- South Korea

- /

- Auto Components

- /

- KOSE:A000240

Unveiling Three Undiscovered Gems In South Korea With Solid Financial Foundations

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has remained flat, but it has risen 3.4% over the past 12 months with earnings forecast to grow by 29% annually. In this promising environment, identifying stocks with solid financial foundations can offer significant potential for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CYMECHS | 10.99% | 11.45% | 3.52% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 0.40% | 27.17% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 2.58% | 14.14% | ★★★★★★ |

| Miwon Chemicals | 0.16% | 12.04% | 14.03% | ★★★★★★ |

| NOROO PAINT & COATINGS | 17.16% | 5.11% | 6.31% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| Kyungdong Invest | 8.15% | 3.08% | 15.07% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 59.19% | 3.54% | 5.92% | ★★★★★★ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

| EASY BIOInc | 188.46% | 15.71% | 55.75% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

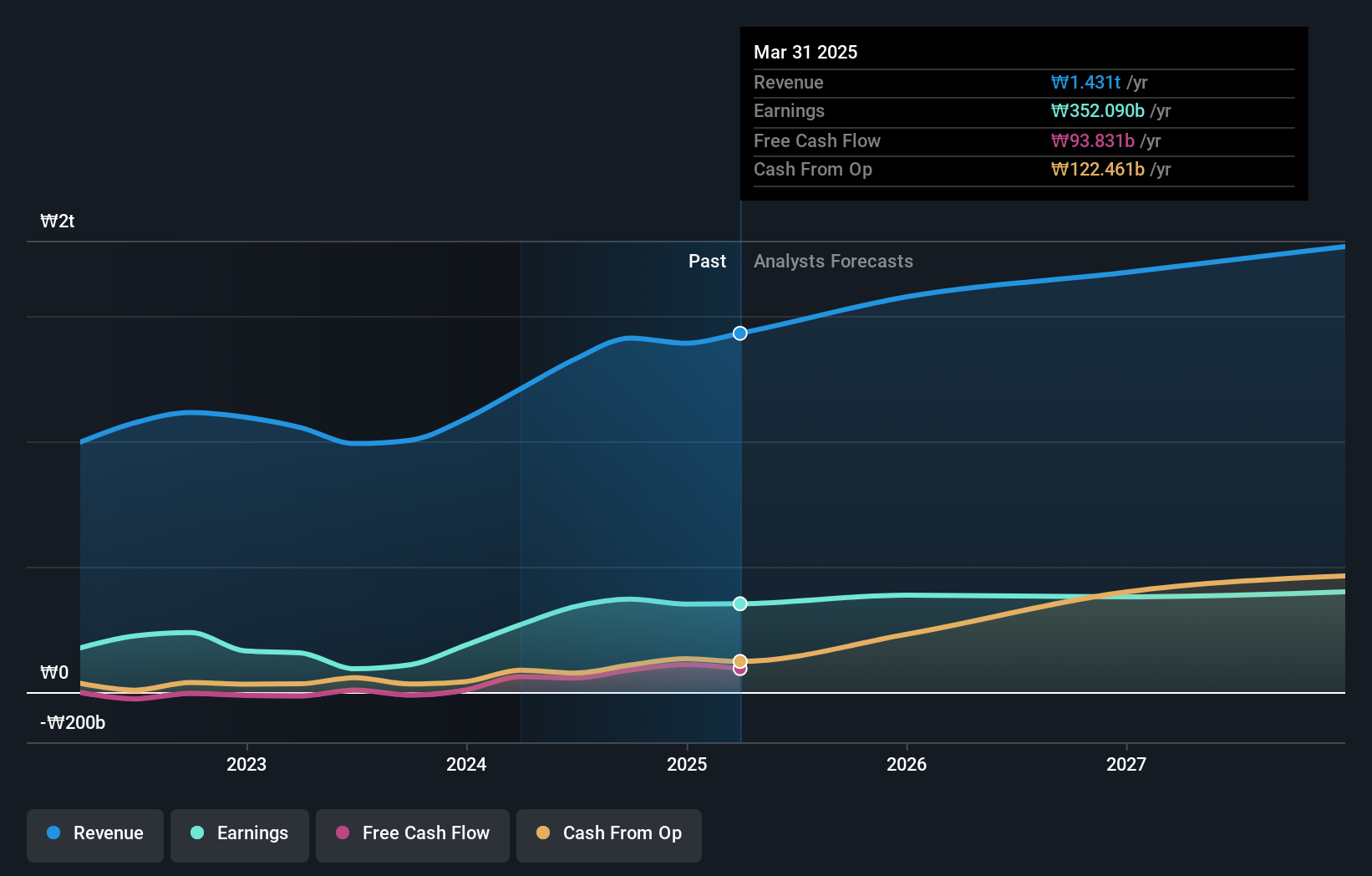

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. manufactures and sells storage batteries, with a market cap of ₩1.54 trillion.

Operations: Hankook & Company Co., Ltd. generates revenue primarily from its Storage Battery Division, contributing ₩859.55 billion, and its Investment Business Division, adding ₩349.37 billion.

Hankook offers a compelling investment case with its recent earnings growth of 72%, far outpacing the Auto Components industry at 21.4%. Trading at 79.1% below estimated fair value, it shows strong potential for appreciation. The company’s debt to equity ratio has risen from 2.8% to 7.4% over five years, yet remains satisfactory with a net debt to equity ratio of just 0.8%. EBIT covers interest payments by an impressive 37.1x, indicating robust financial health and high-quality past earnings.

- Delve into the full analysis health report here for a deeper understanding of Hankook.

Review our historical performance report to gain insights into Hankook's's past performance.

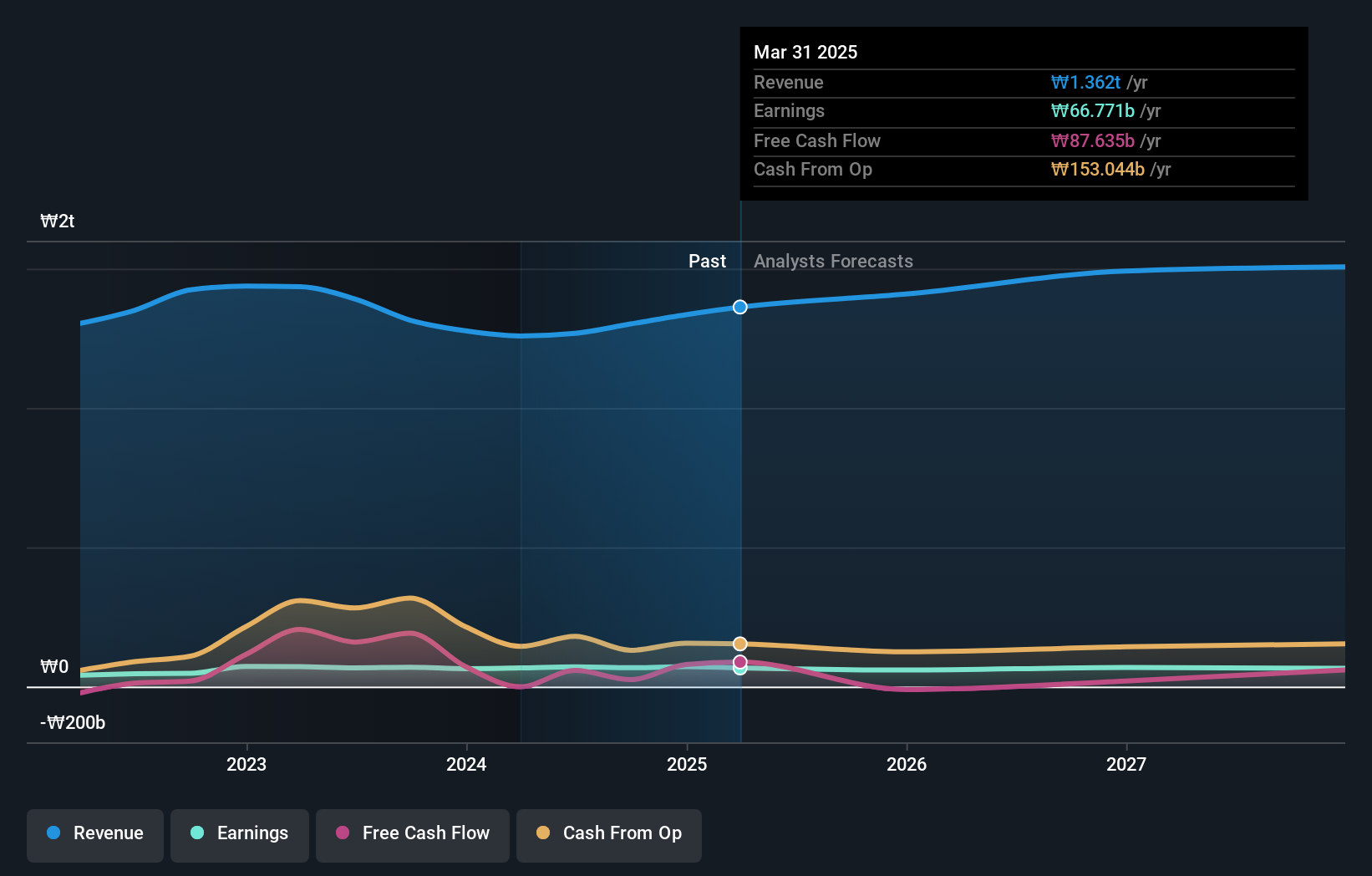

Dongwon Systems (KOSE:A014820)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dongwon Systems Corporation, a packaging company, manufactures and markets packaging materials in South Korea and has a market cap of ₩1.39 billion.

Operations: The company generates revenue primarily from its packaging business, with reported earnings of ₩1.26 billion.

Dongwon Systems, a smaller player in South Korea's packaging sector, reported Q1 2024 sales of KRW 7.22 million, down from KRW 7.68 million the previous year. Despite this, net income rose to KRW 15.48 million from KRW 12.89 million due to higher earnings per share (KRW 529 vs KRW 441). The company's debt-to-equity ratio has improved over five years from 72.3% to 66.4%, although it remains high at 49%. EBIT covers interest payments by nearly five times, indicating strong profitability despite recent negative earnings growth (-7%).

- Click here and access our complete health analysis report to understand the dynamics of Dongwon Systems.

Gain insights into Dongwon Systems' past trends and performance with our Past report.

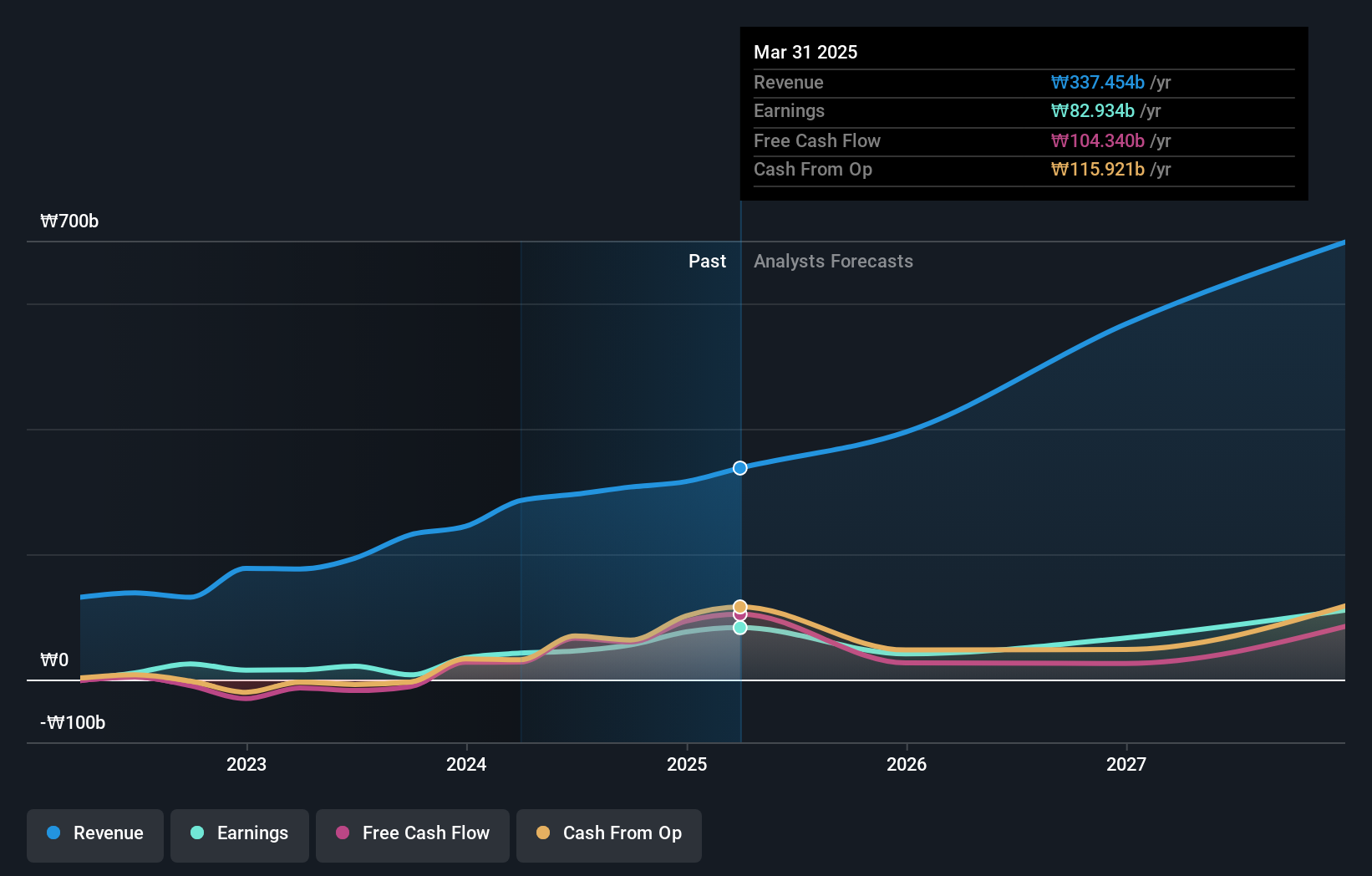

STX Heavy Industries (KOSE:A071970)

Simply Wall St Value Rating: ★★★★★☆

Overview: STX Heavy Industries Co., Ltd. manufactures and sells marine engines, industrial facilities, and plants in South Korea and internationally, with a market cap of approximately ₩658.14 billion.

Operations: STX Heavy Industries generates revenue from the sale of marine engines, industrial facilities, and plants both domestically and internationally. The company has a market cap of approximately ₩658.14 billion.

STX Heavy Industries has shown promising signs despite its small cap status. The company’s net debt to equity ratio stands at a satisfactory 8.6%, significantly reduced from 107% five years ago. Earnings growth of 148.6% last year outpaced the Machinery industry, which saw a -1.9% change in earnings. Recently, Korea Shipbuilding & Offshore Engineering acquired a 22.85% stake for KRW 39 billion, indicating strong interest and potential strategic synergies going forward.

- Unlock comprehensive insights into our analysis of STX Heavy Industries stock in this health report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 208 companies within our KRX Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hankook might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000240

Undervalued with solid track record.