- South Korea

- /

- Commercial Services

- /

- KOSE:A372910

Market Cool On Hancom Lifecare Inc.'s (KRX:372910) Revenues

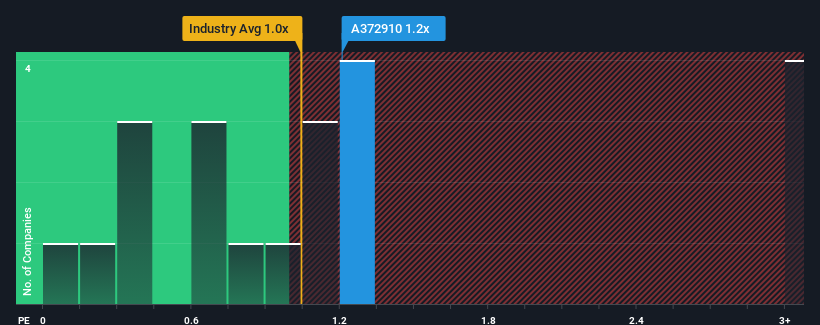

It's not a stretch to say that Hancom Lifecare Inc.'s (KRX:372910) price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" for companies in the Commercial Services industry in Korea, where the median P/S ratio is around 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Hancom Lifecare

How Hancom Lifecare Has Been Performing

Hancom Lifecare certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hancom Lifecare.Is There Some Revenue Growth Forecasted For Hancom Lifecare?

Hancom Lifecare's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 24% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 14% as estimated by the one analyst watching the company. With the industry only predicted to deliver 8.6%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Hancom Lifecare's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Hancom Lifecare's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - Hancom Lifecare has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Hancom Lifecare's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hancom Lifecare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A372910

Hancom Lifecare

HANCOM LIFECARE Inc. manufactures and sells personal safety equipment in South Korea, Vietnam, Mongolia, Indonesia, Thailand, the Philippines, and the Middle East countries.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives