- South Korea

- /

- Professional Services

- /

- KOSE:A030190

Should You Buy NICE Information Service Co., Ltd. (KOSDAQ:030190) For Its Upcoming Dividend?

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that NICE Information Service Co., Ltd. (KOSDAQ:030190) is about to go ex-dividend in just three days. You will need to purchase shares before the 29th of December to receive the dividend, which will be paid on the 17th of April.

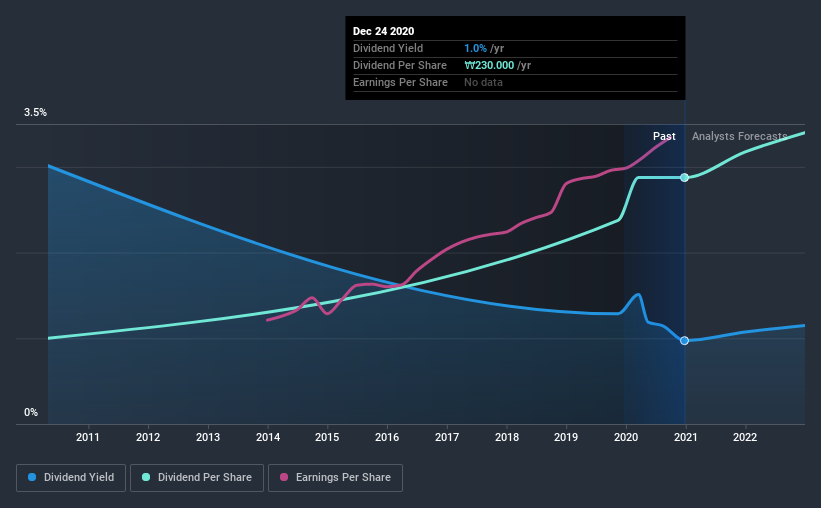

NICE Information Service's next dividend payment will be ₩230 per share, and in the last 12 months, the company paid a total of ₩230 per share. Based on the last year's worth of payments, NICE Information Service has a trailing yield of 1.0% on the current stock price of ₩23650. If you buy this business for its dividend, you should have an idea of whether NICE Information Service's dividend is reliable and sustainable. So we need to investigate whether NICE Information Service can afford its dividend, and if the dividend could grow.

View our latest analysis for NICE Information Service

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately NICE Information Service's payout ratio is modest, at just 30% of profit. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 20% of its free cash flow as dividends last year, which is conservatively low.

It's positive to see that NICE Information Service's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's encouraging to see NICE Information Service has grown its earnings rapidly, up 21% a year for the past five years. NICE Information Service is paying out less than half its earnings and cash flow, while simultaneously growing earnings per share at a rapid clip. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last 10 years, NICE Information Service has lifted its dividend by approximately 11% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

Final Takeaway

Is NICE Information Service worth buying for its dividend? We love that NICE Information Service is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. These characteristics suggest the company is reinvesting in growing its business, while the conservative payout ratio also implies a reduced risk of the dividend being cut in the future. Overall we think this is an attractive combination and worthy of further research.

Wondering what the future holds for NICE Information Service? See what the six analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading NICE Information Service or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NICE Information Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A030190

NICE Information Service

Provides credit evaluation, credit inquiries, credit investigations, and debt collection services in South Korea.

Undervalued with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success