- South Korea

- /

- Construction

- /

- KOSE:A006360

Investors Appear Satisfied With GS Engineering & Construction Corporation's (KRX:006360) Prospects As Shares Rocket 26%

The GS Engineering & Construction Corporation (KRX:006360) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 51%.

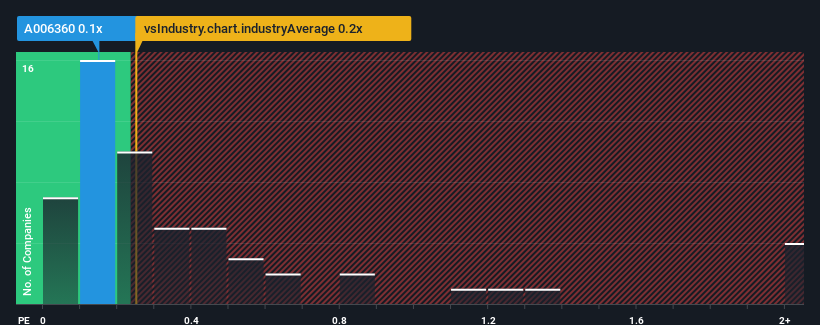

In spite of the firm bounce in price, it's still not a stretch to say that GS Engineering & Construction's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Construction industry in Korea, where the median P/S ratio is around 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for GS Engineering & Construction

What Does GS Engineering & Construction's P/S Mean For Shareholders?

GS Engineering & Construction hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GS Engineering & Construction.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like GS Engineering & Construction's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.1%. Still, the latest three year period has seen an excellent 37% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company are not great, suggesting revenue should decline by 0.8% over the next year. With the rest of the industry predicted to shrink by 2.0%, it's set to post a similar result.

With this information, it's not too hard to see why GS Engineering & Construction is trading at a fairly similar P/S in comparison. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What We Can Learn From GS Engineering & Construction's P/S?

GS Engineering & Construction appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of GS Engineering & Construction's analyst forecasts revealed that its equally shaky outlook against the industry is keeping its P/S in line with the industry too. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to justify a high or low P/S ratio. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. For now though, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for GS Engineering & Construction (1 makes us a bit uncomfortable!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A006360

GS Engineering & Construction

Engages in the civil works and construction, sales of new houses, repairs and maintenance, overseas general construction, and technology consultation activities in South Korea and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives