- South Korea

- /

- Machinery

- /

- KOSE:A329180

Exploring Undervalued Stocks On KRX With Discounts Ranging From 15.3% To 31.2%

Reviewed by Simply Wall St

The South Korean market has shown resilience, climbing 1.1% in the last week and 3.7% over the past year, with earnings expected to grow by 29% annually. In this context, identifying undervalued stocks can be particularly compelling for investors looking for opportunities that may not yet reflect their full potential value given the current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Poongsan Holdings (KOSE:A005810) | ₩27950.00 | ₩49434.05 | 43.5% |

| Solum (KOSE:A248070) | ₩22250.00 | ₩40192.45 | 44.6% |

| Iljin ElectricLtd (KOSE:A103590) | ₩26300.00 | ₩50826.51 | 48.3% |

| DYPNFLtd (KOSDAQ:A104460) | ₩20100.00 | ₩39834.02 | 49.5% |

| Caregen (KOSDAQ:A214370) | ₩23550.00 | ₩43428.59 | 45.8% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49571.57 | 49.8% |

| Intellian Technologies (KOSDAQ:A189300) | ₩57500.00 | ₩107862.38 | 46.7% |

| IMLtd (KOSDAQ:A101390) | ₩7380.00 | ₩13686.06 | 46.1% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩78000.00 | ₩137549.91 | 43.3% |

| Hancom Lifecare (KOSE:A372910) | ₩5680.00 | ₩10725.67 | 47% |

We're going to check out a few of the best picks from our screener tool

HANMI Semiconductor (KOSE:A042700)

Overview: HANMI Semiconductor Co., Ltd. is a company based in South Korea that manufactures and sells semiconductor equipment globally, with a market capitalization of approximately ₩17.38 billion.

Operations: The company generates revenue through the manufacture and sale of semiconductor equipment both domestically and internationally.

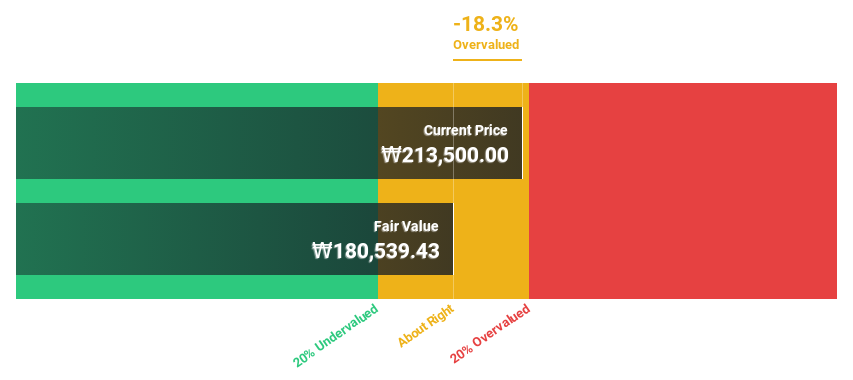

Estimated Discount To Fair Value: 21.7%

HANMI Semiconductor, currently trading at ₩180,100, is perceived as undervalued with a fair value estimate of ₩229,930.89. The company's earnings are forecasted to increase significantly by 33.54% annually, outpacing the South Korean market's growth. Despite recent earnings decline and high share price volatility, HANMI has robust revenue projections (50% yearly) and is involved in strategic activities like share repurchases to boost shareholder value. Recently added to the KOSPI 200 index underscores its market recognition.

- Upon reviewing our latest growth report, HANMI Semiconductor's projected financial performance appears quite optimistic.

- Navigate through the intricacies of HANMI Semiconductor with our comprehensive financial health report here.

APR (KOSE:A278470)

Overview: APR Co., Ltd. is a company that manufactures and sells cosmetics for both men and women, with a market capitalization of approximately ₩2.97 billion.

Operations: The company generates its revenue through the sale of cosmetics designed for both male and female consumers.

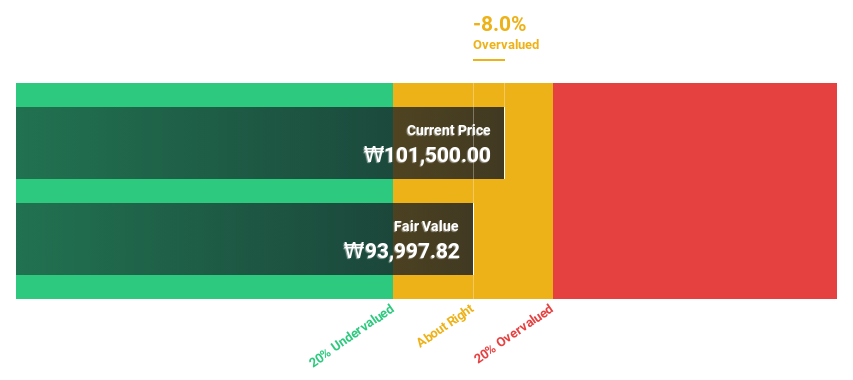

Estimated Discount To Fair Value: 15.3%

APR Co., Ltd., priced at ₩390,000, is assessed below its fair value of ₩460,574.62, indicating a potential undervaluation. Despite a highly volatile share price recently, APR's earnings are set to grow by 26.21% annually over the next three years. Although this growth rate is slightly below the broader South Korean market forecast of 29%, the company's revenue growth projections are robust at 23.1% per year—more than double the market average of 10.5%.

- Our comprehensive growth report raises the possibility that APR is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of APR.

HD Hyundai Heavy IndustriesLtd (KOSE:A329180)

Overview: HD Hyundai Heavy Industries Co., Ltd. operates globally in shipbuilding, offshore construction, naval and special ships, and engine and machinery sectors with a market capitalization of approximately ₩11.94 trillion.

Operations: The company's revenue is generated from three primary segments: shipbuilding and offshore, naval and special ships, and engine and machinery.

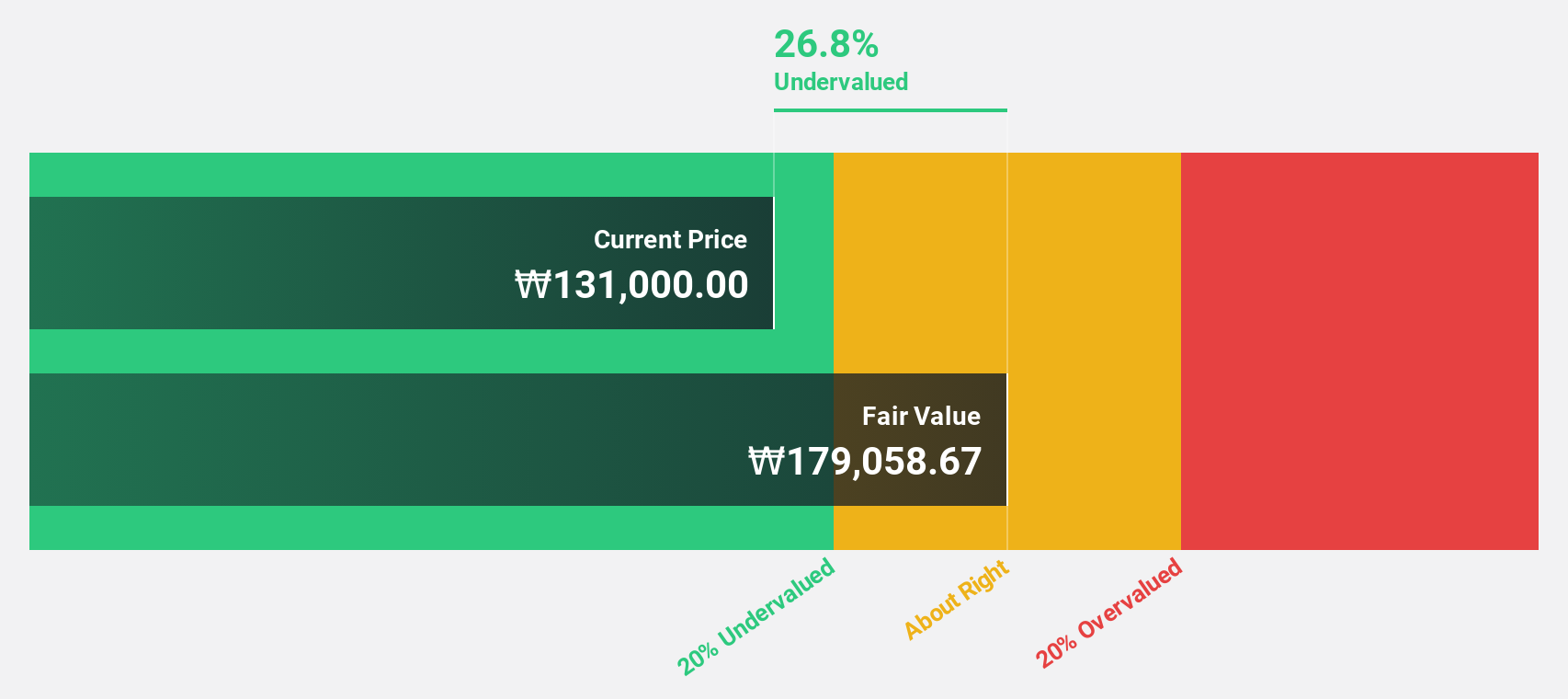

Estimated Discount To Fair Value: 31.2%

HD Hyundai Heavy Industries Co., Ltd. is trading at ₩134,500, well below its estimated fair value of ₩195,454.69, suggesting significant undervaluation based on discounted cash flows. The company's earnings are expected to grow by 69.21% annually over the next three years, outpacing the South Korean market's forecast growth rate of 29%. Despite this robust profit outlook and a recent transition to profitability this year, its revenue growth forecast at 10.5% annually aligns with the market average and remains below higher growth benchmarks.

- The growth report we've compiled suggests that HD Hyundai Heavy IndustriesLtd's future prospects could be on the up.

- Click here to discover the nuances of HD Hyundai Heavy IndustriesLtd with our detailed financial health report.

Summing It All Up

- Get an in-depth perspective on all 35 Undervalued KRX Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HD Hyundai Heavy IndustriesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A329180

HD Hyundai Heavy IndustriesLtd

Engages in operating shipbuilding and offshore, naval and special ships, and engine and machinery business units worldwide.

Adequate balance sheet with moderate growth potential.