- Japan

- /

- Marine and Shipping

- /

- TSE:9386

Top 3 Global Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cooling labor markets, fluctuating manufacturing activity, and geopolitical tensions, investors are closely watching the performance of major indices. With U.S. stocks climbing for the second consecutive week and European indexes buoyed by easing monetary policies, dividend stocks present an attractive option for those seeking stable returns amid economic uncertainty. A good dividend stock typically offers consistent payouts and resilience to market fluctuations, making it a valuable consideration in today's dynamic environment.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.53% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.15% | ★★★★★★ |

| NCD (TSE:4783) | 4.07% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.37% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.29% | ★★★★★★ |

| Daicel (TSE:4202) | 4.97% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.81% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.40% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.45% | ★★★★★★ |

Click here to see the full list of 1555 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

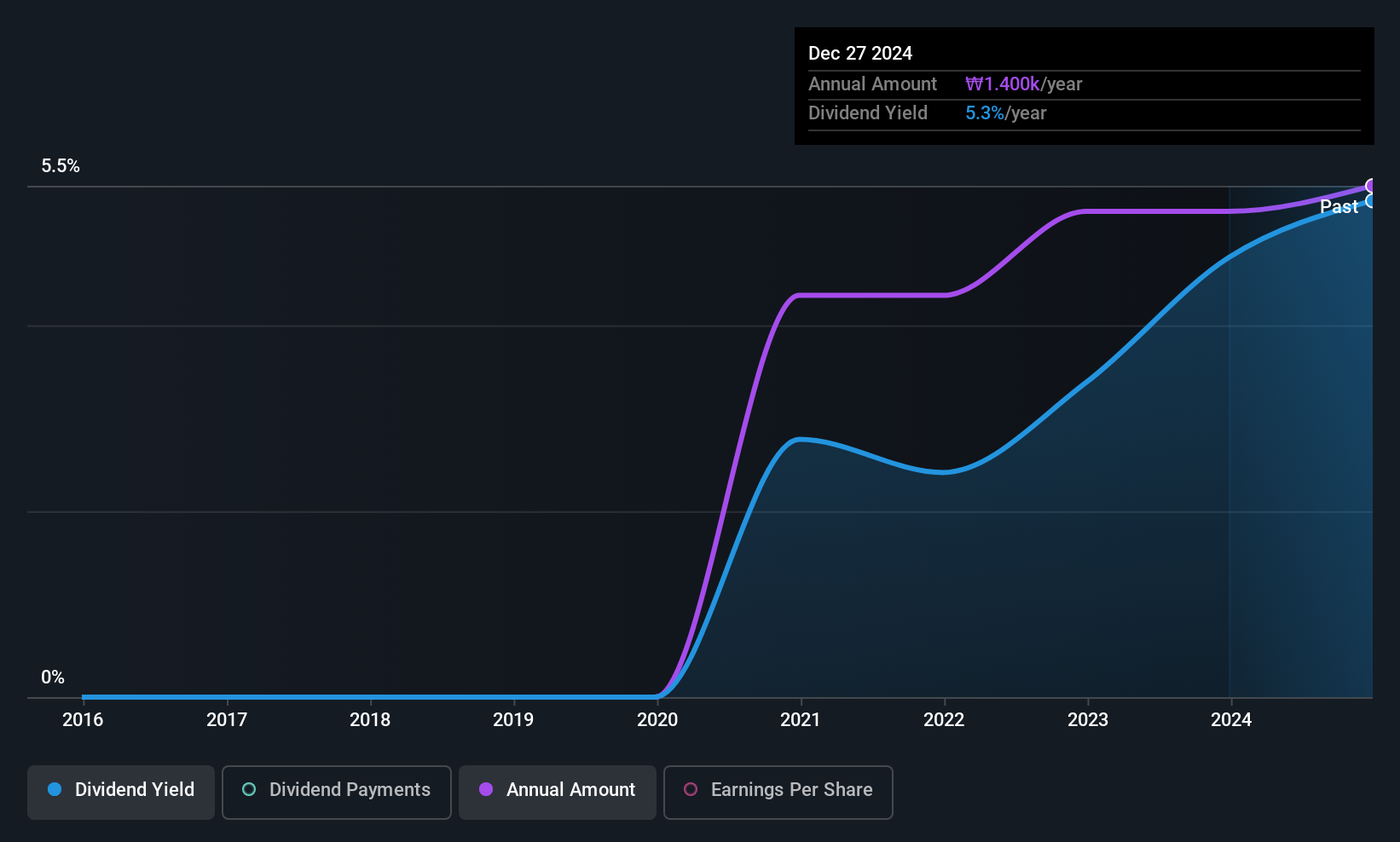

Ace Bed (KOSDAQ:A003800)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ace Bed Company Limited manufactures and sells beds and furniture products both in Korea and internationally, with a market cap of ₩296.12 billion.

Operations: Ace Bed Company Limited generates its revenue primarily from the sale of beds, amounting to ₩296.19 billion, and furniture products, contributing ₩27.57 billion.

Dividend Yield: 4.8%

Ace Bed's dividend payments are well-supported, with a payout ratio of 24.9% and a cash payout ratio of 37.3%, indicating sustainability from both earnings and cash flows. Its dividend yield of 4.76% ranks in the top quartile in the KR market, though its history is limited to five years. Recent earnings show sales growth but declining net income, highlighting potential challenges despite its attractive price-to-earnings ratio of 5.2x compared to the market average.

- Navigate through the intricacies of Ace Bed with our comprehensive dividend report here.

- Our valuation report here indicates Ace Bed may be overvalued.

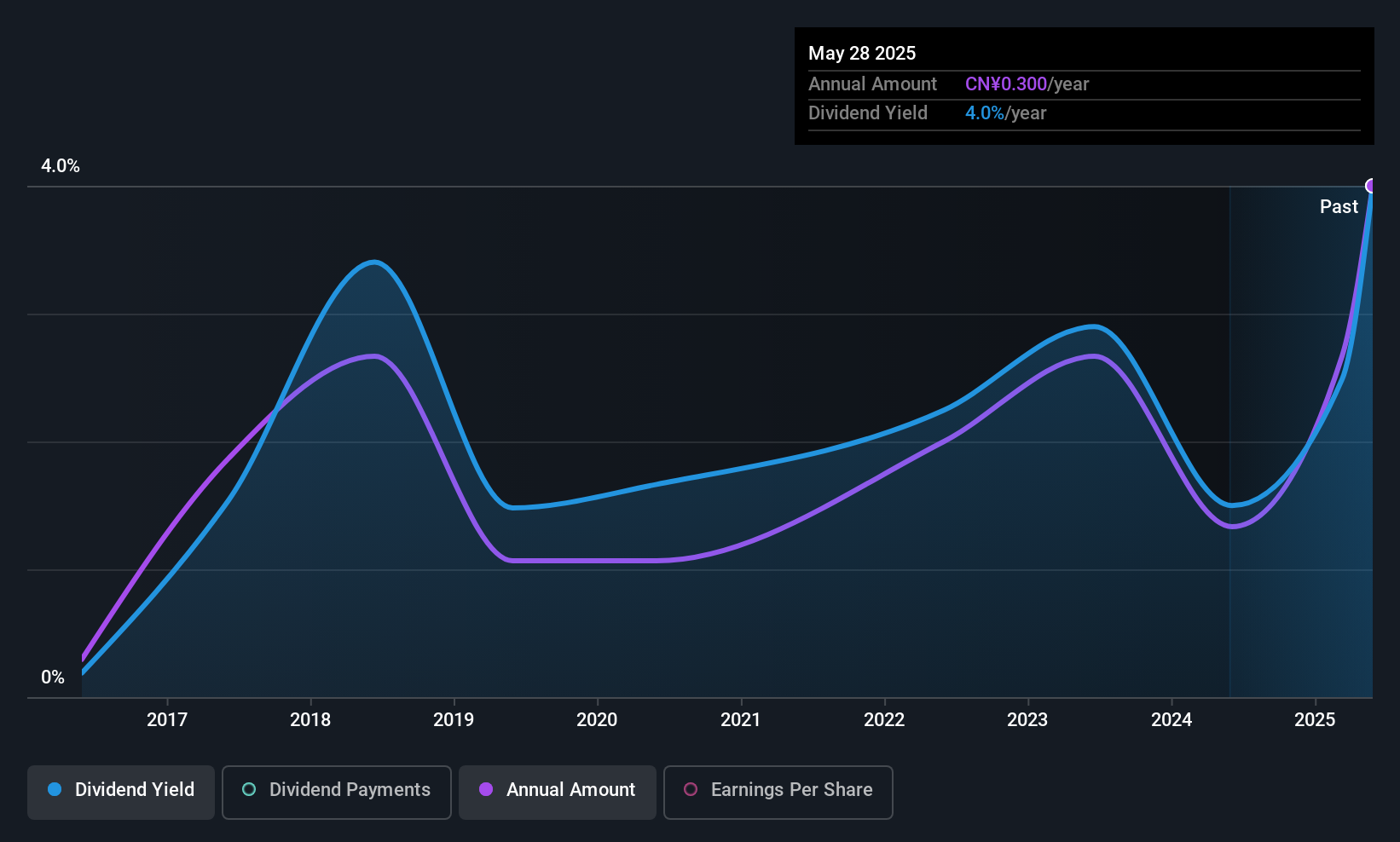

ZheJiang Haers Vacuum ContainersLtd (SZSE:002615)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ZheJiang Haers Vacuum Containers Co., Ltd. (SZSE:002615) operates in the manufacturing and sale of vacuum containers, with a market cap of CN¥3.93 billion.

Operations: ZheJiang Haers Vacuum Containers Co., Ltd. generates its revenue primarily from the production and sale of vacuum containers.

Dividend Yield: 3.2%

ZheJiang Haers Vacuum Containers offers a dividend yield of 3.22%, ranking in the top 25% of CN market payers, but sustainability is questionable as dividends are not covered by free cash flows. Despite a low payout ratio of 37.9% from earnings, past dividend volatility and unreliable payments pose risks. Recent approval for CNY 1.50 per ten shares highlights commitment to dividends amidst growing earnings, yet reliance on non-cash earnings could affect future stability.

- Delve into the full analysis dividend report here for a deeper understanding of ZheJiang Haers Vacuum ContainersLtd.

- The analysis detailed in our ZheJiang Haers Vacuum ContainersLtd valuation report hints at an deflated share price compared to its estimated value.

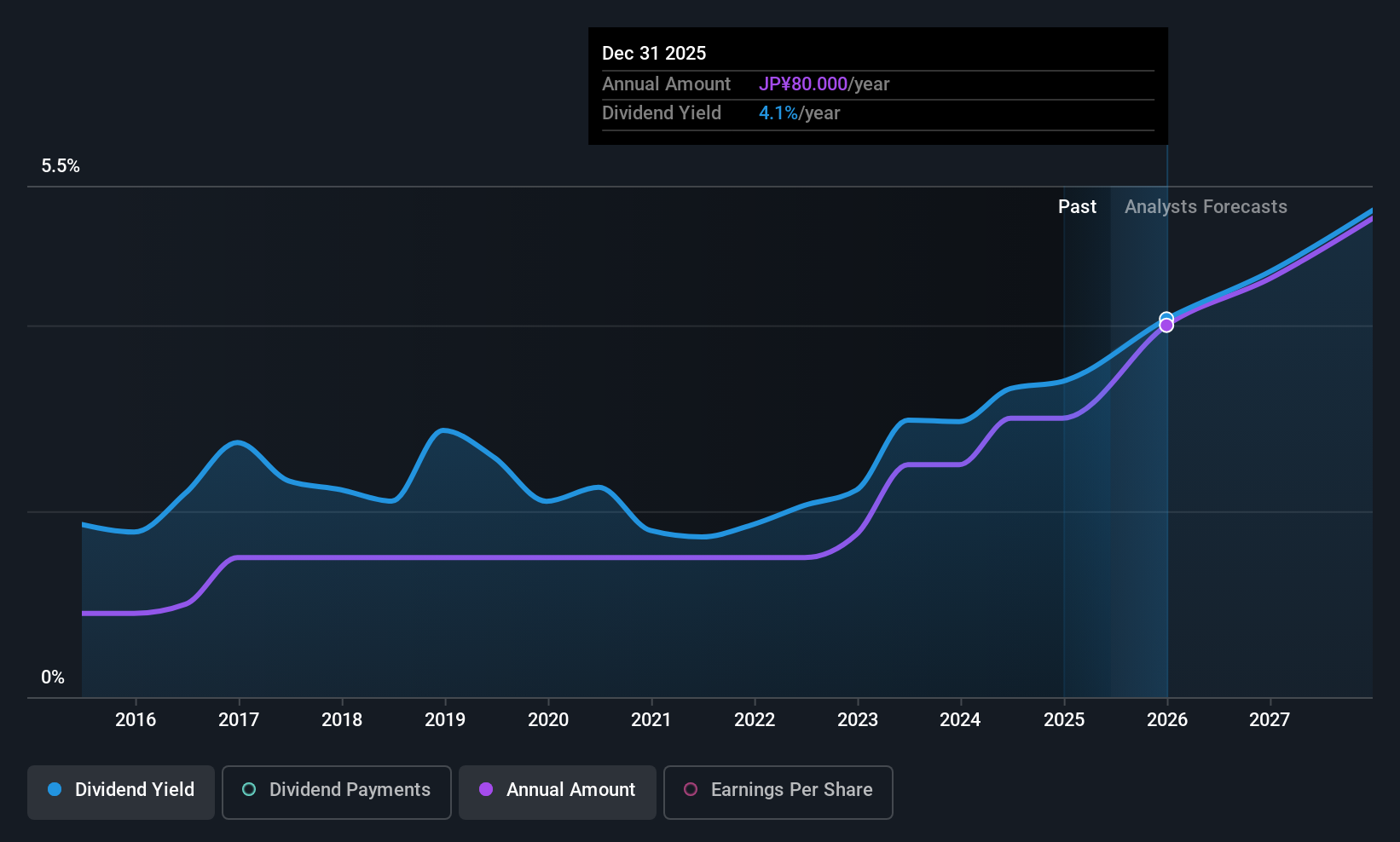

Nippon Concept (TSE:9386)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Nippon Concept Corporation offers transportation services for various liquid cargoes and gases both in Japan and internationally, with a market cap of ¥25.96 billion.

Operations: Nippon Concept Corporation generates revenue through its transportation services for a range of liquid cargoes and gases across domestic and international markets.

Dividend Yield: 4.1%

Nippon Concept's dividends, yielding 4.13%, rank in the top 25% of the JP market. Despite a recent decrease to JPY 40 per share for Q2, dividends remain stable and well-covered by earnings (56.1% payout ratio) and cash flows (59.3%). The company projects net sales of JPY 19.94 billion for FY2025 with steady profit growth, supporting dividend reliability over the past decade without significant volatility or disruption.

- Click here and access our complete dividend analysis report to understand the dynamics of Nippon Concept.

- The valuation report we've compiled suggests that Nippon Concept's current price could be inflated.

Make It Happen

- Delve into our full catalog of 1555 Top Global Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Concept might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9386

Nippon Concept

Provides transportation services for various liquid cargoes and various gases in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives