Stock Analysis

- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A009470

Exploring High Insider Ownership Growth Companies On The KRX

Reviewed by Simply Wall St

Recently, the South Korean market has experienced a slight downturn with a 1.4% drop over the last week, although it maintains a positive annual growth of 4.3%. In this context, companies with high insider ownership can be particularly compelling as they often indicate strong confidence from those most familiar with the company's potential and align well with expected earnings growth.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| Modetour Network (KOSDAQ:A080160) | 12.4% | 45.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.7% | 73.1% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Innosimulation (KOSDAQ:A274400) | 28.2% | 112.5% |

| UTI (KOSDAQ:A179900) | 34.2% | 122.7% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 74.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 67.2% |

| Enchem (KOSDAQ:A348370) | 21.3% | 105.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 102.5% |

Let's review some notable picks from our screened stocks.

People & Technology (KOSDAQ:A137400)

Simply Wall St Growth Rating: ★★★★★☆

Overview: People & Technology Inc., a South Korean company, specializes in providing various machinery services including coating, calendaring, slitting, and automation with a market capitalization of approximately ₩1.03 billion.

Operations: The firm specializes in diverse machinery services such as coating, calendaring, slitting, and automation.

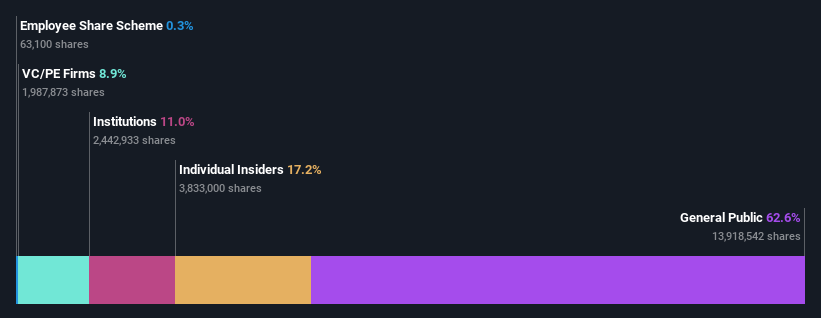

Insider Ownership: 17.2%

Earnings Growth Forecast: 30.8% p.a.

People & Technology, a South Korean company, is witnessing robust growth with earnings up by 31.4% last year and expected to grow by 30.84% annually. Its revenue is also set to outpace the market at a rate of 29.3% per year against the national average of 10.2%. Despite lacking recent insider trading data, analysts project a significant potential upside in its stock price, suggesting it's undervalued by about 10.8%. This financial profile underscores its appeal amid high insider ownership sectors.

- Unlock comprehensive insights into our analysis of People & Technology stock in this growth report.

- According our valuation report, there's an indication that People & Technology's share price might be on the cheaper side.

Samwha ElectricLtd (KOSE:A009470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Samwha Electric Co., Ltd. specializes in the manufacture of electrolytic capacitors, serving both the domestic South Korean market and international markets, with a market capitalization of approximately ₩462.97 billion.

Operations: The company generates revenue primarily from the production and sale of electrolytic capacitors across various global markets.

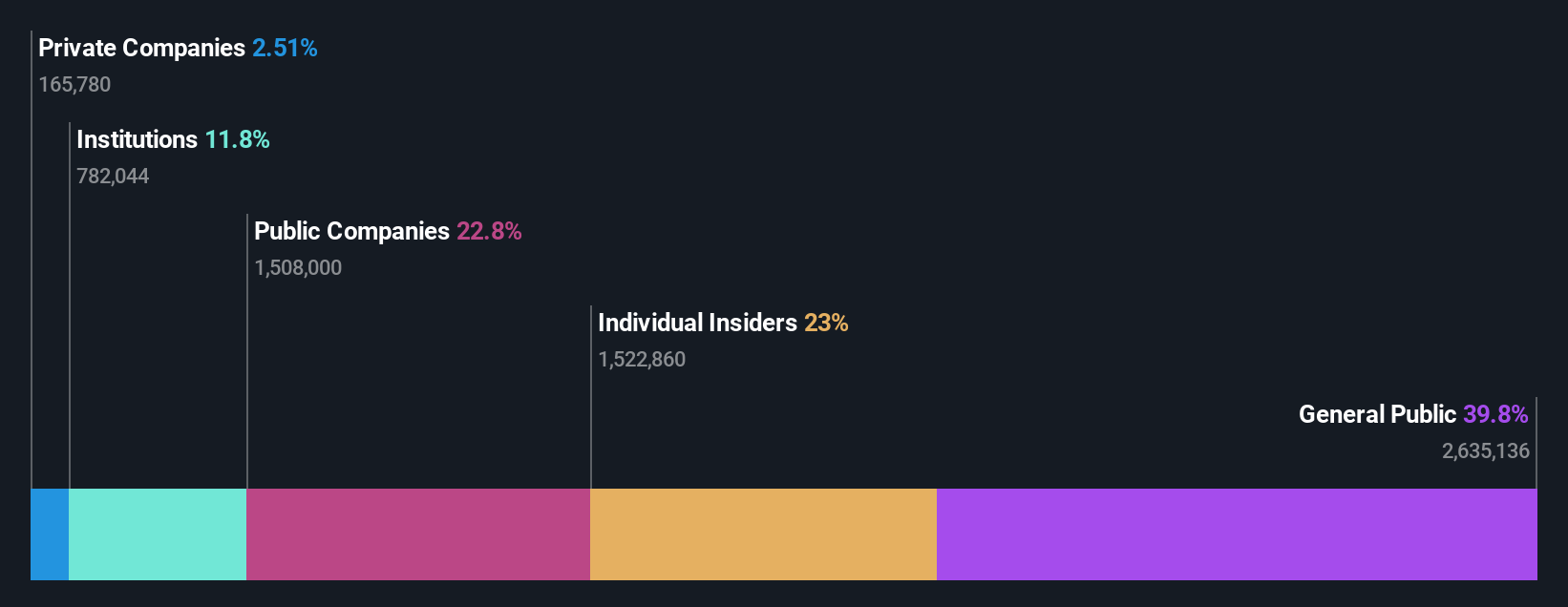

Insider Ownership: 23%

Earnings Growth Forecast: 50.6% p.a.

Samwha Electric Co., Ltd., a South Korean entity, is positioned for notable growth with projected annual revenue and earnings increases of 19% and 50.57%, respectively, outstripping the national market predictions of 10.2% and 28%. Despite its share price volatility over the past three months, it trades at a 7.7% discount to its estimated fair value. Forecasted Return on Equity stands impressively at 31.6% in three years, highlighting strong management efficiency despite no recent insider trading activity.

- Navigate through the intricacies of Samwha ElectricLtd with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Samwha ElectricLtd's shares may be trading at a premium.

Lotte Tour Development (KOSE:A032350)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Tour Development Co., Ltd. operates in the travel and tourism sector in South Korea, with a market capitalization of approximately ₩758.05 billion.

Operations: The company's revenue is primarily derived from travel and tourism services in South Korea.

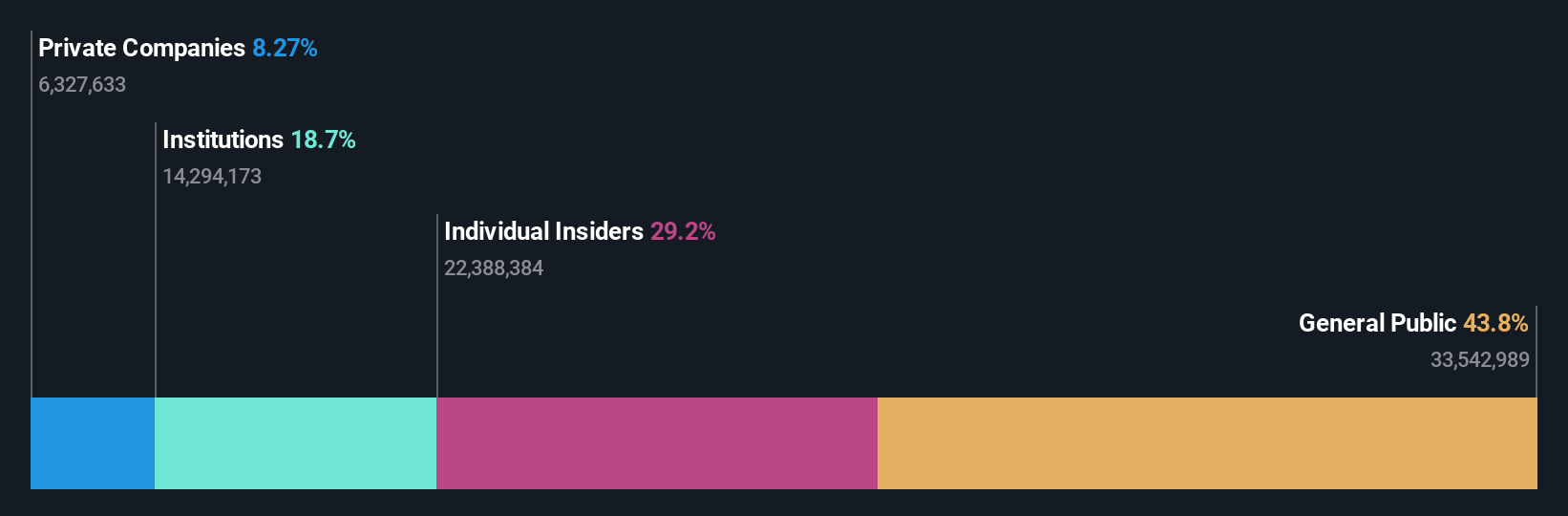

Insider Ownership: 29.5%

Earnings Growth Forecast: 100.3% p.a.

Lotte Tour Development Co., Ltd. experienced a significant revenue increase to KRW 313.55 billion in 2023, up from KRW 183.67 billion the previous year, indicating strong sales growth. Despite this, the company reported a substantial net loss of KRW 202.22 billion, an improvement over the prior year's KRW 224.70 billion loss. Looking ahead, revenue is expected to grow at 16.4% annually, outpacing the Korean market forecast of 10.2%. The firm is projected to reach profitability within three years and shows potential with a forecasted earnings growth rate of over 100% per year, although its future Return on Equity is anticipated to remain low at around 4.2%.

- Delve into the full analysis future growth report here for a deeper understanding of Lotte Tour Development.

- Insights from our recent valuation report point to the potential undervaluation of Lotte Tour Development shares in the market.

Make It Happen

- Reveal the 81 hidden gems among our Fast Growing KRX Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Samwha ElectricLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009470

Samwha ElectricLtd

Operates in the electrolytic capacitor industry in South Korea and internationally.

Flawless balance sheet with high growth potential.