- South Korea

- /

- Electrical

- /

- KOSDAQ:A243840

Unpleasant Surprises Could Be In Store For Shin Heung Energy & Electronics Co.,Ltd.'s (KOSDAQ:243840) Shares

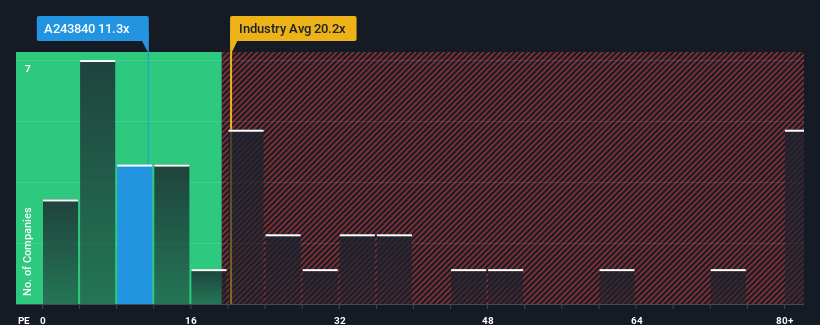

There wouldn't be many who think Shin Heung Energy & Electronics Co.,Ltd.'s (KOSDAQ:243840) price-to-earnings (or "P/E") ratio of 11.3x is worth a mention when the median P/E in Korea is similar at about 11x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Shin Heung Energy & ElectronicsLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Shin Heung Energy & ElectronicsLtd

What Are Growth Metrics Telling Us About The P/E?

Shin Heung Energy & ElectronicsLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 55% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 4.8% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 13% per annum during the coming three years according to the two analysts following the company. With the market predicted to deliver 19% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Shin Heung Energy & ElectronicsLtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Shin Heung Energy & ElectronicsLtd's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shin Heung Energy & ElectronicsLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shin Heung Energy & ElectronicsLtd, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A243840

Shin Heung Energy & ElectronicsLtd

Engages in the manufacturing and sale of parts and facilities for the secondary battery markets in South Korea and internationally.

High growth potential and fair value.

Market Insights

Community Narratives