David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that DL Holdings Co.,Ltd. (KRX:000210) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for DL HoldingsLtd

How Much Debt Does DL HoldingsLtd Carry?

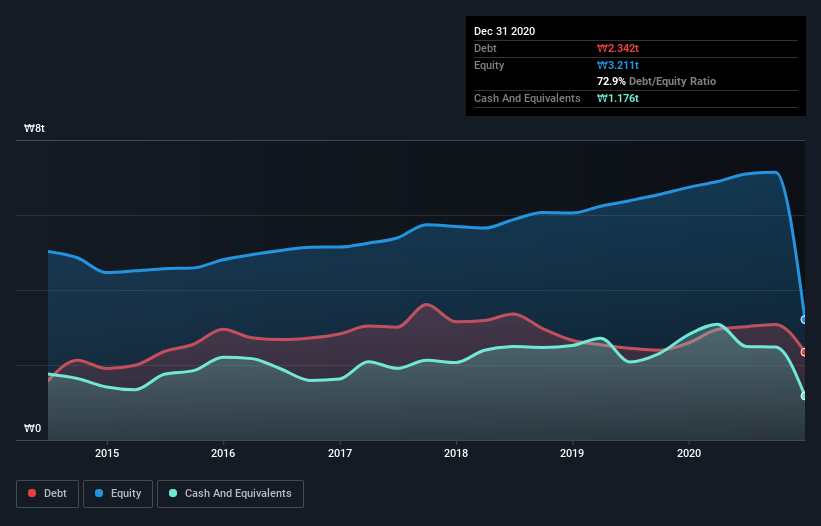

You can click the graphic below for the historical numbers, but it shows that DL HoldingsLtd had ₩2.34t of debt in December 2020, down from ₩2.59t, one year before. However, it also had ₩1.18t in cash, and so its net debt is ₩1.17t.

A Look At DL HoldingsLtd's Liabilities

Zooming in on the latest balance sheet data, we can see that DL HoldingsLtd had liabilities of ₩7.75t due within 12 months and liabilities of ₩2.94t due beyond that. Offsetting this, it had ₩1.18t in cash and ₩247.2b in receivables that were due within 12 months. So its liabilities total ₩9.27t more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the ₩1.72t company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, DL HoldingsLtd would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if DL HoldingsLtd can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, DL HoldingsLtd made a loss at the EBIT level, and saw its revenue drop to ₩1.6t, which is a fall of 11%. That's not what we would hope to see.

Caveat Emptor

While DL HoldingsLtd's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost ₩21b at the EBIT level. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it lost ₩47b in just last twelve months, and it doesn't have much by way of liquid assets. So we think this stock is quite risky. We'd prefer to pass. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 3 warning signs we've spotted with DL HoldingsLtd .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade DL HoldingsLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A000210

DL Holdings

Through its subsidiaries, engages in the research and development, manufacture, wholesale, retail, and distribution of petrochemical products in Korea, rest of Asia, the Middle East, Europe, the United States, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives