- South Korea

- /

- Leisure

- /

- KOSDAQ:A050120

How Much Did LiveplexLtd's(KOSDAQ:050120) Shareholders Earn From Share Price Movements Over The Last Year?

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the Liveplex Co.,Ltd. (KOSDAQ:050120) share price is down 34% in the last year. That's well below the market return of 38%. Even if you look out three years, the returns are still disappointing, with the share price down31% in that time. The falls have accelerated recently, with the share price down 12% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for LiveplexLtd

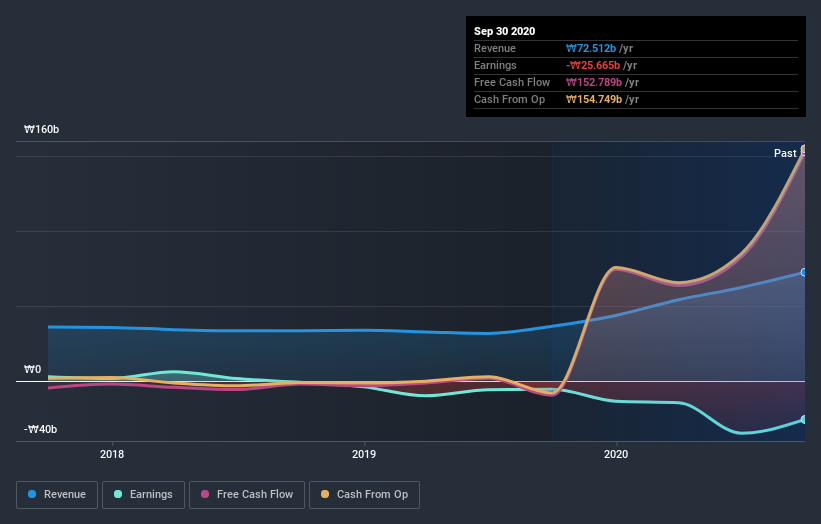

Given that LiveplexLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year LiveplexLtd saw its revenue grow by 98%. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 34% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on LiveplexLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in LiveplexLtd had a tough year, with a total loss of 34%, against a market gain of about 38%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that LiveplexLtd is showing 3 warning signs in our investment analysis , and 2 of those can't be ignored...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading LiveplexLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ES Cube might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A050120

ES Cube

Manufactures and sells leisure tents in South Korea and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives