- South Korea

- /

- Luxury

- /

- KOSE:A001380

More Unpleasant Surprises Could Be In Store For SG Global Co.,Ltd.'s (KRX:001380) Shares After Tumbling 27%

SG Global Co.,Ltd. (KRX:001380) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 57%, which is great even in a bull market.

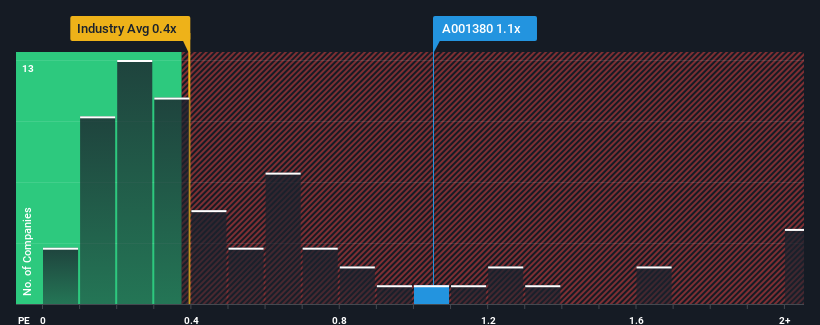

In spite of the heavy fall in price, when almost half of the companies in Korea's Luxury industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider SG GlobalLtd as a stock probably not worth researching with its 1.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for SG GlobalLtd

What Does SG GlobalLtd's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, SG GlobalLtd has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SG GlobalLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, SG GlobalLtd would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. Revenue has also lifted 17% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.1% shows it's about the same on an annualised basis.

With this in mind, we find it intriguing that SG GlobalLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Despite the recent share price weakness, SG GlobalLtd's P/S remains higher than most other companies in the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't expect to see SG GlobalLtd trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware SG GlobalLtd is showing 3 warning signs in our investment analysis, and 1 of those can't be ignored.

If you're unsure about the strength of SG GlobalLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001380

SG GlobalLtd

Engages in the development, production, and sale of automobile seat covers in South Korea, Vietnam, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives