- South Korea

- /

- Electrical

- /

- KOSDAQ:A243840

Shin Heung Energy & Electronics Co.,Ltd.'s (KOSDAQ:243840) P/E Is Still On The Mark Following 25% Share Price Bounce

Despite an already strong run, Shin Heung Energy & Electronics Co.,Ltd. (KOSDAQ:243840) shares have been powering on, with a gain of 25% in the last thirty days. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

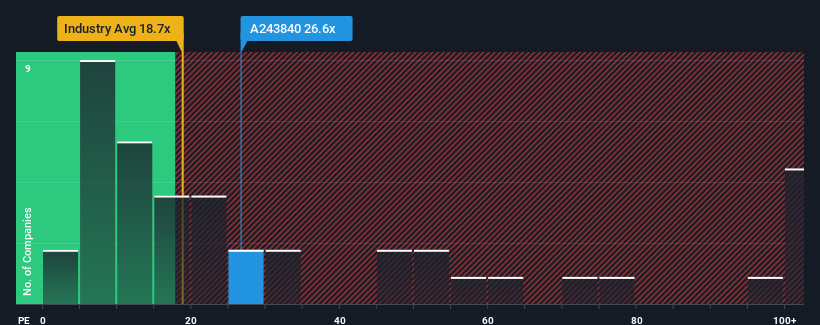

Following the firm bounce in price, Shin Heung Energy & ElectronicsLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 26.6x, since almost half of all companies in Korea have P/E ratios under 14x and even P/E's lower than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings that are retreating more than the market's of late, Shin Heung Energy & ElectronicsLtd has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Shin Heung Energy & ElectronicsLtd

Does Growth Match The High P/E?

In order to justify its P/E ratio, Shin Heung Energy & ElectronicsLtd would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 32% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 91% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 35%, which is noticeably less attractive.

With this information, we can see why Shin Heung Energy & ElectronicsLtd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Shin Heung Energy & ElectronicsLtd's P/E

Shares in Shin Heung Energy & ElectronicsLtd have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shin Heung Energy & ElectronicsLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shin Heung Energy & ElectronicsLtd you should know about.

If these risks are making you reconsider your opinion on Shin Heung Energy & ElectronicsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A243840

Shin Heung Energy & ElectronicsLtd

Engages in the manufacturing and sale of parts and facilities for the secondary battery markets in South Korea and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success