- South Korea

- /

- Auto Components

- /

- KOSE:A000240

Discovering Undiscovered Gems in South Korea This September 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 5.7%, contributing to a 3.9% decline over the past year, though earnings are forecast to grow by 29% annually. In these conditions, identifying stocks with strong growth potential and solid fundamentals becomes crucial for investors looking to uncover hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. produces and exports laminating machines and films worldwide, with a market cap of ₩1.20 trillion.

Operations: VT Co., Ltd. generates revenue primarily from its Cosmetic segment (₩256.27 billion), followed by Entertainment (₩93.74 billion) and Laminating (₩33.86 billion).

VT Co., Ltd. has shown remarkable growth, with earnings skyrocketing by 563.7% over the past year, far outpacing the Personal Products industry’s 30.2%. The debt to equity ratio has impressively reduced from 71.2% to 22.4% in five years, indicating better financial health. Recent earnings reports highlight a net income of ₩15,400 million for Q2 2024 compared to ₩5,086 million a year ago and basic EPS rising from ₩154 to ₩481 over the same period.

- Delve into the full analysis health report here for a deeper understanding of VT.

Evaluate VT's historical performance by accessing our past performance report.

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. manufactures and sells storage batteries with a market cap of ₩1.70 trillion.

Operations: Hankook & Company Co., Ltd. generates revenue primarily from the sale of storage batteries. The company has a market cap of ₩1.70 trillion.

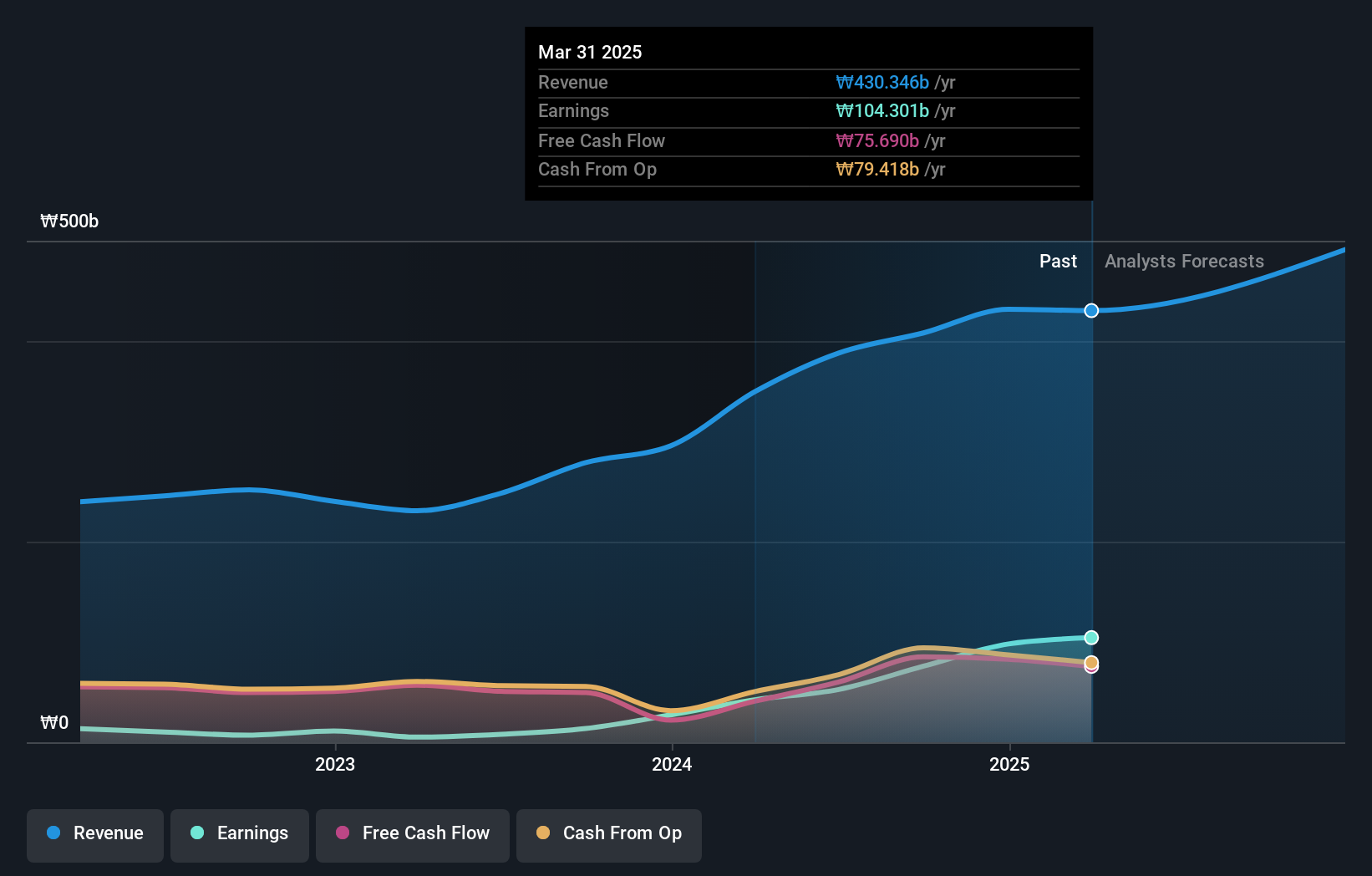

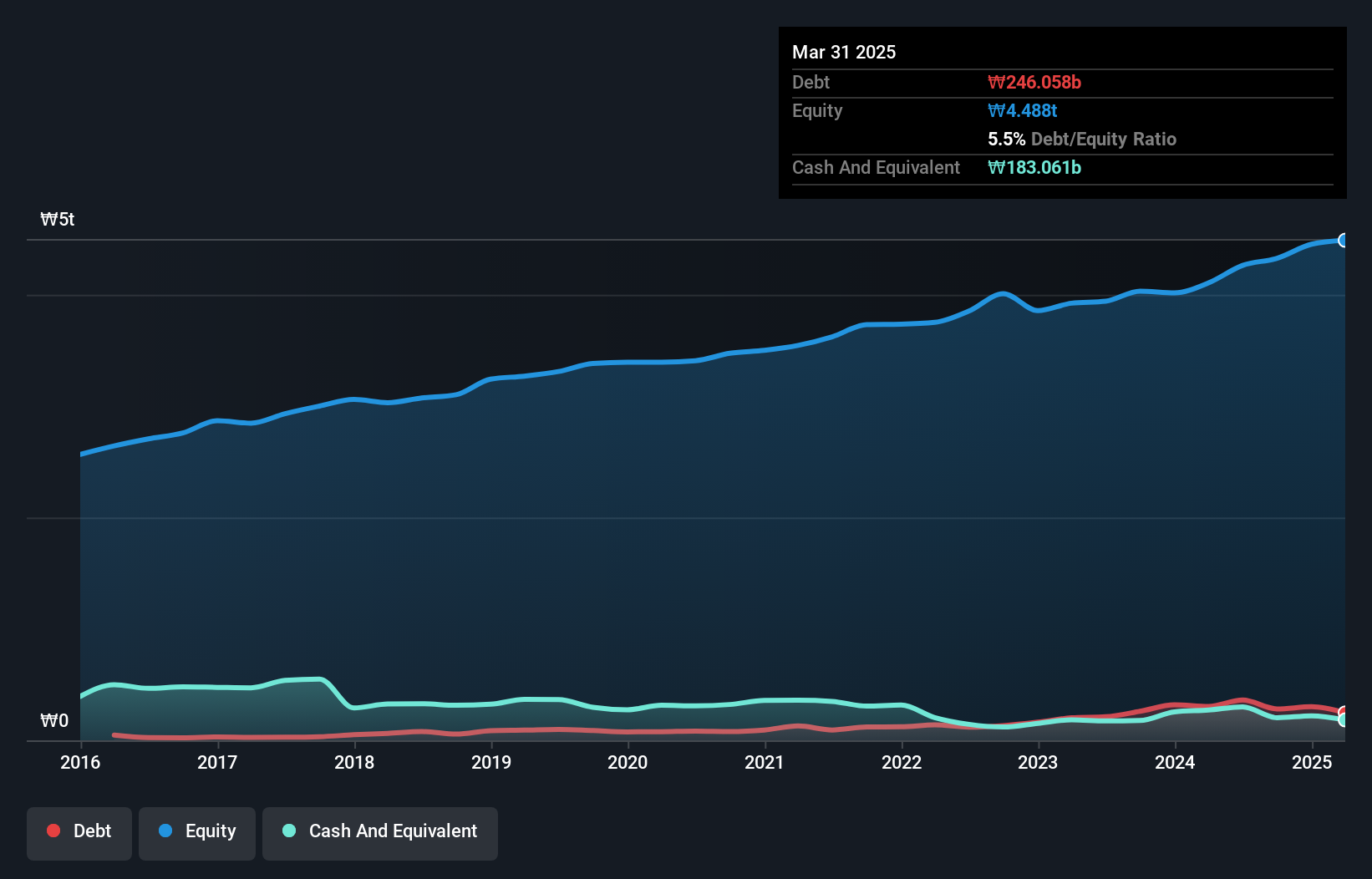

Hankook's earnings surged by 267% over the past year, significantly outpacing the Auto Components industry’s 20.8% growth. Trading at a price-to-earnings ratio of 4.9x, it is well below the KR market average of 11x, indicating good value. The company’s net debt to equity ratio stands at a satisfactory 1.4%, while EBIT covers interest payments by an impressive 40x margin. Recent results show second-quarter sales at KRW 4,810 million and net income at KRW 108,476 million compared to last year's figures of KRW 4,433 million and KRW 36,322 million respectively.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. manufactures and sells machinery and heat combustion equipment in South Korea, with a market cap of approximately ₩979.91 billion.

Operations: The company generates revenue primarily from the air conditioning manufacturing and sale segment, which brought in ₩1.29 billion.

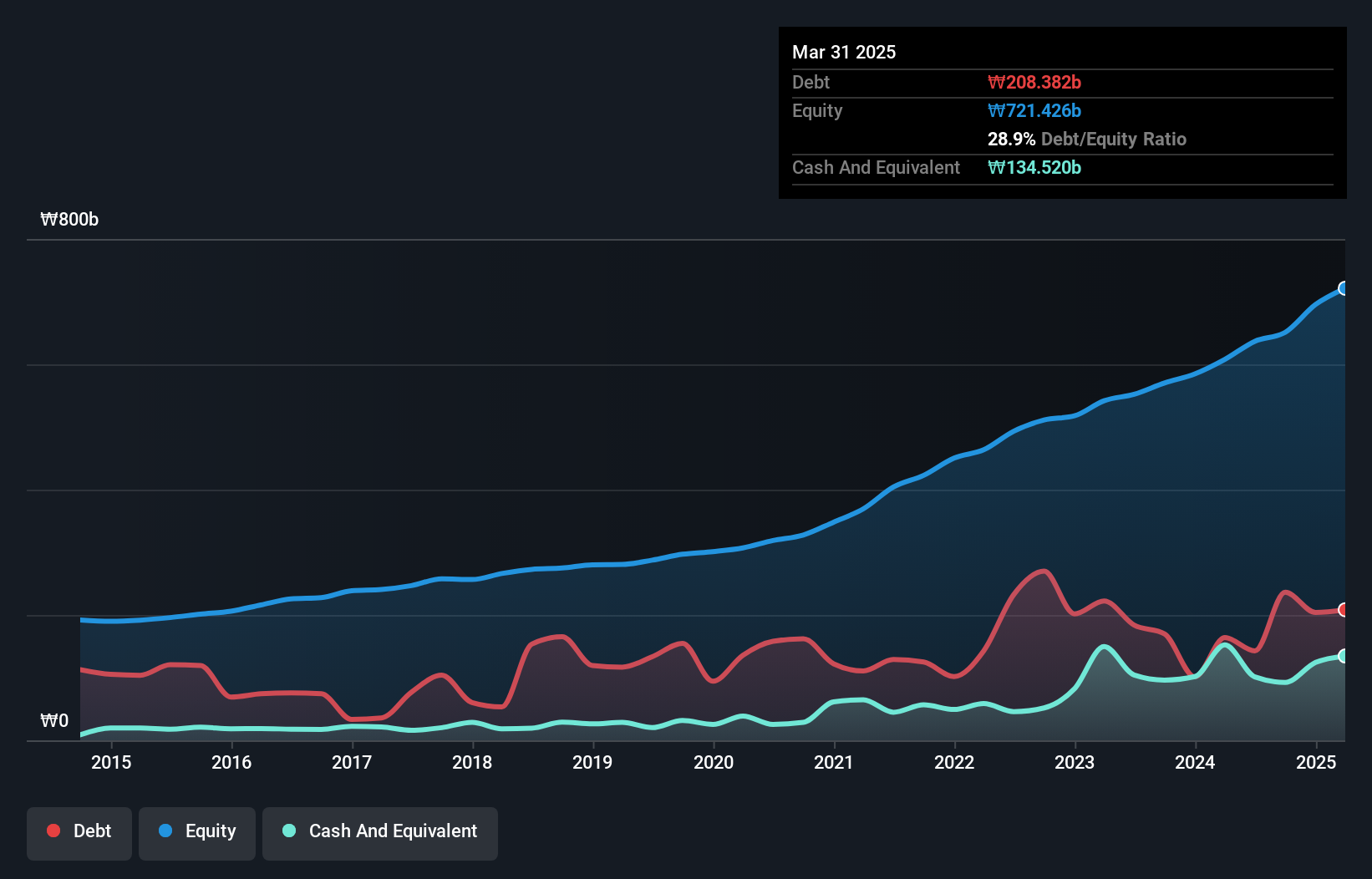

Kyung Dong Navien, a notable player in South Korea's heating solutions market, has shown impressive financial stability. Over the past year, earnings surged by 85.5%, significantly outpacing the building industry’s 28.5% growth rate. The company’s net debt to equity ratio stands at a satisfactory 6.5%, and its price-to-earnings ratio is an attractive 9.7x compared to the KR market's 11x average. Additionally, Kyung Dong Navien repurchased shares in the latest year, signaling confidence in its future prospects.

- Take a closer look at Kyung Dong Navien's potential here in our health report.

Explore historical data to track Kyung Dong Navien's performance over time in our Past section.

Turning Ideas Into Actions

- Embark on your investment journey to our 183 KRX Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hankook might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000240

Excellent balance sheet and good value.

Market Insights

Community Narratives