- South Korea

- /

- Construction

- /

- KOSDAQ:A100130

Dongkuk Structures & Construction Company Limited (KOSDAQ:100130) Looks Just Right With A 25% Price Jump

The Dongkuk Structures & Construction Company Limited (KOSDAQ:100130) share price has done very well over the last month, posting an excellent gain of 25%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

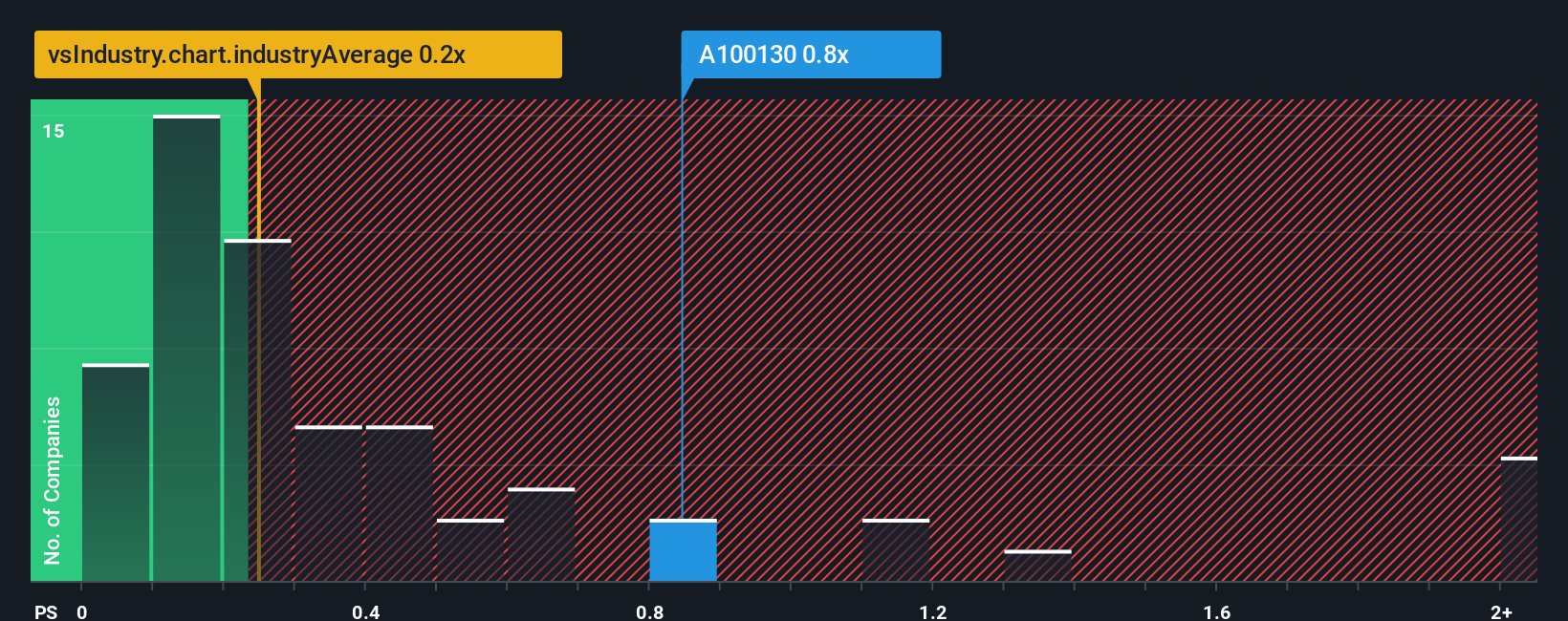

Since its price has surged higher, given close to half the companies operating in Korea's Construction industry have price-to-sales ratios (or "P/S") below 0.2x, you may consider Dongkuk Structures & Construction as a stock to potentially avoid with its 0.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Dongkuk Structures & Construction

What Does Dongkuk Structures & Construction's P/S Mean For Shareholders?

Dongkuk Structures & Construction certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Dongkuk Structures & Construction.Is There Enough Revenue Growth Forecasted For Dongkuk Structures & Construction?

In order to justify its P/S ratio, Dongkuk Structures & Construction would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 100%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 54% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 165% as estimated by the only analyst watching the company. With the industry only predicted to deliver 0.9%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Dongkuk Structures & Construction's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Dongkuk Structures & Construction shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Dongkuk Structures & Construction shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Dongkuk Structures & Construction with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A100130

Dongkuk Structures & Construction

Engages in the manufacture and sale of wind towers in South Korea and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives