- South Korea

- /

- Machinery

- /

- KOSE:A010140

Samsung Heavy Industries (KRX:010140) Share Prices Have Dropped 45% In The Last Three Years

This month, we saw the Samsung Heavy Industries Co., Ltd. (KRX:010140) up an impressive 34%. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 45% in the last three years, significantly under-performing the market.

View our latest analysis for Samsung Heavy Industries

Given that Samsung Heavy Industries didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Samsung Heavy Industries grew revenue at 0.5% per year. That's not a very high growth rate considering it doesn't make profits. Indeed, the stock dropped 13% over the last three years. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

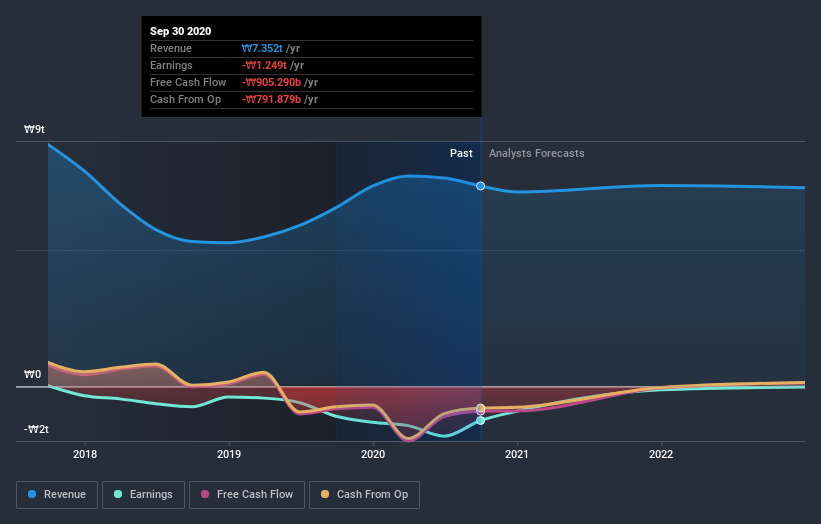

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Samsung Heavy Industries is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Samsung Heavy Industries stock, you should check out this free report showing analyst consensus estimates for future profits.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Samsung Heavy Industries' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Samsung Heavy Industries shareholders, and that cash payout explains why its total shareholder loss of 38%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Investors in Samsung Heavy Industries had a tough year, with a total loss of 3.0%, against a market gain of about 31%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 4% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Samsung Heavy Industries that you should be aware of before investing here.

But note: Samsung Heavy Industries may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Samsung Heavy Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A010140

Samsung Heavy Industries

Engages in the shipbuilding, offshore, and energy and infra businesses worldwide.

Good value with reasonable growth potential.