- South Korea

- /

- Electrical

- /

- KOSDAQ:A247540

Recent 5.6% pullback isn't enough to hurt long-term EcoPro BM (KOSDAQ:247540) shareholders, they're still up 323% over 5 years

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. For example, the EcoPro BM Co., Ltd. (KOSDAQ:247540) share price is up a whopping 314% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. In more good news, the share price has risen 30% in thirty days. But this could be related to good market conditions -- stocks in its market are up 12% in the last month.

Although EcoPro BM has shed ₩870b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

EcoPro BM wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, EcoPro BM can boast revenue growth at a rate of 25% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 33% per year in that time. It's never too late to start following a top notch stock like EcoPro BM, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

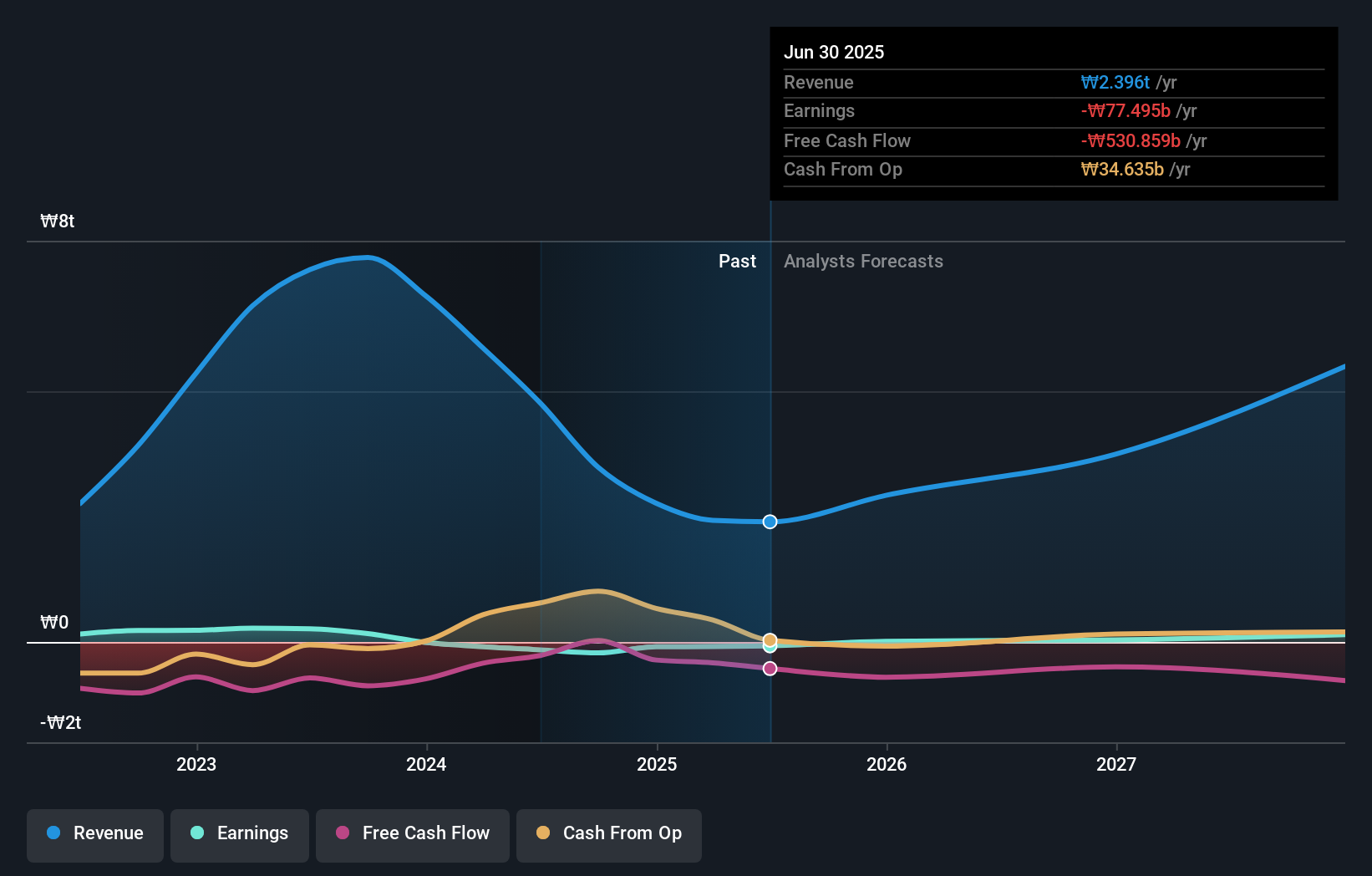

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

EcoPro BM is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think EcoPro BM will earn in the future (free analyst consensus estimates)

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between EcoPro BM's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. EcoPro BM's TSR of 323% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 56% in the last year, EcoPro BM shareholders lost 5.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 33%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that EcoPro BM is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EcoPro BM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A247540

EcoPro BM

Engages in the manufacture and sale of cathode materials used in batteries in Korea and internationally.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives