- South Korea

- /

- Machinery

- /

- KOSDAQ:A073010

KSP Co., Ltd.'s (KOSDAQ:073010) Subdued P/E Might Signal An Opportunity

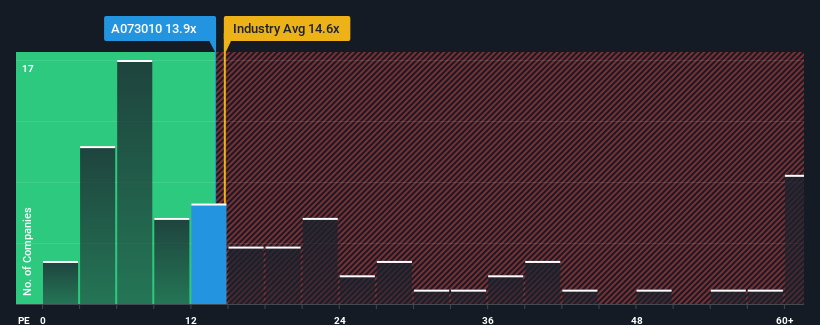

With a median price-to-earnings (or "P/E") ratio of close to 13x in Korea, you could be forgiven for feeling indifferent about KSP Co., Ltd.'s (KOSDAQ:073010) P/E ratio of 13.9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

KSP certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for KSP

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like KSP's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 222%. Pleasingly, EPS has also lifted 811% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 29% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that KSP's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On KSP's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that KSP currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Having said that, be aware KSP is showing 2 warning signs in our investment analysis, and 1 of those is concerning.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if KSP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A073010

Very low risk with weak fundamentals.

Market Insights

Community Narratives