- South Korea

- /

- Building

- /

- KOSE:A001780

What You Need To Know About Aluko Co., Ltd.'s (KRX:001780) Investor Composition

If you want to know who really controls Aluko Co., Ltd. (KRX:001780), then you'll have to look at the makeup of its share registry. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

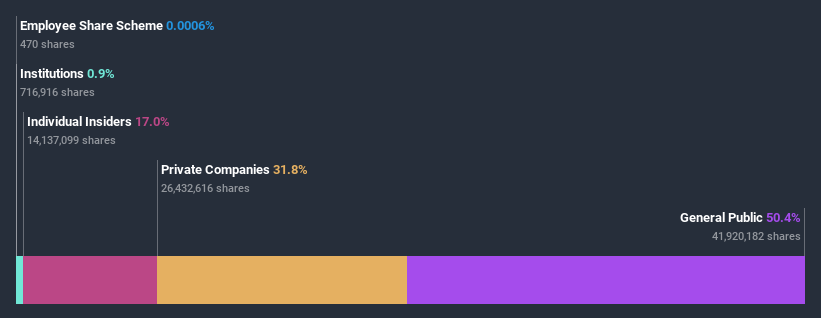

Aluko is a smaller company with a market capitalization of ₩405b, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions don't own many shares in the company. Let's take a closer look to see what the different types of shareholders can tell us about Aluko.

See our latest analysis for Aluko

What Does The Lack Of Institutional Ownership Tell Us About Aluko?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

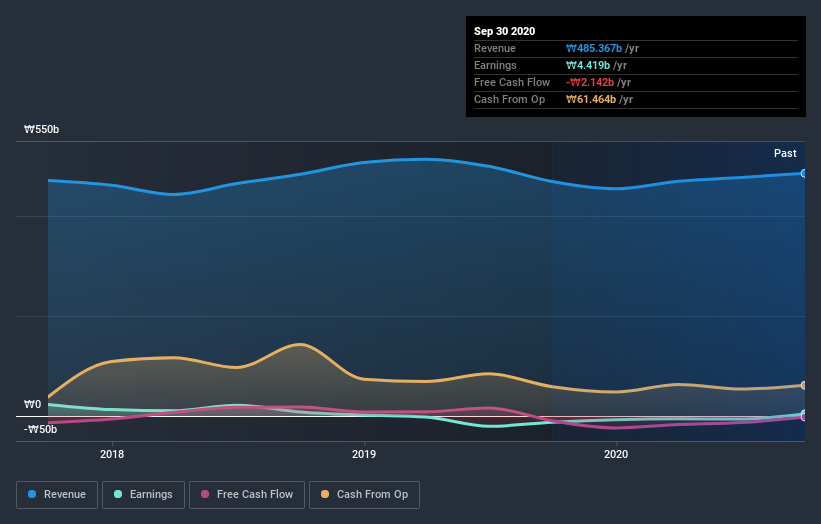

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. Alternatively, there might be something about the company that has kept institutional investors away. Aluko's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Hedge funds don't have many shares in Aluko. Our data shows that Alutec Company Ltd. is the largest shareholder with 32% of shares outstanding. In comparison, the second and third largest shareholders hold about 9.3% and 2.6% of the stock.

Our studies suggest that the top 13 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Aluko

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders maintain a significant holding in Aluko Co., Ltd.. Insiders have a ₩69b stake in this ₩405b business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 50% of Aluko shares. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Private Company Ownership

It seems that Private Companies own 32%, of the Aluko stock. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Aluko better, we need to consider many other factors. Be aware that Aluko is showing 3 warning signs in our investment analysis , and 2 of those are significant...

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Aluko, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A001780

Aluko

Manufactures and sells aluminum products in South Korea and internationally.

Reasonable growth potential with low risk.

Market Insights

Community Narratives