltd.'s (KRX:009240) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

It is hard to get excited after looking at Hanssem's (KRX:009240) recent performance, when its stock has declined 9.3% over the past month. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Particularly, we will be paying attention to Hanssem's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Hanssem

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hanssem is:

11% = ₩69b ÷ ₩609b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. Another way to think of that is that for every ₩1 worth of equity, the company was able to earn ₩0.11 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Hanssem's Earnings Growth And 11% ROE

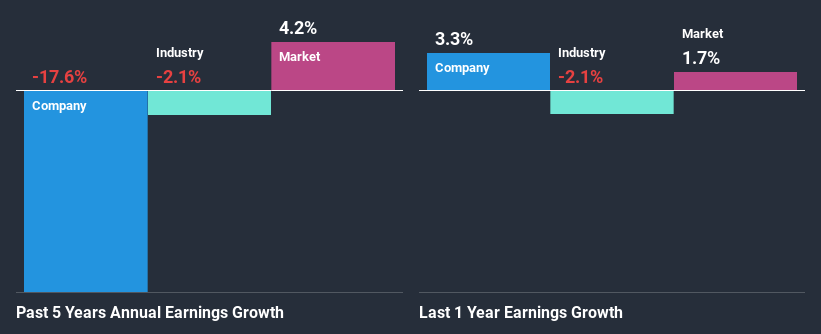

At first glance, Hanssem's ROE doesn't look very promising. Although a closer study shows that the company's ROE is higher than the industry average of 6.6% which we definitely can't overlook. However, Hanssem's five year net income decline rate was 18%. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. Hence, this goes some way in explaining the shrinking earnings.

Furthermore, even when compared to the industry, which has been shrinking its earnings at a rate 2.1% in the same period, we found that Hanssem's performance is pretty disappointing, as it suggests that the company has been shrunk its earnings at a rate faster than the industry.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Hanssem fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Hanssem Making Efficient Use Of Its Profits?

Looking at its three-year median payout ratio of 32% (or a retention ratio of 68%) which is pretty normal, Hanssem's declining earnings is rather baffling as one would expect to see a fair bit of growth when a company is retaining a good portion of its profits. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Moreover, Hanssem has been paying dividends for six years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer consistent dividends even though earnings have been shrinking. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 24% over the next three years. Regardless, the ROE is not expected to change much for the company despite the lower expected payout ratio.

Conclusion

In total, it does look like Hanssem has some positive aspects to its business. However, while the company does have a decent ROE and a high profit retention, its earnings growth number is quite disappointing. This suggests that there might be some external threat to the business, that's hampering growth. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you decide to trade Hanssem, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hanssem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A009240

Hanssem

Manufactures and distributes kitchen furniture and interior-related products in South Korea, Japan, and China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026