- South Korea

- /

- Construction

- /

- KOSE:A010960

Samho Development Co., LTD (KRX:010960) Stock Goes Ex-Dividend In Just Four Days

Samho Development Co., LTD (KRX:010960) stock is about to trade ex-dividend in 4 days. Ex-dividend means that investors that purchase the stock on or after the 29th of December will not receive this dividend, which will be paid on the 14th of April.

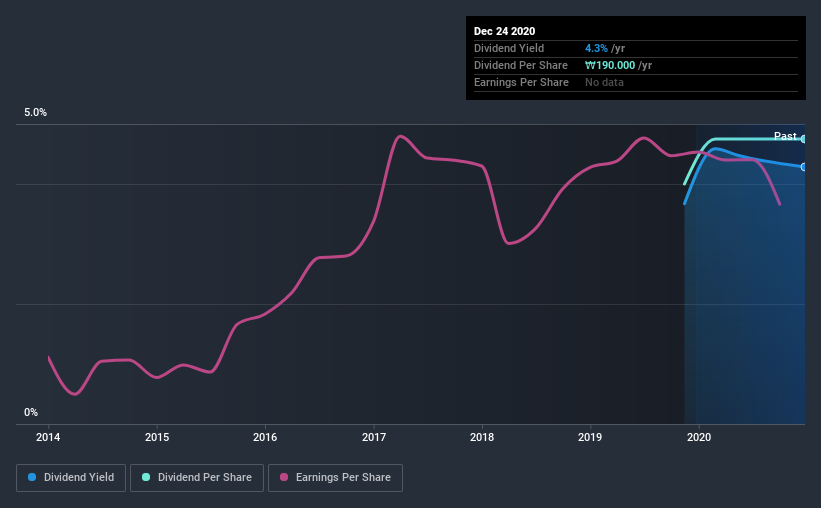

Samho Development's upcoming dividend is ₩190 a share, following on from the last 12 months, when the company distributed a total of ₩190 per share to shareholders. Based on the last year's worth of payments, Samho Development has a trailing yield of 4.3% on the current stock price of ₩4435. If you buy this business for its dividend, you should have an idea of whether Samho Development's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Samho Development

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. That's why it's good to see Samho Development paying out a modest 26% of its earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the last year, it paid out dividends equivalent to 342% of what it generated in free cash flow, a disturbingly high percentage. It's pretty hard to pay out more than you earn, so we wonder how Samho Development intends to continue funding this dividend, or if it could be forced to cut the payment.

Samho Development does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

Samho Development paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to Samho Development's ability to maintain its dividend.

Click here to see how much of its profit Samho Development paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see Samho Development has grown its earnings rapidly, up 36% a year for the past five years. Earnings have been growing quickly, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Given that Samho Development has only been paying a dividend for a year, there's not much of a past history to draw insight from.

The Bottom Line

From a dividend perspective, should investors buy or avoid Samho Development? We're glad to see the company has been improving its earnings per share while also paying out a low percentage of income. However, it's not great to see it paying out what we see as an uncomfortably high percentage of its cash flow. Overall, it's not a bad combination, but we feel that there are likely more attractive dividend prospects out there.

On that note, you'll want to research what risks Samho Development is facing. For example - Samho Development has 2 warning signs we think you should be aware of.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Samho Development, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A010960

Samho Development

Engages in civil engineering construction business in South Korea.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives