- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A041190

Discovering Undiscovered Gems in South Korea This October 2024

Reviewed by Simply Wall St

In October 2024, the South Korean stock market showed signs of resilience as it rebounded from a recent slide, with the KOSPI index hovering just above the 2,600-point mark despite potential selling pressures. This mixed performance comes amid global uncertainties and profit-taking activities seen in other regions, highlighting the importance of identifying promising small-cap stocks that can thrive under fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Woori Technology Investment (KOSDAQ:A041190)

Simply Wall St Value Rating: ★★★★★★

Overview: Woori Technology Investment Co., Ltd. is a venture capital firm focusing on venture funds, mezzanine fund projects, and investments in small and medium-sized companies, with a market cap of ₩623.75 billion.

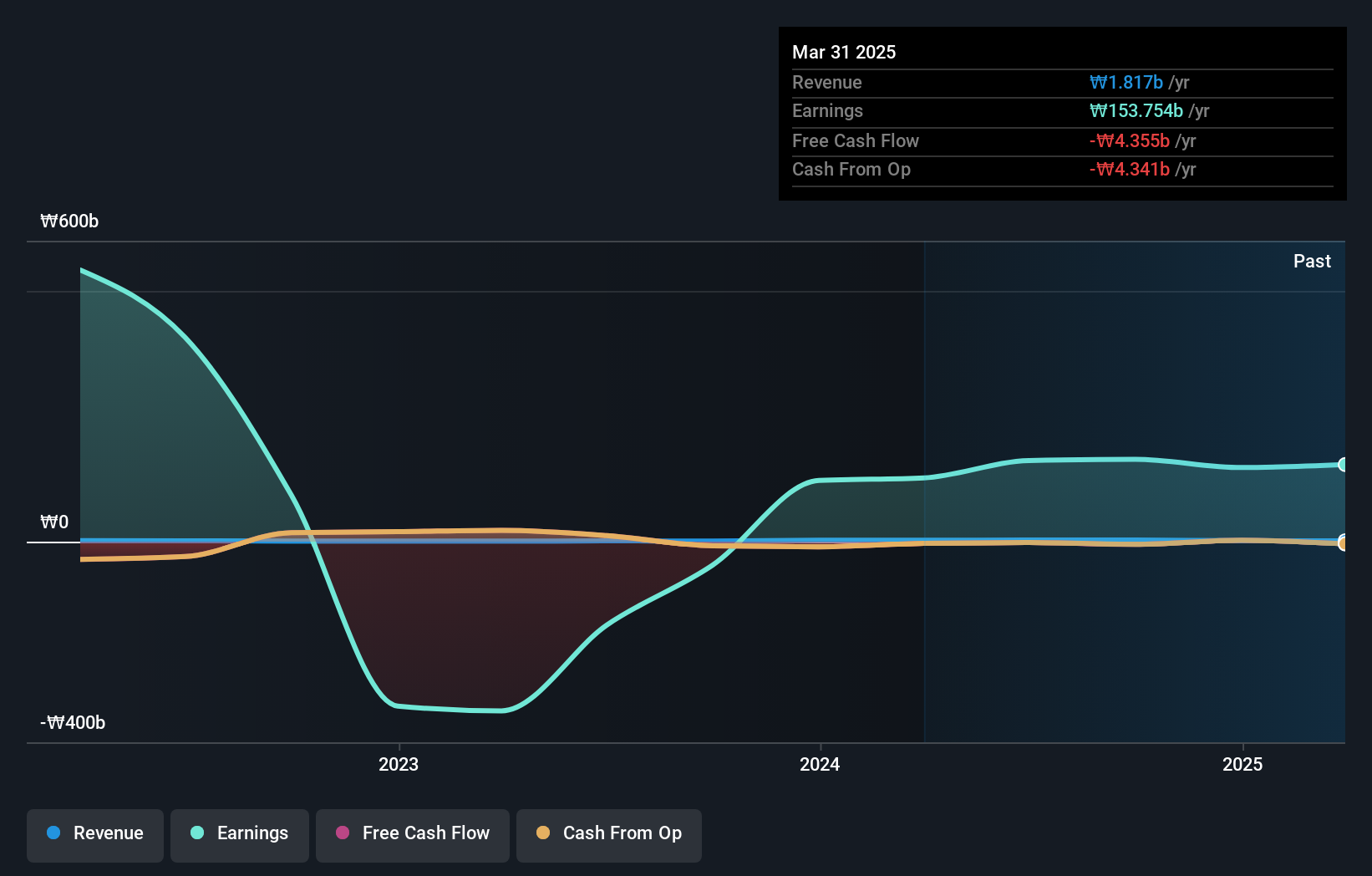

Operations: Woori Technology Investment generates revenue primarily from its financial services in the commercial sector, amounting to ₩3.31 billion. The company's net profit margin offers insight into its profitability relative to its total revenue.

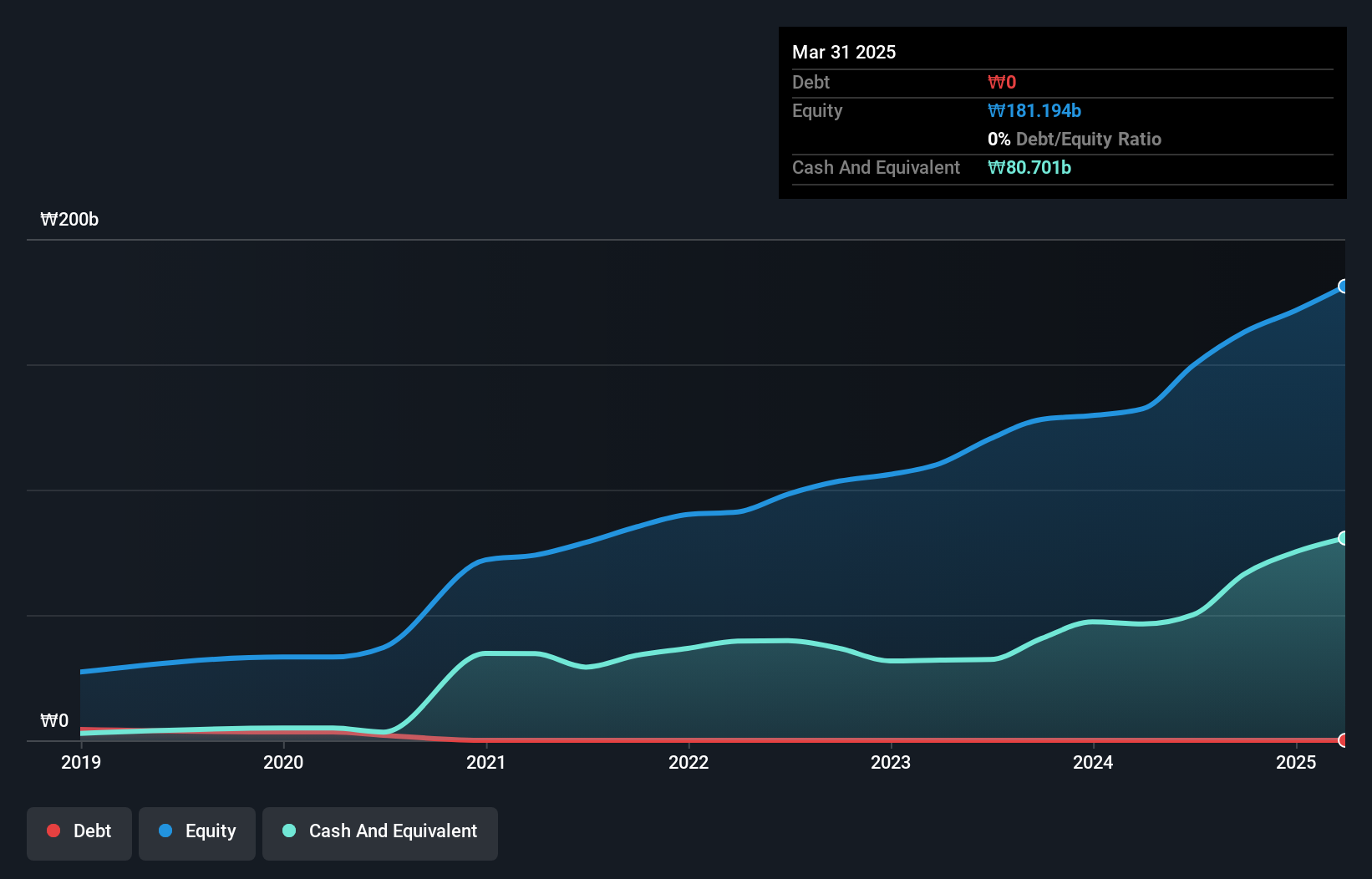

Woori Technology Investment, a relatively small player in South Korea's financial landscape, has recently turned profitable, marking a significant shift in its performance. Despite being debt-free for the past five years and trading at 73.7% below its estimated fair value, it faces challenges with earnings declining by 1.4% annually over the last five years. The company does not generate meaningful revenue yet but boasts high-quality earnings. Its lack of debt implies no concerns about interest coverage, positioning it as an intriguing prospect for those seeking undervalued opportunities in the capital markets sector.

- Click to explore a detailed breakdown of our findings in Woori Technology Investment's health report.

Learn about Woori Technology Investment's historical performance.

T&L (KOSDAQ:A340570)

Simply Wall St Value Rating: ★★★★★★

Overview: T&L Co., Ltd. is a South Korean company that manufactures and sells medical and polymer material products, with a market cap of ₩606.21 billion.

Operations: T&L generates revenue primarily from the sale of medical products, amounting to ₩131.62 billion. The company's financial performance includes a focus on net profit margin trends.

T&L, a promising player in South Korea's market, showcases strong financial health with no debt and a reduction from a 12.7% debt-to-equity ratio five years ago. Its earnings soared by 22.7% over the past year, outpacing the Medical Equipment industry's modest 4% growth. The company trades at an attractive valuation, sitting 75.9% below its estimated fair value, indicating potential upside for investors seeking undervalued opportunities. With high-quality earnings and positive free cash flow reported consistently, T&L seems well-positioned for continued growth with forecasts predicting a robust 28.7% annual increase in earnings going forward.

- Dive into the specifics of T&L here with our thorough health report.

Review our historical performance report to gain insights into T&L's's past performance.

HD-Hyundai Marine Engine (KOSE:A071970)

Simply Wall St Value Rating: ★★★★★★

Overview: HD-Hyundai Marine Engine Co., Ltd. manufactures and sells marine engines, industrial facilities, and plants in South Korea and internationally with a market cap of ₩724.13 billion.

Operations: HD-Hyundai Marine Engine's primary revenue stream is from its Engine and Equipment segment, generating ₩296.25 billion.

HD-Hyundai Marine Engine, a promising player in South Korea's industrial landscape, has shown impressive financial resilience. The company reported second-quarter sales of KRW 85.09 billion, up from KRW 75.03 billion last year, with net income rising to KRW 9.38 million from KRW 5.83 million a year earlier. Its interest payments are comfortably covered by EBIT at 9.3 times coverage, indicating strong operational efficiency. Over the past five years, its debt-to-equity ratio improved significantly from 64% to 37%, reflecting better financial management and stability despite recent shareholder dilution and share price volatility concerns.

- Get an in-depth perspective on HD-Hyundai Marine Engine's performance by reading our health report here.

Assess HD-Hyundai Marine Engine's past performance with our detailed historical performance reports.

Taking Advantage

- Click through to start exploring the rest of the 179 KRX Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woori Technology Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A041190

Woori Technology Investment

A venture capital firm specializing in venture fund, mezzanine fund project fund, venture capital and small & medium companies investments.

Flawless balance sheet and good value.