- South Korea

- /

- Construction

- /

- KOSE:A023960

SC Engineering Co., Ltd's (KRX:023960) Shares Leap 31% Yet They're Still Not Telling The Full Story

Despite an already strong run, SC Engineering Co., Ltd (KRX:023960) shares have been powering on, with a gain of 31% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.2% in the last twelve months.

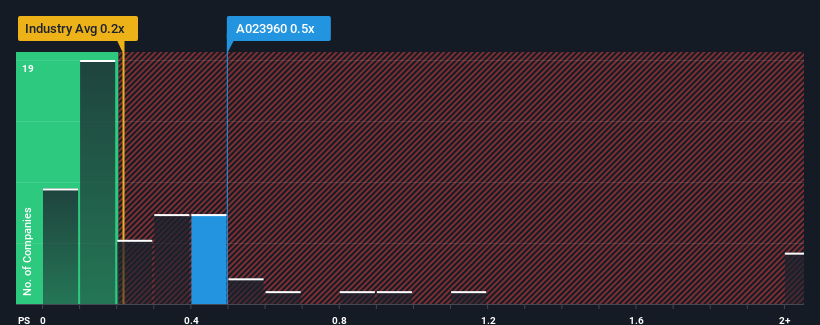

Even after such a large jump in price, you could still be forgiven for feeling indifferent about SC Engineering's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Korea is also close to 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for SC Engineering

What Does SC Engineering's Recent Performance Look Like?

SC Engineering has been doing a decent job lately as it's been growing revenue at a reasonable pace. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SC Engineering will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like SC Engineering's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.4% last year. This was backed up an excellent period prior to see revenue up by 151% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 1.6%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that SC Engineering's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From SC Engineering's P/S?

SC Engineering's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, SC Engineering revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for SC Engineering that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A023960

SC Engineering

Operates as an engineering company in South Korea and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives