- South Korea

- /

- Electrical

- /

- KOSE:A011690

Shareholders In Y2 Solution (KRX:011690) Should Look Beyond Earnings For The Full Story

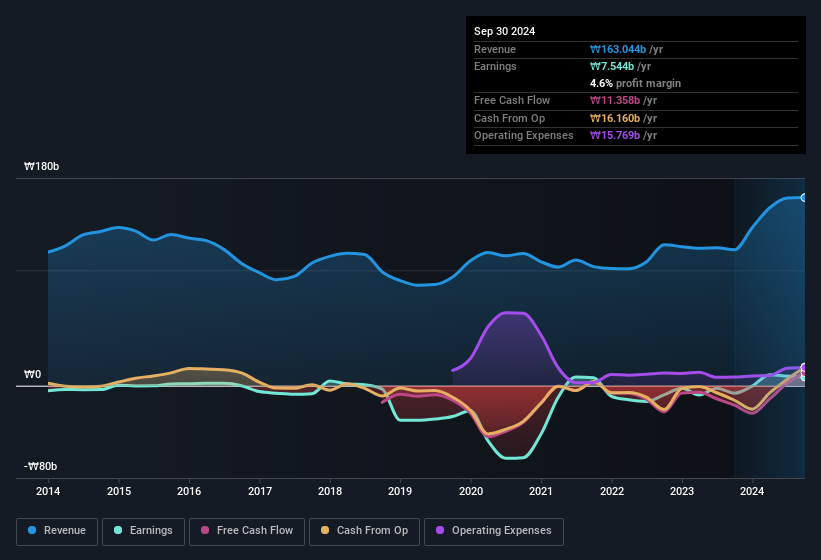

We didn't see Y2 Solution Co., Ltd's (KRX:011690) stock surge when it reported robust earnings recently. We think that investors might be worried about the foundations the earnings are built on.

View our latest analysis for Y2 Solution

The Impact Of Unusual Items On Profit

To properly understand Y2 Solution's profit results, we need to consider the ₩5.9b gain attributed to unusual items. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Y2 Solution had a rather significant contribution from unusual items relative to its profit to September 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Y2 Solution.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Y2 Solution received a tax benefit which contributed ₩2.0b to the bottom line. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. And given that it lost money last year, it seems possible that the benefit is evidence that it now expects to find value in its past tax losses. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Y2 Solution's Profit Performance

In its last report Y2 Solution received a tax benefit which might make its profit look better than it really is on a underlying level. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated. Considering all this we'd argue Y2 Solution's profits probably give an overly generous impression of its sustainable level of profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of Y2 Solution.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011690

Y2 Solution

Provides TV power supply and LED lighting services in South Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives