- South Korea

- /

- Construction

- /

- KOSDAQ:A100130

Slammed 27% Dongkuk Structures & Construction Company Limited (KOSDAQ:100130) Screens Well Here But There Might Be A Catch

To the annoyance of some shareholders, Dongkuk Structures & Construction Company Limited (KOSDAQ:100130) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

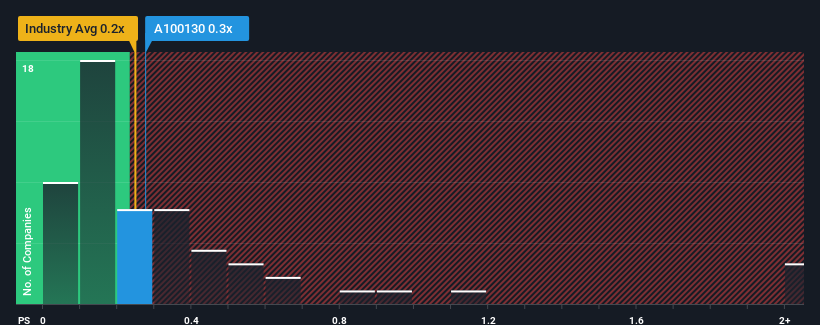

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Dongkuk Structures & Construction's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Korea is also close to 0.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Dongkuk Structures & Construction

What Does Dongkuk Structures & Construction's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Dongkuk Structures & Construction has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Dongkuk Structures & Construction.Is There Some Revenue Growth Forecasted For Dongkuk Structures & Construction?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Dongkuk Structures & Construction's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. The latest three year period has also seen a 24% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth will show minor resilience over the next year growing only by 0.3%. Meanwhile, the broader industry is forecast to contract by 0.2%, which would indicate the company is doing better than the majority of its peers.

Even though the growth is only slight, it's peculiar that Dongkuk Structures & Construction's P/S sits in line with the majority of other companies given the industry is set for a decline. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Bottom Line On Dongkuk Structures & Construction's P/S

Following Dongkuk Structures & Construction's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Dongkuk Structures & Construction's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Dongkuk Structures & Construction is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A100130

Dongkuk Structures & Construction

Engages in the manufacture and sale of wind towers in South Korea and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success