- South Korea

- /

- Professional Services

- /

- KOSE:A030190

NICE Information Service's (KRX:030190) 57% return outpaced the company's earnings growth over the same one-year period

On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. Over the last year the NICE Information Service Co., Ltd. (KRX:030190) share price is up 51%, but that's less than the broader market return. It is also impressive that the stock is up 41% over three years, adding to the sense that it is a real winner.

Since the stock has added ₩105b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

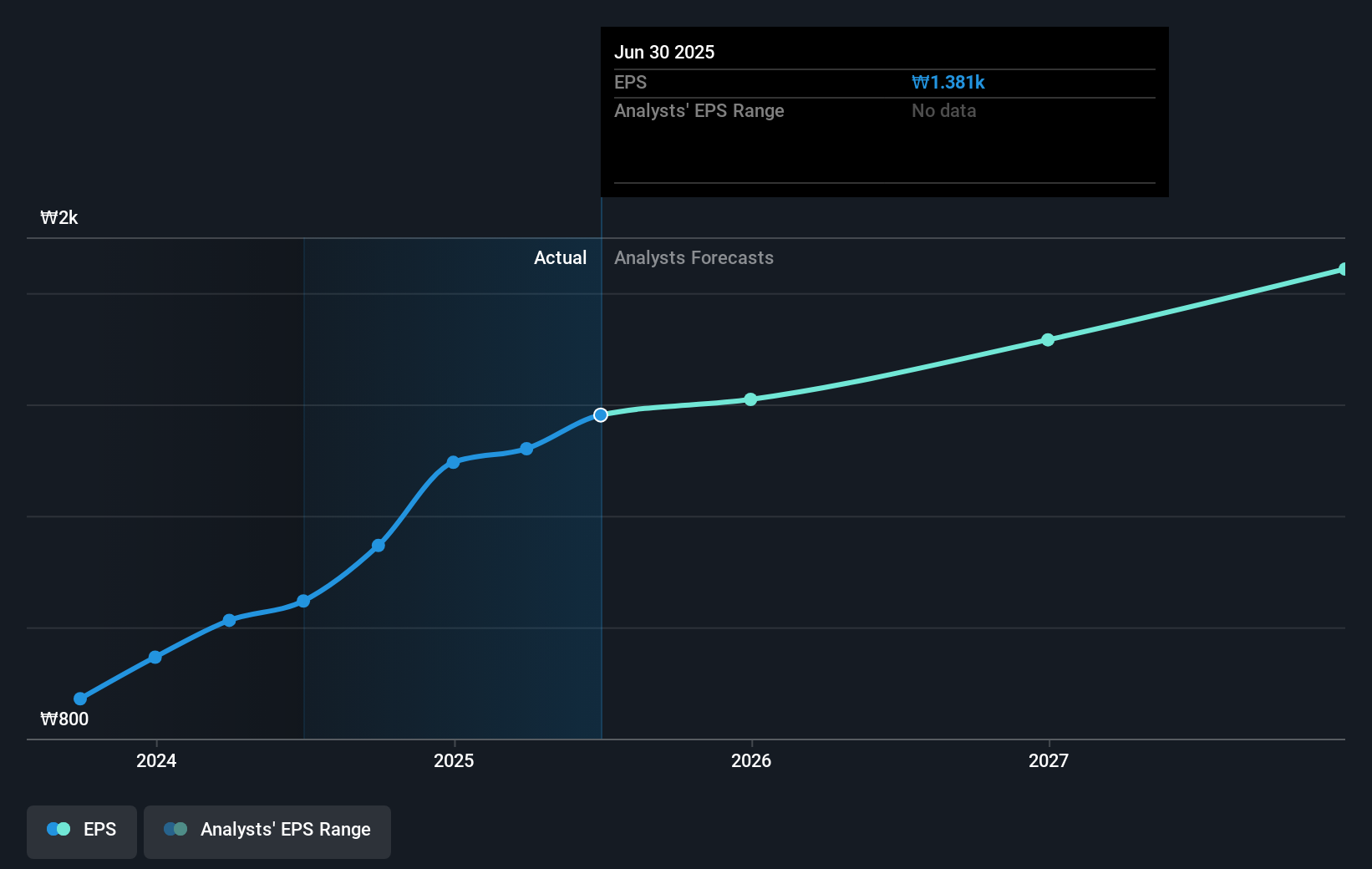

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

NICE Information Service was able to grow EPS by 32% in the last twelve months. The share price gain of 51% certainly outpaced the EPS growth. So it's fair to assume the market has a higher opinion of the business than it a year ago.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that NICE Information Service has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for NICE Information Service the TSR over the last 1 year was 57%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

NICE Information Service provided a TSR of 57% over the year (including dividends). That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 1.9% over the last five years. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. Before forming an opinion on NICE Information Service you might want to consider these 3 valuation metrics.

Of course NICE Information Service may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NICE Information Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A030190

NICE Information Service

Provides credit evaluation, credit inquiries, credit investigations, and debt collection services in South Korea.

Undervalued with solid track record.

Market Insights

Community Narratives