- South Korea

- /

- Luxury

- /

- KOSDAQ:A130500

Can You Imagine How Jubilant GH Advanced Materials' (KOSDAQ:130500) Shareholders Feel About Its 191% Share Price Gain?

GH Advanced Materials Inc. (KOSDAQ:130500) shareholders might be concerned after seeing the share price drop 15% in the last week. Despite this, the stock is a strong performer over the last year, no doubt about that. Like an eagle, the share price soared 191% in that time. So it may be that the share price is simply cooling off after a strong rise. The real question is whether the business is trending in the right direction.

View our latest analysis for GH Advanced Materials

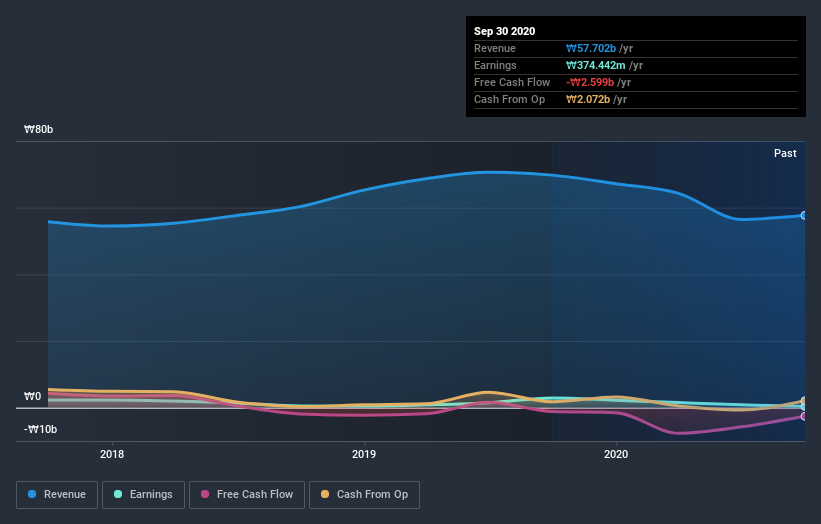

Given that GH Advanced Materials only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last year GH Advanced Materials saw its revenue shrink by 17%. So we would not have expected the share price to rise 191%. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that GH Advanced Materials shareholders have received a total shareholder return of 191% over one year. That's better than the annualised return of 17% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - GH Advanced Materials has 5 warning signs (and 2 which are significant) we think you should know about.

Of course GH Advanced Materials may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade GH Advanced Materials, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A130500

GH Advanced Materials

Engages in the manufacture and sale of non-woven fabrics in South Korea and internationally.

Questionable track record with imperfect balance sheet.

Market Insights

Community Narratives