- South Korea

- /

- Building

- /

- KOSDAQ:A060260

Nuvotec Co. Ltd.'s (KOSDAQ:060260) 38% Share Price Plunge Could Signal Some Risk

Nuvotec Co. Ltd. (KOSDAQ:060260) shares have had a horrible month, losing 38% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

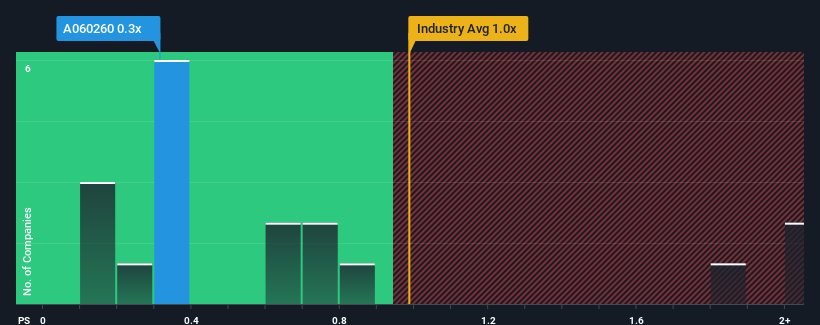

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Nuvotec's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Building industry in Korea is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Nuvotec

How Has Nuvotec Performed Recently?

For example, consider that Nuvotec's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nuvotec's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nuvotec's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 6.5% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 9.9% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Nuvotec's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Nuvotec looks to be in line with the rest of the Building industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Nuvotec's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Plus, you should also learn about these 3 warning signs we've spotted with Nuvotec (including 2 which don't sit too well with us).

If you're unsure about the strength of Nuvotec's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nuvotec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A060260

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives