- South Korea

- /

- Professional Services

- /

- KOSDAQ:A204620

Global Tax Free (KOSDAQ:204620) Share Prices Have Dropped 30% In The Last Three Years

While it may not be enough for some shareholders, we think it is good to see the Global Tax Free Co., Ltd. (KOSDAQ:204620) share price up 18% in a single quarter. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 30% in the last three years, significantly under-performing the market.

See our latest analysis for Global Tax Free

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Global Tax Free became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

We note that, in three years, revenue has actually grown at a 17% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Global Tax Free further; while we may be missing something on this analysis, there might also be an opportunity.

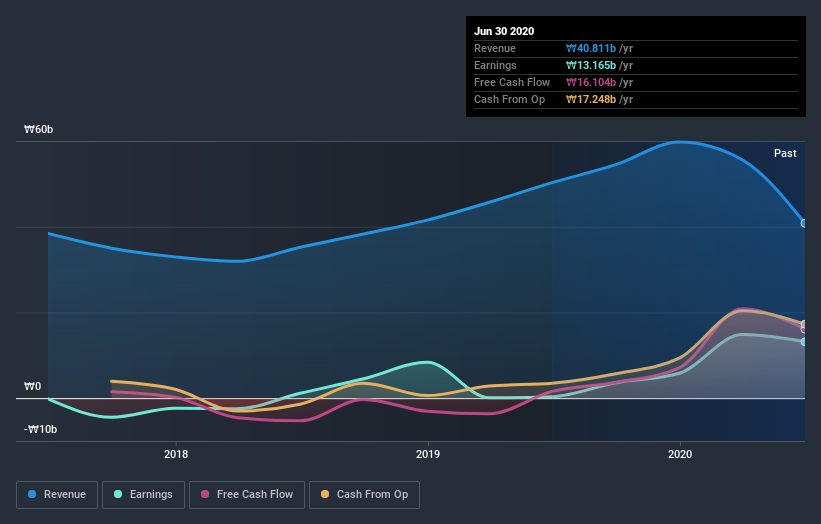

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

The last twelve months weren't great for Global Tax Free shares, which cost holders 4.3%, while the market was up about 28%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 9% per year over three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Global Tax Free has 2 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Global Tax Free or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A204620

Global Tax Free

Operates as tax refund company for foreign tourists in South Korea, Singapore, Japan, and France.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success