- South Korea

- /

- Machinery

- /

- KOSE:A000850

Little Excitement Around Hwacheon Machine Tool Co., Ltd.'s (KRX:000850) Revenues

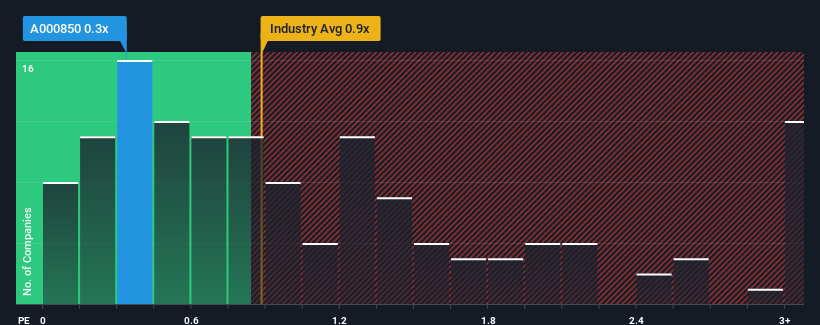

When you see that almost half of the companies in the Machinery industry in Korea have price-to-sales ratios (or "P/S") above 0.9x, Hwacheon Machine Tool Co., Ltd. (KRX:000850) looks to be giving off some buy signals with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Hwacheon Machine Tool

What Does Hwacheon Machine Tool's Recent Performance Look Like?

For example, consider that Hwacheon Machine Tool's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Hwacheon Machine Tool will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Hwacheon Machine Tool, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Hwacheon Machine Tool's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 20% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 37% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Hwacheon Machine Tool's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Hwacheon Machine Tool's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Hwacheon Machine Tool revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Plus, you should also learn about these 3 warning signs we've spotted with Hwacheon Machine Tool.

If these risks are making you reconsider your opinion on Hwacheon Machine Tool, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hwacheon Machine Tool might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000850

Hwacheon Machine Tool

Engages in the manufacture and sale of metal machine tools and kitchenware in South Korea, the United States, Japan, Europe, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives