- South Korea

- /

- Construction

- /

- KOSE:A006360

Fewer Investors Than Expected Jumping On GS Engineering & Construction Corporation (KRX:006360)

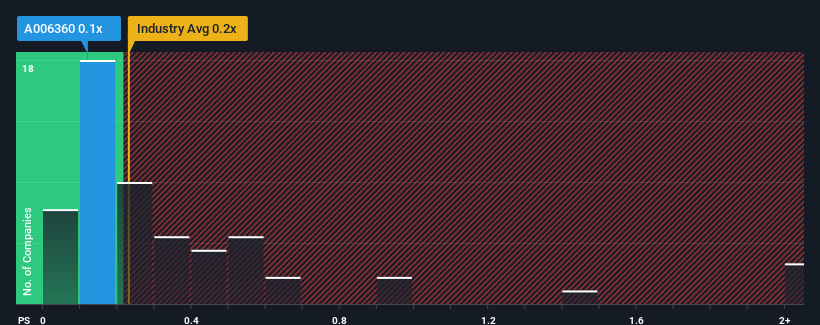

There wouldn't be many who think GS Engineering & Construction Corporation's (KRX:006360) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Construction industry in Korea is similar at about 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for GS Engineering & Construction

What Does GS Engineering & Construction's Recent Performance Look Like?

While the industry has experienced revenue growth lately, GS Engineering & Construction's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on GS Engineering & Construction will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like GS Engineering & Construction's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 8.8% decrease to the company's top line. Still, the latest three year period has seen an excellent 39% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 0.2% during the coming year according to the analysts following the company. Meanwhile, the broader industry is forecast to contract by 0.5%, which would indicate the company is doing better than the majority of its peers.

Despite the marginal growth, we find it odd that GS Engineering & Construction is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On GS Engineering & Construction's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that GS Engineering & Construction currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for GS Engineering & Construction you should know about.

If you're unsure about the strength of GS Engineering & Construction's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A006360

GS Engineering & Construction

Engages in the civil works and construction, sales of new houses, repairs and maintenance, overseas general construction, and technology consultation activities in South Korea and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives